A) $857

B) $842

C) $835

D) $821

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

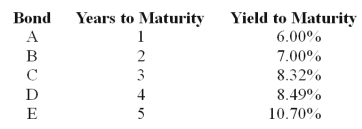

Consider the following $1,000 par value zero-coupon bonds:  The expected one-year interest rate three years from now should be _________.

The expected one-year interest rate three years from now should be _________.

A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a 10 year $1,000 par 4% annual payment coupon bond priced to yield 6%.You do not sell the bond at year end.If you are in a 15% tax bracket at year end you will owe taxes on this investment equal to _______.

A) $9.10

B) $4.25

C) $7.68

D) $5.20

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A coupon bond which pays interest semi-annually has a par value of $1,000,matures in 8 years,and has a yield to maturity of 6%.If the coupon rate is 7%,the intrinsic value of the bond today will be __________ (to the nearest dollar) .

A) $1,000

B) $1,063

C) $1,081

D) $1,100

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A __________ bond is a bond where the issuer has an option to retire the bond before maturity at a specific price after a specific date.

A) callable

B) coupon

C) puttable

D) treasury

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price of a $10,000 par Treasury bond is $10,237.50 the quote would be listed in the newspaper as ________.

A) 102:10

B) 102:11

C) 102:12

D) 102:13

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

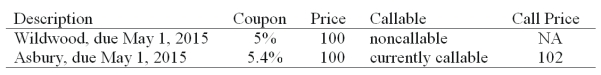

On May 1, 2007, Joe Hill is considering one of the following newly-issued 10 year AAA corporate bonds.  -If the volatility of interest rates is expected to increase,the Joe Hill should __.

-If the volatility of interest rates is expected to increase,the Joe Hill should __.

A) prefer the Wildwood bond to the Asbury bond

B) prefer the Asbury bond to the Wildwood bond

C) be indifferent between the Wildwood bond and the Asbury bond

D) there is not enough information given to tell

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Japanese firm issued and sold a pound denominated bond in the United Kingdom.A U.S.firm issued bonds denominated in dollars but sold the bonds in Japan.Which one of the following statements is correct?

A) Both bonds are examples of Eurobonds.

B) The Japanese bond is a Eurobond and the U.S. bond is termed a foreign bond.

C) The U.S. bond is a Eurobond and the Japanese bond is termed a foreign bond.

D) Neither bond is a Eurobond.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a subordinated debenture in a firm.In the event of bankruptcy you will be paid off before which one of the following?

A) Mortgage bonds

B) Senior debentures

C) Preferred stock

D) Equipment obligation bonds

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond pays a semi-annual coupon and the last coupon was paid 61 days ago.If the annual coupon payment is $75,what is the accrued interest?

A) $13.21

B) $12.57

C) $15.44

D) $16.32

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mortgage bond is _______.

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A convertible bond has a par value of $1,000 but its current market price is $975.The current price of the issuing company's stock is $26 and the conversion ratio is 34 shares.The bond's market conversion value is _________.

A) $1,000

B) $884

C) $933

D) $980

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the coupon rate on a bond is 4.50% and the bond is selling at a premium,which of the following is the most likely yield to maturity on the bond?

A) 4.30%

B) 4.50%

C) 5.20%

D) 5.50%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 93 of 93

Related Exams