A) 11.34%

B) 11.63%

C) 11.92%

D) 12.22%

E) 12.52%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A two-stock portfolio will always have a lower standard deviation than a one-stock portfolio.

B) A portfolio that consists of 40 stocks that are not highly correlated with "the market" will probably be less risky than a portfolio of 40 stocks that are highly correlated with the market, assuming the stocks all have the same standard deviations.

C) A two-stock portfolio will always have a lower beta than a one-stock portfolio.

D) If portfolios are formed by randomly selecting stocks, a 10-stock portfolio will always have a lower beta than a one-stock portfolio.

E) A stock with an above-average standard deviation must also have an above-average beta.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

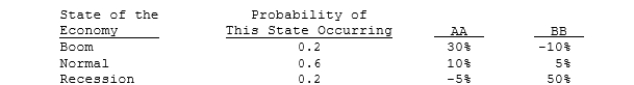

The distributions of rates of return for Companies AA and BB are given below:  We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

We can conclude from the above information that any rational, risk- averse investor would be better off adding Security AA to a well- diversified portfolio over Security BB.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

We would generally find that the beta of a single security is more stable over time than the beta of a diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The standard deviation is a better measure of risk than the coefficient of variation if the expected returns of the securities being compared differ significantly.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that investors have recently become more risk averse, so the market risk premium has increased. Also, assume that the risk-free rate and expected inflation have not changed. Which of the following is most likely to occur?

A) The required rate of return for an average stock will increase by an amount equal to the increase in the market risk premium.

B) The required rate of return will decline for stocks whose betas are less than 1.0.

C) The required rate of return on the market, rM, will not change as a result of these changes.

D) The required rate of return for each individual stock in the market will increase by an amount equal to the increase in the market risk premium.

E) The required rate of return on a riskless bond will decline.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If an investor buys enough stocks, he or she can, through diversification, eliminate all of the market risk inherent in owning stocks, but as a general rule it will not be possible to eliminate all diversifiable risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nile Food's stock has a beta of 1.4, while Elba Eateries' stock has a beta of 0.7. Assume that the risk-free rate, rRF, is 5.5% and the market risk premium, (rM − rRF) , equals 4%. Which of the following statements is CORRECT?

A) If the risk-free rate increases but the market risk premium remains unchanged, the required return will increase for both stocks but the increase will be larger for Nile since it has a higher beta.

B) If the market risk premium increases but the risk-free rate remains unchanged, Nile's required return will increase because it has a beta greater than 1.0 but Elba's required return will decline because it has a beta less than 1.0.

C) Since Nile's beta is twice that of Elba's, its required rate of return will also be twice that of Elba's.

D) If the risk-free rate increases while the market risk premium remains constant, then the required return on an average stock will increase.

E) If the market risk premium decreases but the risk-free rate remains unchanged, Nile's required return will decrease because it has a beta greater than 1.0 and Elba's will also decrease, but by more than Nile's because it has a beta less than 1.0.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bill Dukes has $100,000 invested in a 2-stock portfolio. $35,000 is invested in Stock X and the remainder is invested in Stock Y. X's beta is 1.50 and Y's beta is 0.70. What is the portfolio's beta?

A) 0.65

B) 0.72

C) 0.80

D) 0.89

E) 0.98

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bob has a $50,000 stock portfolio with a beta of 1.2, an expected return of 10.8%, and a standard deviation of 25%. Becky also has a $50,000 portfolio, but it has a beta of 0.8, an expected return of 9.2%, and a standard deviation that is also 25%. The correlation coefficient, r, between Bob's and Becky's portfolios is zero. If Bob and Becky marry and combine their portfolios, which of the following best describes their combined $100,000 portfolio?

A) The combined portfolio's expected return will be less than the simple weighted average of the expected returns of the two individual portfolios, 10.0%.

B) The combined portfolio's beta will be equal to a simple weighted average of the betas of the two individual portfolios, 1.0; its expected return will be equal to a simple weighted average of the expected returns of the two individual portfolios, 10.0%; and its standard deviation will be less than the simple average of the two portfolios' standard deviations, 25%.

C) The combined portfolio's expected return will be greater than the simple weighted average of the expected returns of the two individual portfolios, 10.0%.

D) The combined portfolio's standard deviation will be greater than the simple average of the two portfolios' standard deviations, 25%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain, and most investors are risk averse.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scheuer Enterprises has a beta of 1.10, the real risk-free rate is 2.00%, investors expect a 3.00% future inflation rate, and the market risk premium is 4.70%. What is Scheuer's required rate of return?

A) 9.43%

B) 9.67%

C) 9.92%

D) 10.17%

E) 10.42%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A, B, and C all have an expected return of 10% and a standard deviation of 25%. Stocks A and B have returns that are independent of one another, i.e., their correlation coefficient, r, equals zero. Stocks A and C have returns that are negatively correlated with one another, i.e., r is less than 0. Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B. Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C. Which of the following statements is CORRECT?

A) Portfolio AC has an expected return that is less than 10%.

B) Portfolio AC has an expected return that is greater than 25%.

C) Portfolio AB has a standard deviation that is greater than 25%.

D) Portfolio AB has a standard deviation that is equal to 25%.

E) Portfolio AC has a standard deviation that is less than 25%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free rate is 6% and the market risk premium is 5%. Your $1 million portfolio consists of $700,000 invested in a stock that has a beta of 1.2 and $300,000 invested in a stock that has a beta of 0.8. Which of the following statements is CORRECT?

A) If the stock market is efficient, your portfolio's expected return should equal the expected return on the market, which is 11%.

B) The required return on the market is 10%.

C) The portfolio's required return is less than 11%.

D) If the risk-free rate remains unchanged but the market risk premium increases by 2%, your portfolio's required return will increase by more than 2%.

E) If the market risk premium remains unchanged but expected inflation increases by 2%, your portfolio's required return will increase by more than 2%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a portfolio of three randomly selected stocks, which of the following could NOT be true, i.e., which statement always is false?

A) The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation.

B) The riskiness of the portfolio is greater than the riskiness of one or two of the stocks.

C) The beta of the portfolio is lower than the lowest of the three betas.

D) The beta of the portfolio is lower than the highest of the three betas.

E) None of the above statements is obviously false, because they all could be true, but not necessarily at the same time.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An investor can eliminate virtually all market risk if he or she holds a very large and well diversified portfolio of stocks.

B) The higher the correlation between the stocks in a portfolio, the lower the risk inherent in the portfolio.

C) It is impossible to have a situation where the market risk of a single stock is less than that of a portfolio that includes the stock.

D) Once a portfolio has about 40 stocks, adding additional stocks will not reduce its risk by even a small amount.

E) An investor can eliminate virtually all diversifiable risk if he or she holds a very large, well-diversified portfolio of stocks.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The slope of the SML is determined by the value of beta.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe the following information regarding Companies X and Y: Company X has a higher expected return than Company Y. Company X has a lower standard deviation of returns than Company Y. Company X has a higher beta than Company Y. Given this information, which of the following statements is CORRECT?

A) Company X has more diversifiable risk than Company Y.

B) Company X has a lower coefficient of variation than Company Y.

C) Company X has less market risk than Company Y.

D) Company X's returns will be negative when Y's returns are positive.

E) Company X's stock is a better buy than Company Y's stock.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the coming year, the market risk premium (rM − rRF) , is expected to fall, while the risk-free rate, rRF, is expected to remain the same. Given this forecast, which of the following statements is CORRECT?

A) The required return will increase for stocks with a beta less than 1.0 and will decrease for stocks with a beta greater than 1.0.

B) The required return on all stocks will remain unchanged.

C) The required return will fall for all stocks, but it will fall more for stocks with higher betas.

D) The required return for all stocks will fall by the same amount.

E) The required return will fall for all stocks, but it will fall less for stocks with higher betas.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jane has a portfolio of 20 average stocks, and Dick has a portfolio of 2 average stocks. Assuming the market is in equilibrium, which of the following statements is CORRECT?

A) Jane's portfolio will have less diversifiable risk and also less market risk than Dick's portfolio.

B) The required return on Jane's portfolio will be lower than that on Dick's portfolio because Jane's portfolio will have less total risk.

C) Dick's portfolio will have more diversifiable risk, the same market risk, and thus more total risk than Jane's portfolio, but the required (and expected) returns will be the same on both portfolios.

D) If the two portfolios have the same beta, their required returns will be the same, but Jane's portfolio will have less market risk than Dick's.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 137

Related Exams