A) merchandising company at the retail level.

B) service company.

C) merchandising company at the wholesale level.

D) manufacturer.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the term to the appropriate definition.There are more definitions than terms. -Service Company

A) The sum of beginning inventory and purchases for the period.

B) Presents important subtotals,such as gross profit,to help distinguish core operating results from other,less significant items that affect net income.

C) A term of sale indicating that goods are owned by the seller until they are delivered to the buyer.

D) Sells goods that have been obtained from a supplier.

E) Inventory records are updated every time inventory is bought,sold,or returned.

F) A sales price reduction given to customers for prompt payment of their account balance.

G) Inventory records are updated at the end of the accounting period.To determine how much merchandise has been sold,inventory must be physically counted at the end of the period.

H) A term of sale indicating that goods are owned by the buyer the moment they leave the seller's premises.

I) Sells services rather than physical goods.

J) Assets acquired for resale to customers.

L) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A retailer is a company that buys products from manufacturers and sells them to wholesalers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1,Robertson Company sold inventory in the amount of $5,800 to Alberta,with credit terms of 2/10,n/30.The cost of the items sold is $4,000.Robertson uses the periodic inventory system.On October 4,Alberta returns some of the inventory.The selling price of the inventory is $500 and the cost of the inventory returned is $350.What journal entry (entries) will be recorded by Robertson October 4?

A) Debit Sales Revenue and credit Accounts Receivable for $500;debit Inventory and credit Cost of Goods Sold for $350

B) Debit Sales Revenue and credit Accounts Receivable for $500

C) Debit Accounts Receivable and credit Sales Revenue for $500

D) Debit Accounts Receivable and credit Sales Revenue for $500;debit Cost of Goods Sold and credit Inventory for $350

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The perpetual inventory method of tracking inventory is considered superior to the periodic method because the perpetual method:

A) makes calculations easier and less technology can be deployed.

B) tells what inventory a company should have on hand at any point in time.

C) saves a company from ever having to count the goods in inventory.

D) is more consistent with how companies calculated inventory in the past.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine cost of goods sold for the period requires:

A) subtracting ending inventory from the goods available for sale,which is the beginning inventory plus purchases.

B) adding ending inventory to the goods available for sale,which is the beginning inventory plus purchases.

C) subtracting beginning inventory from the goods available for sale,which is the ending inventory plus purchases.

D) adding beginning inventory to the goods available for sale,which is the ending inventory plus purchases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Purple Corp.purchased $10,000 of merchandise on June 3,subject to the terms,2/10,n/30.On June 9,it pays for all the merchandise purchased on June 3.The entry on June 9 will reduce:

A) Accounts Payable by $9,800.

B) net income by $200.

C) stockholders' equity by $200.

D) Inventory by $200.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a periodic inventory system is in use,the Inventory account is updated only at the end of the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using a perpetual inventory system,the Cost of Goods Sold is recorded:

A) each time a sale is made.

B) at the end of each month.

C) at the end of the accounting period.

D) at the end of each day.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

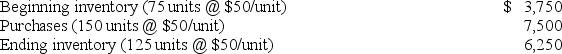

FAD Company uses a periodic inventory system and its inventory records for the period contain the following information:  What is the amount of cost of goods available for sale?

What is the amount of cost of goods available for sale?

A) $11,250

B) $17,500

C) $5,000

D) $13,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Sales discounts are discounts that consumers get from buying clearance items at a reduced price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Generally,a physical count of inventory is performed annually in both a perpetual inventory system and a periodic inventory system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On April 6,Portland purchased $25,000 of inventory,terms 1/15,n/30.Portland uses a perpetual inventory system.The company paid for the purchase on April 26.The entry to record the payment on April 26 includes which of the following?

A) A credit to Inventory for $250.

B) A debit to Accounts Payable for $24,500.

C) A credit to Accounts Payable for $25,000.

D) A credit to Cash for $25,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding shrinkage is not correct?

A) Perpetual inventory systems can help managers detect shrinkage.

B) Shrinkage is another term for inventory loss due to theft,error,or fraud.

C) Shrinkage is detected by comparing the balance in the inventory ledger account with the results of the physical inventory count.

D) It is easier to detect shrinkage in a periodic inventory system than in a perpetual inventory system.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A company either performs a service,sells inventory that it purchases from others,or manufacturers a product;it cannot serve more than one of these functions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Neakanie Industries sells specialized mountain bikes.Each specialized bike purchased includes free maintenance service for 12 months.The price of the specialized bike is $1,000.When sold separately,a maintenance contract is $200 and a comparable but non-specialized bike is $600.If Neakanie sold 3 bikes on December 1,how much total revenue would the company recognize on December 31?

A) $2,937.50.

B) $2,250.00.

C) $2,312.50.

D) $250.00.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following is a listing of some of the balance sheet accounts and all of the income statement accounts for Northview Company as they appear on the company's adjusted trial balance. Income from operations would be:

A) $18,000.

B) $30,000.

C) $33,000.

D) $36,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An account used in the periodic inventory system that is not used in the perpetual inventory system is:

A) Inventory

B) Sales Revenue

C) Sales Returns & Allowances

D) Purchases

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harvard,Inc.paid an invoice for $1,000,with discount terms of 2/7,n/30,within the discount period and will write a check in the amount of:

A) $1,000.

B) $980.

C) $1,020.

D) $998.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ________ inventory system will always give updated balances for ________.

A) perpetual;Cost of Goods Sold

B) periodic;Inventory

C) perpetual;Goods Available for Sale

D) periodic;Cost of Goods Sold

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 209

Related Exams