B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ramirez Company's last dividend was $1.75.Its dividend growth rate is expected to be constant at 24% for 2 years,after which dividends are expected to grow at a rate of 6% forever.Its required return (rs) is 12%.What is the best estimate of the current stock price? Do not round intermediate calculations.

A) $36.94

B) $52.47

C) $41.98

D) $31.90

E) $45.34

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is a hybrid-a cross between a common stock and a bond-in the sense that it pays dividends that normally increase annually (like a stock),but its payments are contractually guaranteed (like interest on a bond).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nachman Industries just paid a dividend of D0 = $3.75.Analysts expect the company's dividend to grow by 30% this year,by 10% in Year 2,and at a constant rate of 5% in Year 3 and thereafter.The required return on this low-risk stock is 9.00%.What is the best estimate of the stock's current market value? Do not round intermediate calculations.

A) $144.04

B) $135.11

C) $127.47

D) $151.68

E) $130.01

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A major disadvantage of financing with preferred stock is that preferred stockholders typically have supernormal voting rights.

B) Preferred stock is normally expected to provide steadier,more reliable income to investors than the same firm's common stock.As a result,the expected after-tax yield on the preferred is lower than the after-tax expected return on the common stock.

C) The preemptive right is a provision in all corporate charters that gives preferred stockholders the right to purchase (on a pro rata basis) new issues of preferred stock.

D) One of the disadvantages to a corporation of owning preferred stock is that 70% of the dividends received represent taxable income to the corporate recipient,whereas interest income earned on bonds is tax free.

E) One of the advantages to financing with preferred stock is that 70% of the dividends paid out are tax deductible to the issuer.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D1 = $1.25,g (which is constant) = 4.7%,and P0 = $22.00,then what is the stock's expected dividend yield for the coming year?

A) 5.40%

B) 6.25%

C) 5.68%

D) 6.08%

E) 4.26%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schnusenberg Corporation just paid a dividend of D0 = $0.75 per share,and that dividend is expected to grow at a constant rate of 6.50% per year in the future.The company's beta is 1.70,the required return on the market is 10.50%,and the risk-free rate is 4.50%.What is the company's current stock price? Do not round intermediate calculations.

A) $10.52

B) $7.40

C) $7.89

D) $9.74

E) $7.70

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Two conditions are used to determine whether a stock is in equilibrium: (1)Does the stock's market price equal its intrinsic value as seen by the marginal investor,and (2)does the expected return on the stock as seen by the marginal investor equal his or her required return? If either of these conditions,but not necessarily both,holds,then the stock is said to be in equilibrium.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A share of common stock just paid a dividend of $1.00.If the expected long-run growth rate for this stock is 5.4%,and if investors' required rate of return is 14.2%,then what is the stock price?

A) $12.70

B) $11.98

C) $14.61

D) $10.66

E) $12.10

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the corporate valuation model,the total corporate value of Chen Lin Inc.is $500 million.Its balance sheet shows $110 million in notes payable,$90 million in long-term debt,$20 million in preferred stock,$140 million in retained earnings,and $280 million in total common equity.If the company has 25 million shares of stock outstanding,what is the best estimate of its stock price per share?

A) $11.20

B) $9.74

C) $9.18

D) $11.54

E) $11.98

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been assigned the task of using the corporate,or free cash flow,model to estimate Petry Corporation's intrinsic value.The firm's WACC is 10.00%,its end-of-year free cash flow (FCF1) is expected to be $70.0 million,the FCFs are expected to grow at a constant rate of 5.00% a year in the future,the company has $200 million of long-term debt and preferred stock,and it has 30 million shares of common stock outstanding.Assume the firm has zero non-operating assets.What is the firm's estimated intrinsic value per share of common stock? Do not round intermediate calculations.

A) $48.80

B) $34.40

C) $36.80

D) $49.60

E) $40.00

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a stock's expected return as seen by the marginal investor exceeds his or her required return,then the investor will buy the stock until its price has risen enough to bring the expected return down to equal the required return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

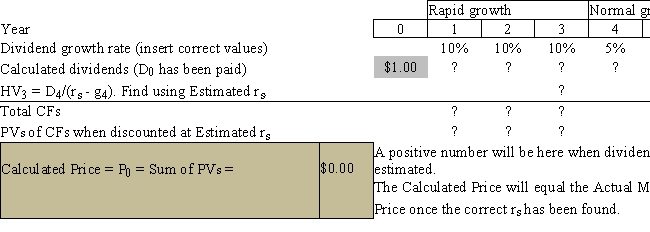

Your boss,Sally Maloney,treasurer of Fred Clark Enterprises (FCE) ,asked you to help her estimate the intrinsic value of the company's stock.FCE just paid a dividend of $1.00,and the stock now sells for $17.50 per share.Sally asked a number of security analysts what they believe FCE's future dividends will be,based on their analysis of the company.The consensus is that the dividend will be increased by 10% during Years 1 to 3,and it will be increased at a rate of 5% per year in Year 4 and thereafter.Sally asked you to use that information to estimate the required rate of return on the stock,rs,and she provided you with the following template for use in the analysis.  ?

?  Sally told you that the growth rates in the template were just put in as a trial,and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated HV.She also notes that the estimated value for rs,at the top of the template,is also just a guess,and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that,after you have put in the correct dividends,you can manually calculate the price,using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes,though,that this trial-and-error process is quite tedious,and that the correct rs could be found much faster with a simple Excel model,especially if you use Goal Seek.What is the value of rs?

Sally told you that the growth rates in the template were just put in as a trial,and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated HV.She also notes that the estimated value for rs,at the top of the template,is also just a guess,and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that,after you have put in the correct dividends,you can manually calculate the price,using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes,though,that this trial-and-error process is quite tedious,and that the correct rs could be found much faster with a simple Excel model,especially if you use Goal Seek.What is the value of rs?

A) 12.44%

B) 9.83%

C) 13.97%

D) 10.54%

E) 11.84%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The preemptive right is important to shareholders because it

A) allows managers to buy additional shares below the current market price.

B) will result in higher dividends per share.

C) is included in every corporate charter.

D) protects the current shareholders against a dilution of their ownership interests.

E) protects bondholders and thus enables the firm to issue debt with a relatively low interest rate.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks X and Y have the following data.Assuming the stock market is efficient and the stocks are in equilibrium,which of the following statements is CORRECT? ?

A) Stock Y pays a higher dividend per share than Stock X.

B) Stock X pays a higher dividend per share than Stock Y.

C) One year from now,Stock X should have the higher price.

D) Stock Y has a lower expected growth rate than Stock X.

E) Stock Y has the higher expected capital gains yield.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wall Inc.forecasts that it will have the free cash flows (in millions) shown below.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3,what is the firm's total corporate value,in millions? Do not round intermediate calculations. ?

A) $535.20

B) $553.65

C) $572.11

D) $549.04

E) $461.38

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The corporate valuation model can be used only when a company doesn't pay dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kale Inc.forecasts the free cash flows (in millions) shown below.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 11.0% and FCF is expected to grow at a rate of 5.0% after Year 2,then what is the firm's total corporate value (in millions) ? Do not round intermediate calculations. ?

A) $1,530

B) $1,833

C) $1,295

D) $1,446

E) $1,682

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in a firm's expected growth rate would cause its required rate of return to

A) increase.

B) decrease.

C) fluctuate less than before.

D) fluctuate more than before.

E) possibly increase,possibly decrease,or possibly remain constant.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sorenson Corp.'s expected year-end dividend is D1 = $4.00,its required return is rs = 11.00%,its dividend yield is 6.00%,and its growth rate is expected to be constant in the future.What is Sorenson's expected stock price in 7 years,i.e. ,what is ? Do not round intermediate calculations.

A) $90.05

B) $85.36

C) $87.24

D) $76.92

E) $93.81

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 89

Related Exams