B) False

Correct Answer

verified

Correct Answer

verified

Essay

For each of the following transactions of Neon Garden, identify the account to be debited and the account to be credited. 1. Purchased 18-month insurance policy for cash. 2. Paid weekly payroll. 3. Purchased supplies on account. 4. Received utility bill to be paid at later date.

Correct Answer

verified

Correct Answer

verified

Essay

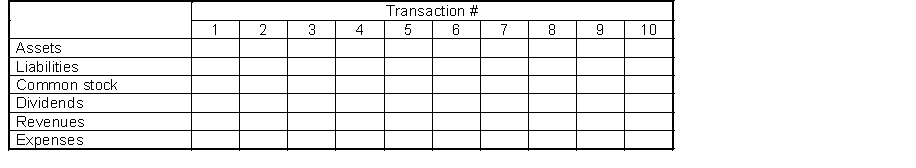

For each transaction given, enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the increases and decreases of the assets, liabilities, and stockholders' equity accounts. In some cases there may be a "D" and a "C" in the same box.

Transactions:

1. Invests cash in exchange for stock.

2. Pays insurance in advance for six months.

3. Pays secretary's salary.

4. Purchases supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash due from customers.

9. Provides services on account.

10. The company pays a dividends.

Correct Answer

verified

Correct Answer

verified

True/False

A credit balance in a liability account indicates that an error in recording has occurred.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

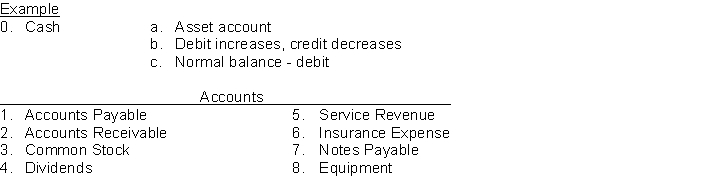

For each of the following accounts indicate (a) the type of account (Asset, Liability, Stockholders' Equity, Revenue, Expense), (b) the debit and credit effects, and (c) the normal account balance.

Correct Answer

verified

Correct Answer

verified

True/False

Business documents can provide evidence that a transaction has occurred.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

All business transactions must be entered first in the general ledger.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard format of a journal would not include

A) a reference column.

B) an account title column.

C) a T-account.

D) a date column.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An account will have a credit balance if the

A) credits exceed the debits.

B) first transaction entered was a credit.

C) debits exceed the credits.

D) last transaction entered was a credit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The double-entry system is a logical method for recording transactions and results in equal debits and credits for each transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A T-account is

A) a way of depicting the basic form of an account.

B) what the computer uses to organize bytes of information.

C) a special account used instead of a trial balance.

D) used for accounts that have both a debit and credit balance.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The first step in the recording process is to

A) prepare financial statements.

B) analyze each transaction for its effect on the accounts.

C) post to a journal.

D) prepare a trial balance.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

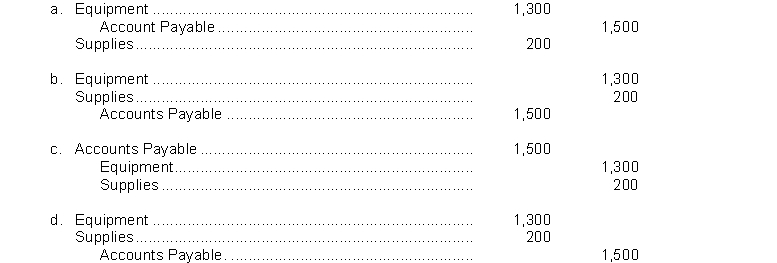

On August 13, 2018, Swell Maps Enterprises purchased equipment for $1,300 and supplies of $200 on account. Which of the following journal entries is recorded correctly and in the standard format?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Revenues increase stockholders' equity.

B) Revenues have normal credit balances.

C) Revenues are a positive factor in the computation of net income.

D) Revenues are increased by debits.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When three or more accounts are required in one journal entry, the entry is referred to as a

A) compound entry.

B) triple entry.

C) multiple entry.

D) simple entry.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which account below is not a subdivision of retained earnings?

A) Dividends

B) Revenues

C) Expenses

D) Common stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Transactions are entered in the ledger first and then they are analyzed in terms of their effect on the accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A compound journal entry involves

A) two accounts.

B) three accounts.

C) three or more accounts.

D) four or more accounts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions. 1. The company issues stock in exchange for $40,000 cash 2. Purchased $400 of supplies on credit. 3. Purchased equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable. 4. Real estate commissions billed to clients amount to $4,000. 5. Paid $700 in cash for the current month's rent. 6. Paid $200 cash on account for supplies purchased in transaction 2. 7. Received a bill for $600 for advertising for the current month. 8. Paid $2,200 cash for office salaries and wages. 9. The company paid dividends of $1,500. 10. Received a check for $3,000 from a client in payment on account for commissions billed in transaction 4.

Correct Answer

verified

Correct Answer

verified

Essay

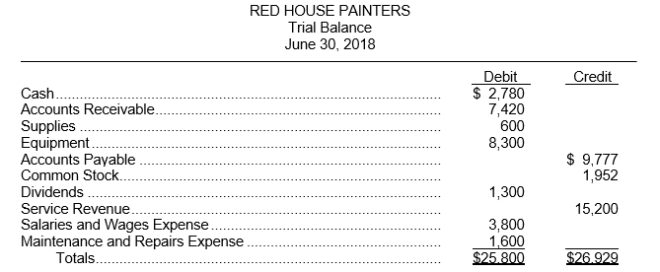

The trial balance of Red House Painters shown below does not balance.  An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of $270 received from a customer on account was debited to Cash $720 and credited to Accounts Receivable $720.

3. A dividend of $400 was posted as a credit to Dividends $400 and credit to Cash $400.

4. A debit of $300 was not posted to Salaries and Wages Expense.

5. The purchase of equipment on account for $700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for $700.

6. Services were performed on account for a customer, $510, for which Accounts Receivable was debited $510 and Service Revenue was credited $51.

7. A payment on account for $235 was credited to Cash for $235 and credited to Accounts Payable for $253.

Instructions

Prepare a correct trial balance.

An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of $270 received from a customer on account was debited to Cash $720 and credited to Accounts Receivable $720.

3. A dividend of $400 was posted as a credit to Dividends $400 and credit to Cash $400.

4. A debit of $300 was not posted to Salaries and Wages Expense.

5. The purchase of equipment on account for $700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for $700.

6. Services were performed on account for a customer, $510, for which Accounts Receivable was debited $510 and Service Revenue was credited $51.

7. A payment on account for $235 was credited to Cash for $235 and credited to Accounts Payable for $253.

Instructions

Prepare a correct trial balance.

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 206

Related Exams