B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is used to analyze the efficiency and effectiveness of inventory management?

A) inventory turnover only

B) number of days' sales in inventory only

C) both inventory turnover and number of days' sales in inventory

D) neither inventory turnover or number of days' sales in inventory

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the following questions. The Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. -Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

A) $108

B) $120

C) $72

D) $180

F) A) and B)

Correct Answer

verified

Correct Answer

verified

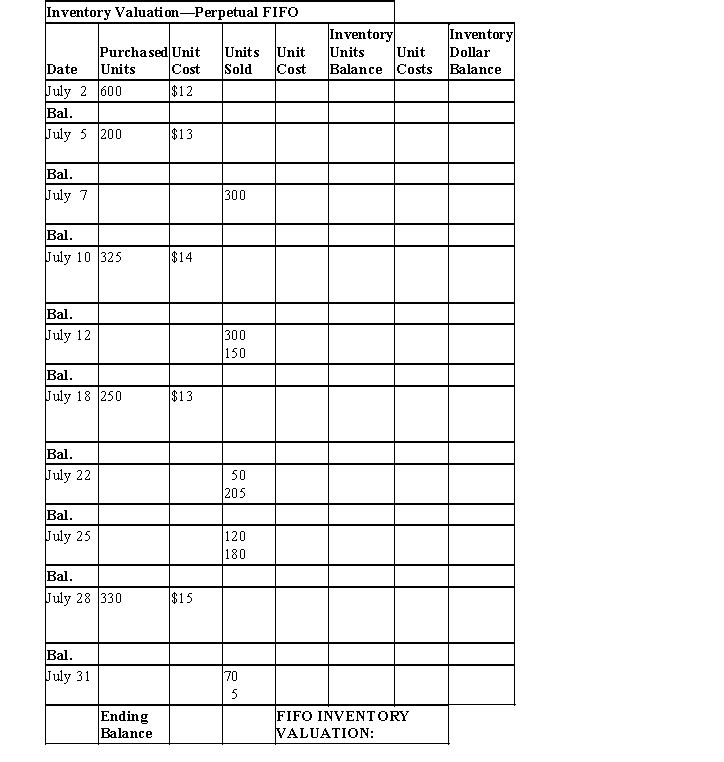

Essay

Complete the following table using the perpetual FIFO method of inventory flow.

Correct Answer

verified

Correct Answer

verified

True/False

Average inventory is computed by adding the inventory at the beginning of the period to the inventory at the end of the period and dividing by two.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Determine the total value of the merchandise using net realizable value.

A) $35

B) $80

C) $115

D) $25

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate cost flow assumption a-c) . -Rarely used with a perpetual inventory system

A) FIFO

B) LIFO

C) Weighted average

E) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate cost flow assumption a-d) . -Cost flow is assumed to be in the reverse order of costs incurred.

A) Weighted average

B) First-in, first-out FIFO)

C) Last-in, first-out LIFO)

D) Specific identification

F) A) and C)

Correct Answer

verified

Correct Answer

verified

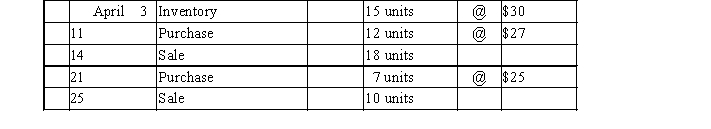

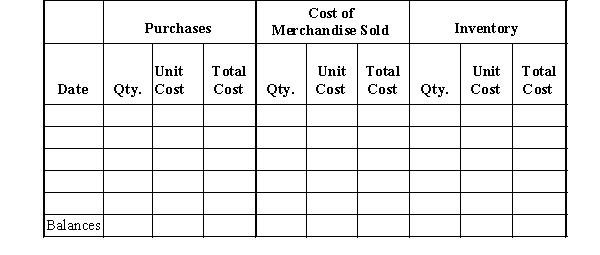

Essay

Beginning inventory, purchases, and sales data for widgets are as follows:  Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of merchandise sold and ending inventory using FIFO.

Correct Answer

verified

Correct Answer

verified

True/False

A subsidiary inventory ledger can be an aid in maintaining inventory levels at their proper levels.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate cost flow assumption a-c) . -Never results in either the highest or lowest possible net income

A) FIFO

B) LIFO

C) Weighted average

E) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If ending inventory for the year is overstated, stockholders' equity reported on the balance sheet at the end of the year is understated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of the inventory at the end of the year using the LIFO method?

A) $1,685

B) $1,575

C) $1,805

D) $3,815

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

During periods of rapidly rising costs, the use of the LIFO method results in illusory or inventory profits.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When merchandise inventory is shown on the balance sheet, both the method of determining the cost of the inventory and the method of valuing the inventory should be shown.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a periodic inventory system

A) accounting records continuously disclose the amount of inventory

B) a separate account for each type of merchandise is maintained in a subsidiary ledger

C) a physical inventory is taken at the end of the period

D) merchandise inventory is debited when goods are returned to vendors

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Inventory controls start when the merchandise is shelved in the store area.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

On the basis of the following data, determine the estimated cost of the inventory as of March 31 by the retail method, presenting details of the computation in good order.

Correct Answer

verified

Correct Answer

verified

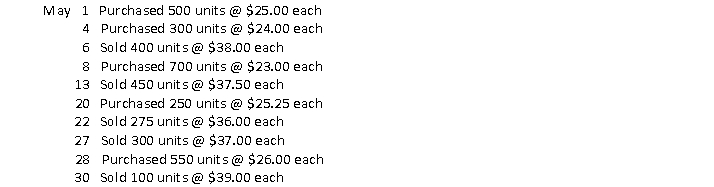

Essay

Brutus Corporation, a newly formed corporation, has the following transactions during May, its first month of operations.  Calculate total sales, cost of merchandise sold, gross profit, and ending inventory using each of the following inventory methods:

1. FIFO perpetual

2. FIFO periodic

3. LIFO perpetual

4. LIFO periodic

5. Average cost periodic round average to nearest cent)

Calculate total sales, cost of merchandise sold, gross profit, and ending inventory using each of the following inventory methods:

1. FIFO perpetual

2. FIFO periodic

3. LIFO perpetual

4. LIFO periodic

5. Average cost periodic round average to nearest cent)

Correct Answer

verified

Correct Answer

verified

True/False

The average cost method will always yield results between FIFO and LIFO.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 205

Related Exams