B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary reason managers give for most mergers is to acquire more assets so as to increase sales and market share.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Great Subs Inc., a regional sandwich chain, is considering purchasing a smaller chain, Eastern Pizza, which is currently financed using 20% debt at a cost of 8%. Great Subs' analysts project that the merger will result in incremental free cash flows and interest tax savings of $2 million in Year 1, $4 million in Year 2, $5 million in Year 3, and $117 million in Year 4. (The Year 4 cash flow includes a horizon value of $107 million.) The acquisition would be made immediately, if it is to be undertaken. Eastern's pre-merger beta is 2.0, and its post- merger tax rate would be 34%. The risk-free rate is 8%, and the market risk premium is 4%. What is the appropriate rate for use in discounting the free cash flows and the interest tax savings?

A) 12.0%

B) 13.9%

C) 14.4%

D) 16.0%

E) 16.9%

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One of the main reasons why foreign firms are interested in buying U.S. companies is to gain entrance to the U.S. market. A decline in the value of the dollar relative to most foreign currencies makes this competitive strategy especially attractive.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although goodwill created in a merger may not be amortized for shareholder reporting purposes, it may be amortized for Federal tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about valuing a firm using the APV approach is most CORRECT?

A) The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.

B) The value of equity is calculated by discounting the horizon value, the tax shields, and the free cash flows at the cost of equity.

C) The value of operations is calculated by discounting the horizon value, the tax shields, and the free cash flows before the horizon date at the unlevered cost of equity.

D) The value of equity is calculated by discounting the horizon value and the free cash flows at the cost of equity.

E) The APV approach stands for the accounting pre-valuation approach.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A parent holding company sells shares in its subsidiary such that the parent now owns only 65% of the subsidiary and, thus, the tax returns of the parent and its subsidiary can't be consolidated. The parent receives annual dividends from the subsidiary of $2,500,000. If the parent's marginal tax rate is 34% and if the exclusion on intercompany dividends is 70%, what is the effective tax rate on the intercompany dividends, and how much net dividends are received?

A) 10.2%; $2,245,000

B) 10.2%; $2,135,000

C) 23.8%; $1,905,000

D) 10.2%; $1,750,000

E) 34.0%; $1,650,000

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the capital structure is stable, and free cash flows are expected to be growing at a constant rate at the horizon date, then the horizon value is calculated by discounting the free cash flows plus the expected future tax shields at the weighted average cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since managers' central goal is to maximize stock price, managerial control issues do not interfere with mergers that would benefit the target firm's stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a petrochemical firm that used oil as feedstock merged with an oil producer that had large oil reserves and a drilling subsidiary, this would be a vertical merger.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Post-merger control and the negotiated price paid by the acquirer are 2 of the most important issues in agreeing on the terms of a merger.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a financial merger, the relevant post-merger cash flows are simply the sum of the expected cash flows of the 2 companies, measured as if they were operated independently.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

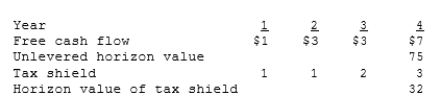

Brau Auto, a national autoparts chain, is considering purchasing a smaller chain, South Georgia Parts (SGP) . Brau's analysts project that the merger will result in the following incremental free cash flows, tax shields, and horizon values:  Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same.

SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same.

SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

A) $53.40 million

B) $61.96 million

C) $64.64 million

D) $76.96 million

E) $79.64 million

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Synergistic benefits can arise from a number of different sources, including operating economies of scale, financial economies, and increased managerial efficiency.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Currently (2007), mergers can be accounted for using either the purchase method or the pooling method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are legal and acceptable reasons for the high level of merger activity in the U.S. during the 1980s?

A) Synergistic benefits arising from mergers.

B) A profitable firm acquires a firm with large accumulated tax losses that my be carried forward.

C) Attempts to stabilize earnings by diversifying.

D) Purchase of assets below their replacement costs.

E) Reduction in competition resulting from mergers.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The rate used to discount projected merger cash flows should be the cost of capital of the new consolidated firm because it incorporates the actual capital structure of the new firm.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dunbar Hardware, a national hardware chain, is considering purchasing a smaller chain, Eastern Hardware. Dunbar's analysts project that the merger will result in incremental free flows and interest tax savings with a combined present value of $72.52 million, and they have determined that the appropriate discount rate for valuing Eastern is 16%. Eastern has 4 million shares outstanding and no debt. Eastern's current price is $16.25. What is the maximum price per share that Dunbar should offer?

A) $16.25

B) $16.97

C) $17.42

D) $18.13

E) $19.00

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A company seeking to fight off a hostile takeover might employ the services of an investment banking firm to develop a defensive strategy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The two principal advantages of holding companies are (1) the holding company can control a great deal of assets with limited equity and (2) the dividends received by the parent from the subsidiary are not taxed if the parent holds at least 50% of the subsidiary's stock.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 41

Related Exams