B) False

Correct Answer

verified

Correct Answer

verified

True/False

Albert buys his mother a TV.For purposes of meeting the support test, Albert cannot include the cost of the TV.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An individual taxpayer uses a fiscal year of March 1 to February 28.The due date of this taxpayer's Federal income tax return is May 15 of each tax year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Using borrowed funds from a mortgage on her home, Leah provides 52% of her own support, and her sons furnished the rest.Leah can be claimed as a dependent under a multiple support agreement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Many taxpayers who previously itemized will start claiming the standard deduction when they purchase a home.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Buddy and Hazel are ages 72 and 71, respectively, and file a joint return.If they have itemized deductions of $25,100 for 2019, they should not claim the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Match the statements that relate to each other.Note: Choice k.may be used more than once. a.Available to a 70-year-old father claimed as a dependent by his son. b.Equal to tax liability divided by taxable income. c.The highest income tax rate applicable to a taxpayer. d.Not eligible for the standard deduction. e.No one qualified taxpayer meets the support test. f.Taxpayer's ex-husband does not qualify. g.A dependent child (age 18) who has only unearned income. h.Highest applicable rate is 37%. i.Applicable rate could be as low as 0%. j.Maximum rate is 28%. k.No correct match provided. -Relationship test (for dependency exemption purposes)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following, if any, is a deduction for AGI?

A) State and local sales taxes.

B) Interest on home mortgage.

C) Charitable contributions.

D) Unreimbursed moving expenses of an employee (not in the military) .

E) None of these.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Ed is divorced and maintains a home in which he and a dependent friend live.Ed does not qualify for head of household filing status.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In any given year, that year's Tax Tables are released by the IRS before the Tax Rate Schedules for that year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because they appear on Schedule 1 of Form 1040, itemized deductions are also referred to as "Schedule 1 deductions."

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Katrina, age 16, is claimed as a dependent by her parents.During 2019, she earned $5,600 as a checker at a grocery store.Her standard deduction is $5,950 ($5,600 earned income + $350).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Certain high-income individuals are subject to three additional Medicare taxes on wages, unearned income, and tax credits claimed.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Match the statements that relate to each other.Note: Choice k.may be used more than once. a.Available to a 70-year-old father claimed as a dependent by his son. b.Equal to tax liability divided by taxable income. c.The highest income tax rate applicable to a taxpayer. d.Not eligible for the standard deduction. e.No one qualified taxpayer meets the support test. f.Taxpayer's ex-husband does not qualify. g.A dependent child (age 18) who has only unearned income. h.Highest applicable rate is 37%. i.Applicable rate could be as low as 0%. j.Maximum rate is 28%. k.No correct match provided. -Average income tax rate

Correct Answer

verified

Correct Answer

verified

True/False

The deduction for personal and dependency exemptions has been suspended from 2018 through 2025.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As opposed to itemizing deductions from AGI, the majority of individual taxpayers choose the standard deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In determining the filing requirement based on gross income received, both additional standard deductions (i.e., age and blindness) are taken into account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When the kiddie tax applies, the child need not file an income tax return because his or her income will be reported on the parents' return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jeremy is married to Amy, who abandoned him in 2018.He has not seen or communicated with her since April of that year.He maintains a household in which their son, Evan, lives.Evan is age 25 and earns over $6,000 each year.For tax year 2019, Jeremy's filing status is:

A) Married, filing jointly.

B) Head of household.

C) Married, filing separately.

D) Surviving spouse.

E) Single.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

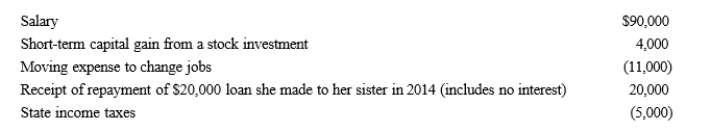

In 2019, Nai-Yu had the following transactions:  Nai-Yu's AGI is:

Nai-Yu's AGI is:

A) $114,000.

B) $103,000.

C) $98,000.

D) $94,000.

E) $83,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 132

Related Exams