A) Federal Accounting Standards Board Act

B) Securities and Exchange Act

C) Sarbanes-Oxley Act

D) Clayton Act

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following was not a change introduced by the Sarbanes-Oxley Act?

A) Limits on executive compensation for most companies

B) Stiffer fines and maximum jail sentences for willful misrepresentation of financial results

C) An external audit of the effectiveness of internal controls

D) Anonymous tip lines and legal protection to whistle-blowers

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A process for approving and documenting all purchases and payments on account is referred to as a:

A) voucher system.

B) imprest system.

C) reconciliation procedure.

D) cash receipts process.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

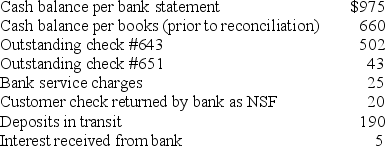

The following information was available to the accountant of Horton Company when preparing the monthly bank reconciliation:

The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:

The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:

A) $660.

B) $640.

C) $620.

D) $305.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a bank reconciliation,interest revenue earned on your bank account is:

A) added to the book balance

B) deducted from the book balance

C) added to the bank balance

D) deducted from the bank balance

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items appearing on a bank reconciliation require a journal entry to bring the Cash account up-to-date?

A) Deposit in transit

B) Check from customers returned as NSF

C) Outstanding check

D) An error made by the bank in recording a deposit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Outstanding checks refer to checks that have been:

A) written,recorded,sent to payees,and received and paid by the bank.

B) written and not yet recorded in the company books.

C) written,recorded,sent to the payees,but not yet paid by the bank.

D) paid by the bank.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A deposit in transit on last month's bank reconciliation is shown as a deposit on the bank statement this month.As a result,in preparing this period's reconciliation,the amount of this deposit should:

A) be added to the book balance of cash.

B) be deducted from the book balance of cash.

C) be added to the bank balance of cash.?

D) not be included as a reconciling item.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the cash count sheets for the day equal $10,100 and the cash register reports $10,200,the journal entry to record the sales will include a:

A) credit to Cash Shortage

B) debit to Cash Shortage

C) credit to Cash Overage

D) debit to Cash Overage

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash count sheet determines all of the following except the:

A) cash shortage or overage, if any.

B) amount of cash available for deposit in the bank

C) amount of cash to be reported on the balance sheet.

D) amount of cash received.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is added to the bank balance on a bank reconciliation?

A) Deposits in transit

B) Outstanding checks

C) EFT received from customers

D) Bank service charge

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deposits in transit are ______ on a bank reconciliation.

A) added to the book balance

B) deducted from the bank balance

C) added to the bank balance

D) deducted from the book balance

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A check is said to have cleared the bank when:

A) it is returned NSF.

B) it bounces.

C) the bank withdraws the amount of the check from the check writer's account.

D) it is presented to a financial institution for deposit or cash.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the statements appearing below is correct regarding bank reconciliations?

A) A bank reconciliation is an external report prepared to report the cash balance to investors and creditors.

B) After preparing a bank reconciliation, no journal entries need to be made for outstanding checks or deposits in transit.

C) If a company's records show a different cash balance from that shown on the company's bank statement, either the company or the bank has made an error.

D) The up-to-date ending cash balance on the bank statement side should not equal the up-to-date ending cash balance on the book side.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The components of an internal control system include control environment,risk assessment,control activities,information and communication,and rationalization.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assigning sequential numbers to cash sales,so that the accounting staff can ensure that every sale has been recorded is required by the internal control principle of:

A) documenting procedures.

B) segregating duties.

C) establishing responsibilities.

D) restricting access.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items on a bank reconciliation would require a journal entry?

A) An error by the bank

B) Outstanding checks

C) A bank service charge

D) A deposit in transit

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An internal report prepared to verify the accuracy of both the bank statement and the cash accounts of a business or individual is a (n) :

A) internal audit.

B) bank reconciliation.

C) bank audit.

D) trial reconciliation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The bank credited your account for a deposit made by another bank customer.This bank error should be a(n) ______ on a bank reconciliation.

A) addition to the bank balance

B) deduction from the bank balance

C) addition to the book balance

D) deduction from the book balance

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of cash available for deposit at the bank is determined from the:

A) income statement.

B) bank reconciliation.

C) cash count sheet .

D) unadjusted trial balance.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 188

Related Exams