A) Capitalizing costs refers to the process of converting assets to expenses.

B) All costs incurred to acquire an asset may be capitalized.

C) Capitalizing a cost means to record it as an asset.

D) Capitalization results in an immediate decrease in net income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodwill may be attributable to all of the following except which one?

A) A large amount of charitable contributions

B) A good reputation

C) A well-trained work force

D) A superior location

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

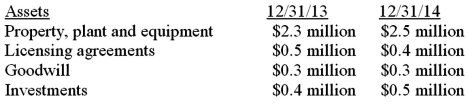

The company has net sales revenue of $3.6 million during 2014.The company's records also included the following information:  What is the company's fixed asset turnover ratio for 2014?

What is the company's fixed asset turnover ratio for 2014?

A) 18.00

B) 1.33

C) 1.00

D) 1.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not true?

A) At the end of an asset's life,its book value should equal its residual value.

B) At the end of an asset's life,the accumulated depreciation should equal the depreciable cost.

C) At the end of an assets life,the book value would equal zero if there is no residual value.

D) Assets area not to be depreciated below residual value,except under the double-declining balance method.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The intangible asset most frequently reported by U.S.businesses is:

A) goodwill.

B) trademarks.

C) patents.

D) licensing rights.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A piece of equipment was acquired on January 1,2013,at a cost of $22,000,with an estimated residual value of $2,000 and an estimated useful life of four years.The company uses the double-declining-balance method.What is its book value at December 31,2014?

A) $5,500.

B) $10,000.

C) $11,000.

D) $12,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In recording the acquisition cost of an entire business:

A) goodwill is recorded as the excess of cost over the fair value of identifiable net assets.

B) assets are recorded at the seller's book values.

C) goodwill,if it exists,is never recorded.

D) goodwill is recorded as the excess of cost over the book value of identifiable net assets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A book manufacturing company sells equipment for $450,000 when the book value of the equipment is $400,000.The company would record the extra $50,000 as:

A) a gain,increasing net income and stockholders' equity.

B) revenue,increasing net income and stockholders' equity.

C) expenses,decreasing net income and stockholders' equity.

D) a loss,decreasing net income and stockholders' equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A fixed asset turnover ratio of 4.3 indicates that for every

A) $1 in sales revenue,the firm acquired $4.30 of assets.

B) $1 in fixed assets,the firm earned $4.30 of net income.

C) $1 in assets,the firm paid $4.30 of expenses.

D) $1 in fixed assets,the firm generated $4.30 of net sales.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

There are no differences between GAAP and IFRS rules of accounting for tangible and intangible assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company paid $17,000 for a vehicle that had an estimated useful life of 4 years,total capacity of 100,000 miles,and a residual value of $1,000.After 2 full years of using the vehicle (20,000 miles in year 1 and 27,000 miles in year 2) ,the company sold the vehicle for $6,000 and reported a loss on disposal of $3,480.What method of depreciation did the company use?

A) Units-of-production method.

B) Double-declining-balance method.

C) Straight-line method.

D) Units-of-production method in year 1 and straight-line in year 2.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An asset is purchased on January 1 for $40,000.It is expected to have a useful life of five years after which it will have an expected salvage value of $5,000.The company uses the straight-line method.If it is sold for $30,000 exactly two years after it is purchased,the company will record a:

A) gain of $6,000.

B) gain of $4,000.

C) loss of $4,000.

D) loss of $6,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company records depletion on natural resources,it will have which of the following effects?

A) Expenses increase.

B) Net income decreases.

C) Inventory increases.

D) Cash flow decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding straight-line depreciation is correct?

A) Straight-line depreciation is the most common method of depreciation used in the U.S.for financial reporting,but is not commonly used for taxes.

B) When the straight-line method is used to compute depreciation,an asset's carrying value remains constant over the life of the asset.

C) Straight-line depreciation is an approved method to allocate the cost of an asset to expense and it serves as a measure of the physical decline in the asset.

D) The straight line method of depreciation results in a straight-line increase of depreciation expense over the life of an asset.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms does not mean the same as the others?

A) Tangible assets.

B) Fixed assets.

C) Property,plant,and equipment.

D) Long-lived assets.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goodwill:

A) should be treated like most other intangible assets and amortized over a useful life of not more than 40 years.

B) is an accounting measurement of how well a company's employees behave towards the company's customers.

C) should be recorded as a negative value if a company is purchased for less than the net carrying value of its assets.

D) is recorded when the purchasers of a business pay more than the fair value of the assets purchased.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.If the units-of-production method is used,the depreciation expense for this period is:

A) $80,000.

B) $400,000.

C) $76,000.

D) $380,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of McGraw-Hill's intangible assets gives it the legal right to prevent you from borrowing a textbook from a friend and photocopying all of it?

A) Patent

B) Trademark

C) Franchise agreement

D) Copyright

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Many companies use accelerated depreciation in computing taxable income because

A) it reports higher net income in the early years as compared to other methods.

B) it is required by IFRS.

C) it is easier than straight-line deprecation.

D) it postpones tax payments until later years because it lowers taxable income in the early years.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company capitalizes costs that should be expensed,how is its income statement for the current period impacted?

A) Net income will be lower than it should be.

B) Revenues will be lower than they should be.

C) Expenses will be lower than they should be.

D) Assets will be lower than they should be.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 145

Related Exams