B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deadweight loss of a tax is

A) the reduction in economic welfare of taxpayers that exceeds the revenue raised by the government.

B) the improved efficiency created as people reallocate resources according to the tax incentive rather than the true costs and benefits.

C) the loss in tax revenues.

D) Both a and b are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax that generates the most revenue for state and local government is the

A) corporate income tax.

B) individual income tax.

C) property tax.

D) sales tax.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The public welfare spending category for state and local governments includes

A) many programs that are initiated by private foundations.

B) contributions in support of public universities.

C) some federal programs that are administered by state and local governments.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 20 percent on the first $50,000 of income and 30 percent on all income above $50,000.What is the marginal tax rate when income is $60,000?

A) 10 percent

B) 20 percent

C) 30 percent

D) 50 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following programs is not included in the federal income security spending?

A) Social Security

B) Temporary Assistance for Needy Families (TANF)

C) Food Stamps

D) unemployment compensation

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If James earns $80,000 in taxable income and pays $20,000 in taxes,his average tax rate is 25 percent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes create deadweight loss when they

A) distort behavior.

B) cause the price of the product to increase.

C) don't raise sufficient government revenue.

D) cannot be computed easily.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An efficient tax system is one that imposes small deadweight losses and small administrative burdens.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An efficient tax system is one that (i) maximizes tax revenues. (ii) minimizes deadweight losses from taxes. (iii) minimizes administrative burdens from taxes. (iv) promotes equity across taxpayers.

A) (i) only

B) (ii) and (iii) only

C) (i) , (ii) , and (iii) only

D) (i) , (ii) , (iii) , and (iv)

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the government imposes a tax of 10 percent on the first $40,000 of income and 20 percent on all income above $40,000.What are the tax liability and the marginal tax rate for a person whose income is $30,000?

A) both are 10 percent

B) 10 percent and $2,000, respectively

C) $3,000 and 10 percent, respectively

D) $3,000 and 20 percent, respectively

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax evasion is

A) facilitated by legal deductions to taxable income.

B) the same as tax avoidance.

C) recommended by the American Accounting Association.

D) illegal.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about the percent of total income all levels of government in the U.S.take as taxes?

A) In 1902 the government collected about 7 percent of total income. In recent years, it collected about 30 percent of total income.

B) In 1902 the government collected about 30 percent of total income. In recent years, it collected about 7 percent of total income.

C) In 1902 the government collected about 7 percent of total income. In recent years, it collected about 7 percent of total income.

D) In 1902 the government collected about 30 percent of total income. In recent years, it collected about 30 percent of total income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In practice,the U.S.income tax system is filled with special provisions that alter a family's tax based on its specific circumstances.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

State and local governments generate revenue from all of the following sources except

A) sales taxes.

B) the federal government.

C) corporate income taxes.

D) customs duties.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following in not a reason that a lump-sum tax imposes a minimal administrative burden on taxpayers?

A) Everyone can easily compute the amount of tax owed.

B) There is no benefit to hiring an accountant to do your taxes.

C) Everyone owes the same amount of tax, regardless of earnings.

D) The government can easily forecast tax revenues.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

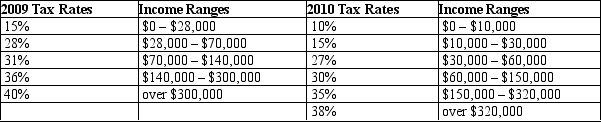

Table 12-12

United States Income Tax Rates for a Single Individual, 2009 and 2010.

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2009?

-Refer to Table 12-12.Mia is a single person whose taxable income is $100,000 a year.What is her average tax rate in 2009?

A) 22.3%

B) 25.3%

C) 27.8%

D) 28.4%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

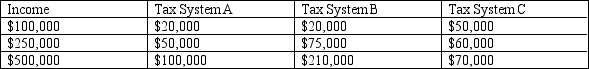

Table 12-17

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-17.Which of the three tax systems is proportional?

-Refer to Table 12-17.Which of the three tax systems is proportional?

A) Tax System A

B) Tax System B

C) Tax System C

D) None of the systems are proportional.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009,which category represented the largest category of spending for the U.S.federal government?

A) Medicare

B) Social Security

C) national defense

D) net interest

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

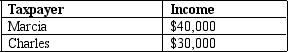

Table 12-8

-Refer to Table 12-8.If the government imposes a $3,000 lump-sum tax,the marginal tax rate for Charles would be

-Refer to Table 12-8.If the government imposes a $3,000 lump-sum tax,the marginal tax rate for Charles would be

A) 0 percent.

B) 5 percent.

C) 6.7 percent.

D) 10 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 421 - 440 of 478

Related Exams