B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A major disadvantage of financing with preferred stock is that preferred stockholders typically have supernormal voting rights.

B) Preferred stock is normally expected to provide steadier, more reliable income to investors than the same firm’s common stock, and, as a result, the expected after-tax yield on the preferred is lower than the after-tax expected return on the common stock.

C) The preemptive right is a provision in all corporate charters that gives preferred stockholders the right to purchase (on a pro rata basis) new issues of preferred stock.

D) One of the disadvantages to a corporation of owning preferred stock is that 70% of the dividends received represent taxable income to the corporate recipient, whereas interest income earned on bonds would be tax free.

E) One of the advantages to financing with preferred stock is that 70% of the dividends paid out are tax deductible to the issuer.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A proxy is a document giving one party the authority to act for another party, including the power to vote shares of common stock. Proxies can be important tools relating to control of firms.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to the nonconstant growth model discussed in the textbook, the discount rate used to find the present value of the expected cash flows during the initial growth period is the same as the discount rate used to find the PVs of cash flows during the subsequent constant growth period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Church Inc. is presently enjoying relatively high growth because of a surge in the demand for its new product. Management expects earnings and dividends to grow at a rate of 25% for the next 4 years, after which competition will probably reduce the growth rate in earnings and dividends to zero, i.e., g = 0. The company's last dividend, D0, was $1) 25, its beta is 1.20, the market risk premium is 5.50%, and the risk-free rate is 3.00%. What is the current price of the common stock?

A) $26.77

B) $27.89

C) $29.05

D) $30.21

E) $31.42

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company has two classes of common stock, Class A and Class B, the stocks may pay different dividends, but under all state charters the two classes must have the same voting rights.

B) The preemptive right gives stockholders the right to approve or disapprove of a merger between their company and some other company.

C) The preemptive right is a provision in the corporate charter that gives common stockholders the right to purchase (on a pro rata basis) new issues of the firm's common stock.

D) The stock valuation model, P0 = D1/(rs - g) , cannot be used for firms that have negative growth rates.

E) The stock valuation model, P0 = D1/(rs - g) , can be used only for firms whose growth rates exceed their required returns.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

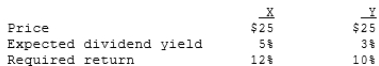

Stocks A and B have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) These two stocks should have the same price.

B) These two stocks must have the same dividend yield.

C) These two stocks should have the same expected return.

D) These two stocks must have the same expected capital gains yield.

E) These two stocks must have the same expected year-end dividend.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Savickas Petroleum's stock has a required return of 12%, and the stock sells for $40 per share. The firm just paid a dividend of $1.00, and the dividend is expected to grow by 30% per year for the next 4 years, so D4 = $1.00(1.30) 4 = $2.8561. After t = 4, the dividend is expected to grow at a constant rate of X% per year forever. What is the stock's expected constant growth rate after t = 4, i.e., what is X?

A) 5.17%

B) 5.44%

C) 5.72%

D) 6.02%

E) 6.34%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If in the opinion of a given investor a stock's expected return exceeds its required return, this suggests that the investor thinks

A) the stock is experiencing supernormal growth.

B) the stock should be sold.

C) the stock is a good buy.

D) management is probably not trying to maximize the price per share.

E) dividends are not likely to be declared.

G) A) and B)

Correct Answer

verified

C

Correct Answer

verified

True/False

The total return on a share of stock refers to the dividend yield less any commissions paid when the stock is purchased and sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Preferred stock is a hybrid--a sort of cross between a common stock and a bond--in the sense that it pays dividends that normally increase annually like a stock but its payments are contractually guaranteed like interest on a bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a stock's market price exceeds its intrinsic value as seen by the marginal investor, then the investor will sell the stock until its price has fallen down to the level of the investor's estimate of the intrinsic value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A share of common stock just paid a dividend of $1.00. If the expected long-run growth rate for this stock is 5.4%, and if investors' required rate of return is 11.4%, what is the stock price?

A) $16.28

B) $16.70

C) $17.13

D) $17.57

E) $18.01

G) C) and D)

Correct Answer

verified

D

Correct Answer

verified

True/False

The constant growth DCF model used to evaluate the prices of common stocks is conceptually similar to the model used to find the price of perpetual preferred stock or other perpetuities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Ramirez Company's last dividend was $1.75. Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever. Its required return (rs) is 12%. What is the best estimate of the current stock price?

A) $41.58

B) $42.64

C) $43.71

D) $44.80

E) $45.92

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

According to the basic DCF stock valuation model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The required returns of Stocks X and Y are rX = 10% and rY = 12%. Which of the following statements is CORRECT?

A) If the market is in equilibrium, and if Stock Y has the lower expected dividend yield, then it must have the higher expected growth rate.

B) If Stock Y and Stock X have the same dividend yield, then Stock Y must have a lower expected capital gains yield than Stock X.

C) If Stock X and Stock Y have the same current dividend and the same expected dividend growth rate, then Stock Y must sell for a higher price.

D) The stocks must sell for the same price.

F) A) and B)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Stocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT?

A) Stock Y pays a higher dividend per share than Stock X.

B) Stock X payg a higher dividend per ghare than stock Y.

C) One year from now, Stock should have the higher price.

D) Stock has a lower expected growth rate than Stock X.

E) Stock has the higher expected capital gains yield.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B have the same price and are in equilibrium, but Stock A has the higher required rate of return. Which of the following statements is CORRECT?

A) If Stock A has a lower dividend yield than Stock B, its expected capital gains yield must be higher than Stock B's.

B) Stock B must have a higher dividend yield than Stock A.

C) Stock A must have a higher dividend yield than Stock B.

D) If Stock A has a higher dividend yield than Stock B, its expected capital gains yield must be lower than Stock B's.

E) Stock A must have both a higher dividend yield and a higher capital gains yield than Stock B.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies can issue different classes of common stock. Which of the following statements concerning stock classes is CORRECT?

A) All common stocks fall into one of three classes: A, B, and C.

B) All common stocks, regardless of class, must have the same voting rights.

C) All firms have several classes of common stock.

D) All common stock, regardless of class, must pay the same dividend.

E) Some class or classes of common stock are entitled to more votes per share than other classes.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 48

Related Exams