A) debit to Retained Earnings.

B) credit to Cash.

C) debit to Common Stock.

D) credit to Additional Paid-in Capital.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of November 29,it appears that Notel will report earnings per share (EPS) of $1.15 for the quarter ended November 30.Which of the following events would cause this EPS number to decrease,assuming the event occurs the morning of November 30?

A) The company pays a supplier for inventory bought on account.

B) The company declares, but does not pay, a cash dividend.

C) The company purchases 10 shares of common stock in another company.

D) The company reissues the treasury stock it holds.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

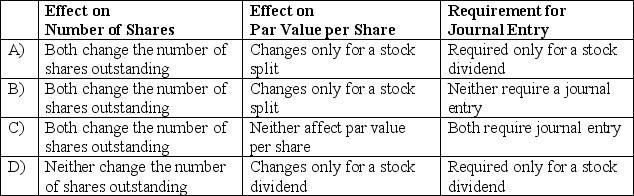

Stock splits and large stock dividends have which of the following similarities or differences in their effects and requirements for a journal entry?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

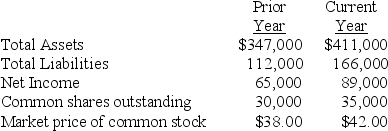

The information below was extracted from the most recent financial statements of Milton Technologies (in millions, except for stock price) :

-Use the information above to answer the following question.What is the EPS for the company's stock for the current year?

-Use the information above to answer the following question.What is the EPS for the company's stock for the current year?

A) $2.74

B) $2.37

C) $2.54

D) $2.97

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation declares and distributes a stock dividend on its common shares:

A) the amount of total assets increases.

B) stockholders' equity decreases.

C) contributed capital decreases.

D) the account Retained Earnings is decreased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Features of common stock usually include all of the following except:

A) voting rights.

B) dividends.

C) primary claim to the company's assets in case of liquidation.

D) preemptive rights.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major advantage of the corporate form of ownership is:

A) limited legal liability.

B) unlimited legal liability.

C) ease of formation.

D) that corporate earnings aren't taxed until they are distributed to owners as dividends.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Dividends in arrears are reported as current liabilities on the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a reason a company would repurchase stock?

A) To reduce the number of outstanding shares.

B) To give the impression that the stock is worth buying.

C) To have shares of stock to issue when stock options are exercised.

D) To increase the total stockholders' equity balance and improve the ROE.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The right of current stockholders to purchase additional shares of newly issued stock in order to maintain the same percentage ownership is called:

A) liquidation.

B) preemptive rights.

C) cumulative preference.

D) voting rights.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

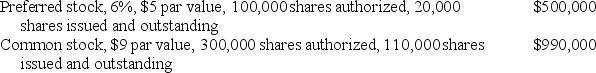

A company has the following paid-in capital:

-Use the information above to answer the following question.If the company pays a $35,000 dividend,and the preferred stock is cumulative and two years' dividends are in arrears,what is the amount the common stockholders will receive?

-Use the information above to answer the following question.If the company pays a $35,000 dividend,and the preferred stock is cumulative and two years' dividends are in arrears,what is the amount the common stockholders will receive?

A) $17,000

B) $23,000

C) $29,000

D) $35,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Wadsworth Corp.has common stock with a par value of $5.During the current year,it declared and paid dividends of $10,000.It sold at $20 per share an additional 1,000 shares of stock that had not been previously issued.In addition,it had net income of $50,000 for the year.What is the amount of change to its stockholders' equity for the year?

A) $70,000

B) $45,000

C) $55,000

D) $60,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of stockholder's equity differs from the statement of retained earnings in that the statement of stockholders' equity:

A) shows the effect of dividends declared.

B) contains net income.

C) contains the changes in contributed capital.

D) contains a liability section.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reported net income of $6 million.During the year the average number of common shares outstanding was 3 million.The price of a share of common stock at the end of the year was $5.There were 400,000 shares of preferred stock outstanding on average and no dividends were declared and the preferred stock is noncumulative. -Use the information above to answer the following question.The EPS is approximately:

A) $0.40

B) $1.76.

C) $1.86.

D) $2.00.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Unpaid dividends on cumulative preferred stock are called dividends in arrears.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the payment date for a cash dividend,the company:

A) debits Dividends and credits Dividends Payable for the amount of the dividend.

B) debits Dividend Expense and credits Cash for the dividend amount.

C) debits Dividends Payable and credits Cash for the dividend amount.

D) establishes who will receive the dividend payment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a company reissues (or sells)shares of its treasury stock at an amount different than its cost,it reports a gain or a loss on the sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

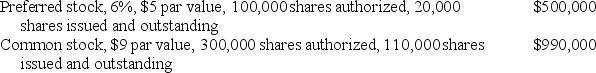

A company has the following paid-in capital:

-Use the information above to answer the following question.If the company pays a $100,000 dividend,and the preferred stock is cumulative and three years' dividends are in arrears,what is the amount the preferred stockholders will receive?

-Use the information above to answer the following question.If the company pays a $100,000 dividend,and the preferred stock is cumulative and three years' dividends are in arrears,what is the amount the preferred stockholders will receive?

A) $18,000

B) $24,000

C) $6,000

D) $54,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following line items are not found on a sole proprietorship's statement of owner's equity?

A) Withdrawals

B) Retained Earnings

C) Capital

D) Net income

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If shares of common stock are issued at a market price greater than par value,the amount in excess of par should be credited to:

A) Common Stock.

B) Treasury Stock.

C) Retained Earnings.

D) Additional Paid-in Capital.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 253

Related Exams