A) If the market risk premium increases by 1%, then the required return will increase for stocks that have a beta greater than 1.0, but it will decrease for stocks that have a beta less than 1.0.

B) The effect of a change in the market risk premium depends on the slope of the yield curve.

C) If the market risk premium increases by 1%, then the required return on all stocks will rise by 1%.

D) If the market risk premium increases by 1%, then the required return will increase by 1% for a stock that has a beta of 1.0.

E) The effect of a change in the market risk premium depends on the level of the risk-free rate.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.6, while Stock Y has a beta of 1.4. Which of the following statements is CORRECT?

A) A portfolio consisting of $50,000 invested in Stock X and $50,000 invested in Stock Y will have a required return that exceeds that of the overall market.

B) Stock Y must have a higher expected return and a higher standard deviation than Stock X.

C) If expected inflation increases but the market risk premium is unchanged, then the required return on both stocks will fall by the same amount.

D) If the market risk premium declines but expected inflation is unchanged, the required return on both stocks will decrease, but the decrease will be greater for Stock Y.

E) If expected inflation declines but the market risk premium is unchanged, then the required return on both stocks will decrease but the decrease will be greater for Stock Y.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A stock with a beta equal to -1.0 has zero systematic (or market) risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events, and their effects on investment risk can in theory be diversified away.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

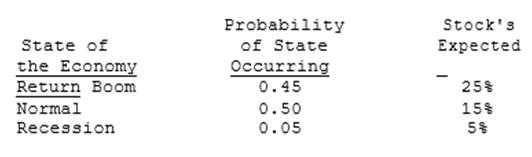

Choudhary Corp believes the following probability distribution exists for its stock. What is the coefficient of variation on the company's stock?

A)

B)

C)

D)

E)

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A stock's beta is more relevant as a measure of risk to an investor who holds only one stock than to an investor who holds a well-diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has an expected return of 12%, a beta of 1.2, and a standard deviation of 20%. Stock B also has a beta of 1.2, but its expected return is 10% and its standard deviation is 15%. Portfolio AB has $900,000 invested in Stock A and $300,000 invested in Stock B. The correlation between the two stocks' returns is zero (that is, rA,B = 0) . Which of the following statements is CORRECT?

A) Portfolio AB's standard deviation is 17.5%.

B) The stocks are not in equilibrium based on the CAPM; if A is valued correctly, then B is overvalued.

C) The stocks are not in equilibrium based on the CAPM; if A is valued correctly, then B is undervalued.

D) Portfolio AB's expected return is 11.0%.

E) Portfolio AB's beta is less than 1.2.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Variance is a measure of the variability of returns, and since it involves squaring the deviation of each actual return from the expected return, it is always larger than its square root, its standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B both have an expected return of 10% and a standard deviation of returns of 25%. Stock A has a beta of 0.8 and Stock B has a beta of 1.2. The correlation coefficient, r, between the two stocks is 0.6. Portfolio P has 50% invested in Stock A and 50% invested in B. Which of the following statements is CORRECT?

A) Portfolio P has a standard deviation of 25% and a beta of 1.0.

B) Based on the information we are given, and assuming those are the views of the marginal investor, it is apparent that the two stocks are in equilibrium.

C) Portfolio P has more market risk than Stock A but less market risk than B.

D) Stock A should have a higher expected return than Stock B as viewed by the marginal investor.

E) Portfolio P has a coefficient of variation equal to 2.5.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

We would generally find that the beta of a single security is more stable over time than the beta of a diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The slope of the SML is determined by investors' aversion to risk. The greater the average investor's risk aversion, the steeper the SML.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A, B, and C all have an expected return of 10% and a standard deviation of 25%. Stocks A and B have returns that are independent of one another, i.e., their correlation coefficient, r, equals zero. Stocks A and C have returns that are negatively correlated with one another, i.e., r is less than 0. Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B. Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C. Which of the following statements is CORRECT?

A) Portfolio AC has an expected return that is less than 10%.

B) Portfolio AC has an expected return that is greater than 25%.

C) Portfolio AB has a standard deviation that is greater than 25%.

D) Portfolio AB has a standard deviation that is equal to 25%.

E) Portfolio AC has a standard deviation that is less than 25%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A portfolio's risk is measured by the weighted average of the standard deviations of the securities in the portfolio. It is this aspect of portfolios that allows investors to combine stocks and thus reduce the riskiness of their portfolios.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain, and most investors are risk averse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

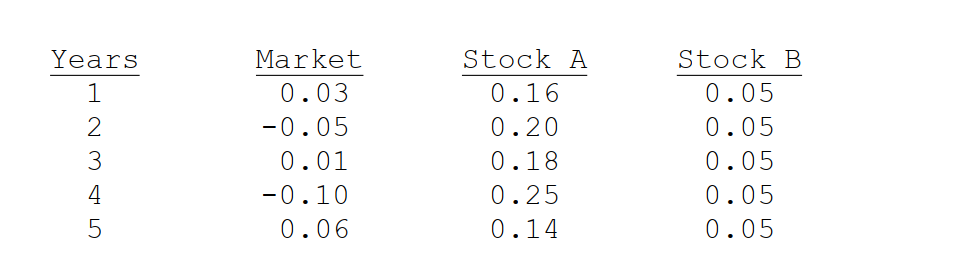

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and

B. Which of the possible answers best describes the historical betas for A and B?

A) bA > 0; bB = 1.

B) bA > +1; bB = 0.

C) bA = 0; bB = -1.

D) bA < 0; bB = 0.

E) bA < -1; bB = 1.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mulherin's stock has a beta of 1.23, its required return is 11.75%, and the risk-free rate is 4.30%. What is the required rate of return on the market? (Hint: First find the market risk premium.)

A) 10.36%

B) 10.62%

C) 10.88%

D) 11.15%

E) 11.43%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tom O'Brien has a 2-stock portfolio with a total value of $100,000. $37,500 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.42. What is his portfolio's beta?

A) 1.17

B) 1.23

C) 1.29

D) 1.35

E) 1.42

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

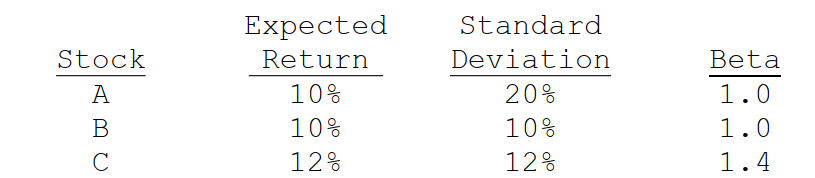

Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlations are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is CORRECT?

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is CORRECT?

A) Portfolio AB has a standard deviation of 20%.

B) Portfolio AB's coefficient of variation is greater than 2.0.

C) Portfolio AB's required return is greater than the required return on Stock A.

D) Portfolio ABC's expected return is 10.66667%.

E) Portfolio ABC has a standard deviation of 20%.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

CCC Corp has a beta of 1.5 and is currently in equilibrium. The required rate of return on the stock is 12.00% versus a required return on an average stock of 10.00%. Now the required return on an average stock increases by 30.0% (not percentage points) . Neither betas nor the risk-free rate change. What would CCC's new required return be?

A) 14.89%

B) 15.68%

C) 16.50%

D) 17.33%

E) 18.19%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a portfolio of 40 randomly selected stocks, which of the following is most likely to be true?

A) The riskiness of the portfolio is greater than the riskiness of each of the stocks if each was held in isolation.

B) The riskiness of the portfolio is the same as the riskiness of each stock if it was held in isolation.

C) The beta of the portfolio is less than the average of the betas of the individual stocks.

D) The beta of the portfolio is equal to the average of the betas of the individual stocks.

E) The beta of the portfolio is larger than the average of the betas of the individual stocks.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 132

Related Exams