A) $335,616

B) $352,397

C) $370,017

D) $388,518

E) $407,944

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kirk Development buys on terms of 2/15, net 60 days. It does not take discounts, and it typically pays on time, 60 days after the invoice date. Net purchases amount to $550,000 per year. On average, what is the dollar amount of total trade credit (costly + free) the firm receives during the year, i.e., what are its average accounts payable? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $ 90,411

B) $ 94,932

C) $ 99,678

D) $104,662

E) $109,895

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A firm that follows an aggressive current asset financing approach uses primarily short-term credit and thus is more exposed to an unexpected increase in interest rates than is a firm that uses long-term capital and thus follows a conservative financing policy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Trade credit can be separated into two components: free trade credit, which is credit received after the discount period ends, and costly trade credit, which is the cost of discounts not taken.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is

A) used to protect cash, i.e., to keep it from being stolen.

B) used to identify inventory safety stocks.

C) used to slow down the collection of checks our firm writes.

D) used to speed up the collection of checks received.

E) used primarily by firms where currency is used frequently in transactions, such as fast food restaurants, and less frequently by firms that receive payments as checks.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Weiss Inc. arranged a $9,000,000 revolving credit agreement with a group of banks. The firm paid an annual commitment fee of 0.5% of the unused balance of the loan commitment. On the used portion of the revolver, it paid 1.5% above prime for the funds actually borrowed on a simple interest basis. The prime rate was 3.25% during the year. If the firm borrowed $6,000,000 immediately after the agreement was signed and repaid the loan at the end of one year, what was the total dollar annual cost of the revolver?

A) $285,000

B) $300,000

C) $315,000

D) $330,750

E) $347,288

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm's cost of goods sold (COGS) average $2,000,000 per month, and it keeps inventory equal to 50% of its monthly COGS on hand at all times. Using a 365-day year, what is its inventory conversion period?

A) 11.7 days

B) 13.0 days

C) 14.4 days

D) 15.2 days

E) 16.7 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Trade credit is provided only to relatively large, strong firms.

B) Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies.

C) Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than long-term debt.

D) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

E) Commercial paper is typically offered at a long-term maturity of at least five years.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has set up a revolving credit agreement with a bank, the risk to the firm of being unable to obtain funds when needed is lower than if it had an informal line of credit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A conservative current operating asset financing approach will result in permanent current assets and some seasonal current assets being financed using long-term securities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions would be likely to shorten the cash conversion cycle?

A) Adopt a new manufacturing process that speeds up the conversion of raw materials to finished goods from 20 days to 10 days.

B) Change the credit terms offered to customers from 3/10 net 30 to 1/10 net 50.

C) Begin to take discounts on inventory purchases; we buy on terms of 2/10 net 30.

D) Adopt a new manufacturing process that saves some labor costs but slows down the conversion of raw materials to finished goods from 10 days to 20 days.

E) Change the credit terms offered to customers from 2/10 net 30 to 1/10 net 60.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

On average, a firm collects checks totaling $250,000 per day. It takes the firm approximately 4 days from the day the checks were mailed until they result in usable cash for the firm. Assume that (1) a lockbox system could be employed which would reduce the cash conversion procedure to 2 1/2 days and (2) the firm could invest any additional cash generated at 6% after taxes. The lockbox system would be a good buy if it costs $25,000 annually.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

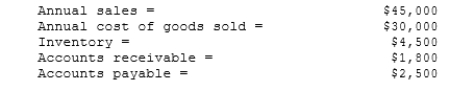

Desai Inc. has the following data, in thousands. Assuming a 365-day year, what is the firm's cash conversion cycle?

A) 28 days

B) 32 days

C) 35 days

D) 39 days

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Because money has time value, a cash sale is always more profitable than a credit sale.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget and the capital budget are handled separately, and although they are both important, they are developed completely independently of one another.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The risk to the firm of borrowing using short-term credit is usually greater than if it used long-term debt. Added risk stems from (1) the greater variability of interest costs on short-term than long-term debt and (2) the fact that even if its long-term prospects are good, the firm's lenders may not be willing to renew short-term loans if the firm is temporarily unable to repay those loans.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Not taking cash discounts is costly, and as a result, firms that do not take them are usually those that are performing poorly and have inadequate cash balances.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An increase in any current asset must be accompanied by an equal increase in some current liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Shorter-term cash budgets, in general, are used primarily for planning purposes, while longer-term budgets are used for actual cash control.

B) The cash budget and the capital budget are developed separately, and although they are both important to the firm, one does not affect the other.

C) Since depreciation is a non-cash charge, it neither appears on nor has any effect on the cash budget.

D) The target cash balance should be set such that it need not be adjusted for seasonal patterns and unanticipated fluctuations in receipts, although it should be changed to reflect long-term changes in the firm's operations.

E) The typical cash budget reflects interest paid on loans as well as income from the investment of surplus cash. These numbers, as well as other items on the cash budget, are expected values; hence, actual results might vary from the budgeted amounts.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bumpas Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15, net 50. If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.)

A) 20.11%

B) 21.17%

C) 22.28%

D) 23.45%

E) 24.63%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 128

Related Exams