A) Retained Earnings represents cash available to pay dividends to stockholders.

B) Retained Earnings cannot be restricted by loan covenants.

C) Retained Earnings generally consists of cumulative net income less any net losses and dividends since inception.

D) Retained Earnings is reduced by the par value of the common stock that is issued.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has net income of $5.6 million.Stockholders' equity at the beginning of the year is $32.55 million and,at the end of the year,it is $38.15 million.The only change to stockholders' equity came from net income.The return on equity ratio is approximately:

A) 0.15.

B) 0.16.

C) 0.87.

D) 6.31.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Council Crest,Inc.had 20,000 shares issued and outstanding of its $.50 par value common stock.At December 31,Common Stock equaled $10,000,Retained Earnings equaled $20,000 and Total stockholders' equity equaled $50,000 prior to a 2-for-1 stock split.As a result of a 2-for-1 stock split:

A) par value equals $0.25.

B) the number of shares outstanding equals 10,000.

C) Common Stock equals $20,000.

D) Retained Earnings equals $40,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Items such as unrealized gains and losses from pensions,foreign currencies or financial investments are reported as:

A) accumulated other comprehensive income.

B) treasury stock.

C) contributed capital.

D) financing activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of debt financing over equity financing include that:

A) interest payments are optional.

B) debt financing does not require repayments.

C) interest payments are tax not deductible.

D) stockholders' control will not be diluted.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hopkins,Inc.has 1,000 shares of common stock and 1,000 shares of preferred stock outstanding.The preferred stock has a cumulative dividend preference.Both classes of stock have a par value of $10.The preferred stock has a dividend rate of 6 percent.Hopkins failed to pay a dividend during the prior year.During the current year,the board of directors declares dividends totaling $2,000.Accordingly,the company will distribute dividends in the amount of:

A) $2,000 to the preferred shareholders.

B) $1,000 to each class of shareholders.

C) $1,200 to the preferred shareholders and $800 to the common shareholders.

D) $1,600 to the preferred shareholders and $400 to the common shareholders.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carla Vista Enterprises buys back 600,000 shares of its stock from investors at $6.50 a share.Two years later,it reissues this stock for $6.00 a share.The stock reissue would be recorded with a debit to Cash for:

A) $3.6 million,a debit to Additional Paid-in Capital for $300,000,and a credit to Treasury Stock for $3.9 million.

B) $3.9 million,a credit to Treasury Stock for $3.6 million,and a credit to Additional Paid-in Capital for $300,000.

C) $3.9 million and a credit to Treasury Stock for $3.9 million.

D) $3.6 million and a credit to Treasury Stock for $3.6 million.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Company Z has 8 million shares of common stock authorized with a par value of $1 and a market price of $72.There are 4 million outstanding shares and 1 million shares held in treasury stock. Required: Part a.Prepare the journal entry if the company declares and distributes a 10% stock dividend. Part b.Show the effect of the 10% stock dividend on assets,liabilities,and stockholders' equity. Part c.Prepare the journal entry if the company declares and distributes a 100% stock dividend. Part d.Show the effect of the 100% stock dividend on assets,liabilities,and stockholders' equity.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The current number of outstanding shares after these transactions have been accounted for is:

A) 8 million shares.

B) 20 million shares.

C) 10 million shares.

D) 9 million shares.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Cash Dividend

A) Stock shares that pay a fixed dividend rate but have no voting rights.

B) The shares of stock held by stockholders.

C) Stock that allows owners to be listed among creditors.

D) This payment raises stockholders' equity.

E) This payment decreases stockholders' equity.

F) The shares of stock held by the issuing company.

G) Earnings per share that reflects treasury and preferred stock.

H) (Net income less preferred dividends) divided by average stockholders' equity.

I) This dividend does not reduce stockholders' equity.

J) Stockholders' entitlement to remaining assets after creditors are repaid.

K) The additional shares of stock a company can issue beyond what are already issued.

L) (Net income less preferred dividends) divided by the average number of outstanding common shares.

M) When a company first starts selling stock to the public.

O) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anthem Inc.issues 200,000 shares of stock with a par value of $0.01 for $150 per share.Three years later,it repurchases these shares for $80 per share.Anthem records the repurchase in which of the following ways?

A) Debit Common Stock for $2,000,debit Additional Paid-in Capital for $29,998,000 and credit Cash for $30 million.

B) Debit Treasury Stock for $16 million and credit Cash for $16 million.

C) Debit Common Stock for $2,000,debit Additional Paid-in Capital for $15,998,000 and credit Cash for $16 million.

D) Debit Stockholders' Equity for $30 million,credit Additional Paid-in Capital for $14 million and credit Cash for $16 million.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Morris Lest recorded the closing entries for his sole proprietorship.The entry to close the M.Lest,Drawings account requires a:

A) debit to M.Lest,Capital.

B) debit to M.Lest,Drawings.

C) debit to M.Lest,Retained Earnings.

D) credit to M.Lest,Capital.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An LLC is different from a corporation in that an LLC has:

A) a "distribution of net income" section in its financial statements.

B) Retained Earnings in its financial statements.

C) Income Tax Expense in its financial statements.

D) Dividends in its financial statements.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about stock options is not correct?

A) Stock options are intended to give upper management the same goals as stockholders.

B) When stock options are exercised by upper management,existing stockholders lose voting power.

C) Stock options may create an incentive for upper management to overstate net income.

D) An expense is reported by the company when stock options are exercised.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of a stock dividend is to:

A) decrease total assets and stockholders' equity.

B) change the composition of stockholders' equity.

C) decrease total assets and total liabilities.

D) increase the market value per share of common shares.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

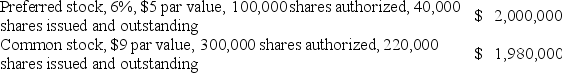

Brazee Company has the following paid-in capital:  If the company pays a $70,000 dividend,and the preferred stock is cumulative and two years' dividends are in arrears,what is the amount the common stockholders will receive?

If the company pays a $70,000 dividend,and the preferred stock is cumulative and two years' dividends are in arrears,what is the amount the common stockholders will receive?

A) $34,000

B) $46,000

C) $58,000

D) $70,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

State laws often restrict dividends to the amount of Retained Earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Issuing stock to obtain financing is called equity financing.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Knapp Industries began business on January 1,2018 by issuing all of its 1,000,000 authorized shares of its $1 par value common stock for $40 per share.On June 30,Knapp declared a cash dividend of $2 per share to stockholders of record on July 31.Knapp paid the cash dividend on August 30.On November 1,Knapp reacquired 200,000 of its own shares of stock for $50 per share.On December 22,Knapp resold 100,000 of these shares for $60 per share. Required: Part a.Prepare all of the necessary journal entries to record the events described above. Part b.Prepare the stockholders' equity section of the balance sheet as of December 31,2018 assuming that the net income for the year was $6,000,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Outstanding Shares

A) Stock shares that pay a fixed dividend rate but have no voting rights.

B) The shares of stock held by stockholders.

C) Stock that allows owners to be listed among creditors.

D) This payment raises stockholders' equity.

E) This payment decreases stockholders' equity.

F) The shares of stock held by the issuing company.

G) Earnings per share that reflects treasury and preferred stock.

H) (Net income less preferred dividends) divided by average stockholders' equity.

I) This dividend does not reduce stockholders' equity.

J) Stockholders' entitlement to remaining assets after creditors are repaid.

K) The additional shares of stock a company can issue beyond what are already issued.

L) (Net income less preferred dividends) divided by the average number of outstanding common shares.

M) When a company first starts selling stock to the public.

O) B) and K)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 278

Related Exams