B) False

Correct Answer

verified

Correct Answer

verified

True/False

A transferor who receives stock for both property and services may not be included in the control group in determining whether an exchange meets the requirements of § 351.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Donald owns a 45% interest in a partnership that earned $130,000 in the current year.He also owns 45% of the stock in a C corporation that earned $130,000 during the year.Donald received $20,000 in distributions from each of the two entities during the year.With respect to this information, Donald must report $78,500 of income on his individual income tax return for the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To ease a liquidity problem, all of the shareholders of Osprey Corporation contribute additional cash to its capital. Osprey has no tax consequences from the contribution.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a taxpayer transfers property subject to a mortgage to a controlled corporation in an exchange qualifying under § 351, the transferor shareholder's basis in stock received in the transferee corporation is increased by the amount of the mortgage on the property.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

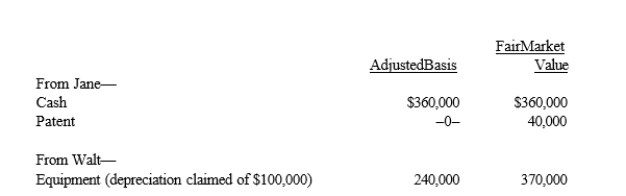

Four individuals form Chickadee Corporation under § 351.Two of these individuals, Jane and Walt, made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer may never recognize a loss on the transfer of property in a transaction subject to § 351.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In general, the basis of property to a corporation in a transfer that qualifies as a nontaxable exchange under § 351 is the basis in the hands of the transferor shareholder decreased by the amount of any gain recognized on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leah transfers equipment (basis of $400,000 and fair market value of $500,000) for additional stock in Crow Corporation.After the transfer, Leah owns 80% of Crow's stock.Associated with the equipment is § 1245 depreciation recapture potential of $70,000.As a result of the transfer:

A) Leah recognizes ordinary income of $70,000.

B) The § 1245 depreciation recapture potential carries over to Crow Corporation.

C) The § 1245 depreciation recapture potential disappears.

D) Leah recognizes ordinary income of $70,000 and § 1231 gain of $30,000.

E) None of these.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

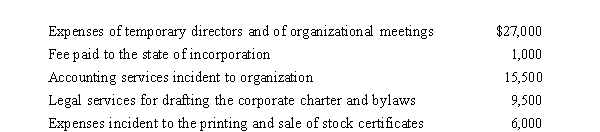

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2019.The following expenses were incurred during the first tax year (April 1 through December 31, 2019) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2019?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2019?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of these.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Earl and Mary form Crow Corporation.Earl transfers property, basis of $200,000 and value of $1,600,000, for 50 shares in Crow Corporation.Mary transfers property, basis of $80,000 and value of $1,480,000, and agrees to serve as manager of Crow for one year; in return Mary receives 50 shares of Crow.The value of Mary's services is $120,000.With respect to the transfers:

A) Mary will not recognize gain or income.

B) Earl will recognize a gain of $1,400,000.

C) Crow Corporation has a basis of $1,480,000 in the property it received from Mary.

D) Crow will have a business deduction of $120,000 for the value of the services Mary will render.

E) None of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Schedule M-1 is used to reconcile net income as computed for financial accounting purposes with taxable income reported on the corporation's income tax return.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Canary Corporation, a calendar year C corporation, received an $80,000 dividend from Stork Corporation.Canary owns 18% of the Stork Corporation stock.Assuming it is not subject to the taxable income limitation, Canary's dividends received deduction is $40,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Schedule M-1 of Form 1120 is used to reconcile financial net income with taxable income reported on the corporation's income tax return as follows: net income per books + additions - subtractions = taxable income.Which of the following items is an addition on Schedule M-1?

A) Tax depreciation in excess of book depreciation.

B) Proceeds of life insurance paid on death of key employee.

C) Excess of capital losses over capital gains.

D) Tax-exempt interest.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When Pheasant Corporation was formed under § 351, Kristen transferred property (basis of $26,000 and fair market value of $22,500) for § 1244 stock.Kristen's basis in the Pheasant stock is $26,000.Three years later, Pheasant Corporation goes bankrupt and its stock becomes worthless.Kristen, who is single, owned the stock as an investment.Kristen's loss is:

A) $26,000 capital.

B) $22,500 ordinary and $3,500 capital.

C) $3,500 ordinary and $22,500 capital.

D) $26,000 ordinary.

E) None of these.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Eve transfers property (basis of $120,000 and fair market value of $400,000) to Green Corporation for 80% of its stock (worth $350,000) and a long-term note (worth $50,000) executed by Green Corporation and made payable to Eve.As a result of the transfer:

A) Eve recognizes no gain.

B) Eve recognizes a gain of $230,000.

C) Eve recognizes a gain of $280,000.

D) Eve recognizes a gain of $50,000.

E) None of these.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jane and Walt form Yellow Corporation.Jane transfers equipment worth $950,000 (basis of $200,000) and cash of $50,000 to Yellow Corporation for 50% of its stock.Walt transfers a building and land worth $1,050,000 (basis of $400,000) for 50% of Yellow's stock and $50,000 in cash.

A) Jane recognizes no gain; Walt recognizes gain of $50,000.

B) Jane recognizes a gain of $50,000; Walt has no gain.

C) Neither Jane nor Walt recognizes gain.

D) Jane recognizes a gain of $750,000; Walt recognizes gain of $650,000.

E) None of these.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The use of § 351 is not limited to the initial formation of a corporation, and it can apply to later transfers as well.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When depreciable property is transferred to a controlled corporation under § 351, any recapture potential disappears and does not carry over to the corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 136

Related Exams