B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the yield curve is upward sloping, then short-term debt will be cheaper than long-term debt. Thus, if a firm's CFO expects the yield curve to continue to have an upward slope, this would tend to cause the current ratio to be relatively low, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is

A) used to protect cash, i.e., to keep it from being stolen.

B) used to identify inventory safety stocks.

C) used to slow down the collection of checks our firm writes.

D) used to speed up the collection of checks received.

E) used primarily by firms where currency is used frequently in transactions, such as fast food restaurants, and less frequently by firms that receive payments as checks.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The risk to the firm of borrowing using short-term credit is usually greater than if it used long-term debt. Added risk stems from (1) the greater variability of interest costs on short-term than long-term debt and (2) the fact that even if its long-term prospects are good, the firm's lenders may not be willing to renew short-term loans if the firm is temporarily unable to repay those loans.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

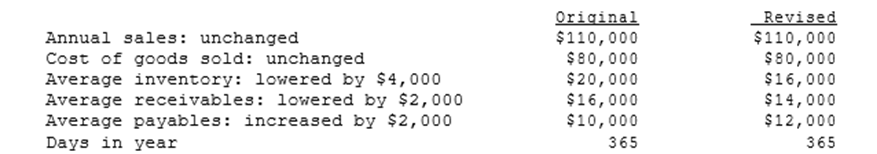

Zervos Inc. had the following data for 2008 (in millions) . The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000, (2) that improvements in the credit department could reduce receivables by $2,000, and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000. Furthermore, she thinks that these changes would not affect either sales or the costs of goods sold. If these changes were made, by how many days would the cash conversion cycle be lowered?

A) 34.0

B) 37.4

C) 41.2

D) 45.3

E) 49.8

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your company has been offered credit terms of 4/30, net 90 days. What will be the nominal annual percentage cost of its non-free trade credit if it pays 120 days after the purchase? (Assume a 365-day year.)

A) 16.05%

B) 16.90%

C) 17.74%

D) 18.63%

E) 19.56%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it does not represent a real financial cost to your firm as long as the customer periodically pays off its entire balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate.

B) In managing a firm's accounts receivable, it is possible to increase credit sales per day yet still keep accounts receivable fairly steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently.

C) Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales.

D) Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

E) Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Short-term marketable securities are held for two separate and distinct purposes: (1) to provide liquidity as a substitute for cash and (2) as a non-operating investment. Marketable securities held while awaiting reinvestment are not available for liquidity purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Madura Inc. wants to increase its free cash flow by $180 million during the coming year, which should result in a higher EVA and stock price. The CFO has made these projections for the upcoming year: EBIT is projected to equal $850 million. Gross capital expenditures are expected to total to $360 million versus depreciation of $120 million, so its net capital expenditures should total $240 million. The tax rate is 40%. There will be no changes in cash or marketable securities, nor will there be any changes in notes payable or accruals. What increase in net working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

A) $ 72

B) $ 90

C) $108

D) $130

E) $156

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cass & Company has the following data. What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 38 days

D) 42 days

E) 46 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

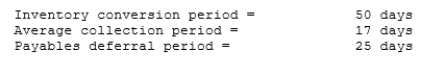

Romano Inc. has the following data. What is the firm's cash conversion cycle?

A) 33 days

B) 37 days

C) 41 days

D) 45 days

E) 49 days

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm buys on terms of 3/15, net 45. It does not take the discount, and it generally pays after 60 days. What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 25.09%

B) 27.59%

C) 30.35%

D) 33.39%

E) 36.73%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Payments lags.

B) Depreciation.

C) Cumulative cash.

D) Repurchases of common stock.

E) Payment for plant construction.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The maturity of most bank loans is short term. Bank loans to businesses are frequently made as 90-day notes which are often rolled over, or renewed, rather than repaid when they mature. However, if the borrower's financial situation deteriorates, then the bank may refuse to roll over the loan. a. True b. False

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm takes actions that reduce its days sales outstanding (DSO), then, other things held constant, this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Uncertainty about the exact lives of assets prevents precise maturity matching in an ex post (i.e., after the fact) sense even though it is possible to match maturities on an ex ante (expected) basis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Trade credit is provided only to relatively large, strong firms.

B) Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies.

C) Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than long-term debt.

D) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

E) Commercial paper is typically offered at a long-term maturity of at least five years.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

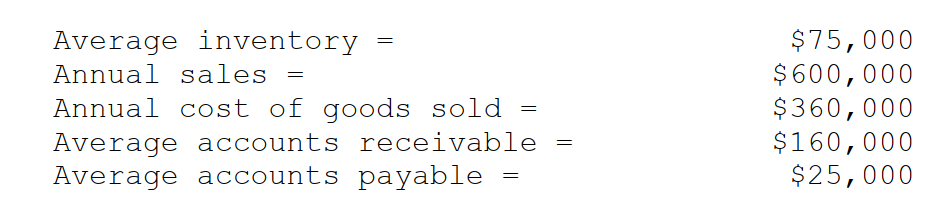

Your consulting firm was recently hired to improve the performance of Shin-Soenen Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle?

A) 120.6 days

B) 126.9 days

C) 133.6 days

D) 140.6 days

E) 148.0 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Short-term financing is riskier than long-term financing since, during periods of tight credit, the firm may not be able to rollover (renew) its debt. This is especially true if the funds are used to finance long-term assets rather than short-term assets.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 129

Related Exams