A) The total number of shares currently owned by stockholders.

B) The amount above the par value of the stock that owners paid the issuer for the stock.

C) When employees of a company have the opportunity to buy a company's stock in the future at a fixed price.

D) The date on which a company determines who receives a dividend.

E) The date on which a liability is recorded for a dividend.

F) When a company sells issues of stock after its IPO.

G) When owners of the company contribute additional capital beyond what they paid for their stock.

H) When cash or stock dividends are issued according to the proportion of stock owned.

I) The date on which a company authorizes a dividend payment.

J) The date on which a company debits dividends payable and credits cash.

K) Dividends that have not had income tax withheld from them.

L) The total number of shares the company has sold,whether held by stockholders or by the company.

M) The accumulation of all the past dividends the company has not paid.

N) When cash or stock dividends are issued in an equal dollar or share amount per stockholder.

P) A) and L)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has outstanding 10 million shares of $2 par common stock and 1 million shares of $4 par preferred stock.The preferred stock has an 8% dividend rate.The company declares $300,000 in total dividends for the year.Which of the following is correct if the preferred stockholders only have a current dividend preference?

A) Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 before the end of the current accounting period.Common stockholders will receive nothing.

B) Preferred stockholders will receive $24,000 or 8% of the total dividends.Common stockholders will receive the remaining $276,000.

C) Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 sometime in the future before common stockholders will receive anything.

D) Preferred stockholders will receive the entire $300,000,but will receive nothing more relating to this dividend declaration.Common stockholders will receive nothing.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about a corporation is not correct?

A) A corporation is a separate legal entity.

B) A corporation has easy transferability of ownership.

C) A corporation may have the ability to raise large amounts of capital.

D) A corporation's owners have unlimited liability.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Date of Record

A) The total number of shares currently owned by stockholders.

B) The amount above the par value of the stock that owners paid the issuer for the stock.

C) When employees of a company have the opportunity to buy a company's stock in the future at a fixed price.

D) The date on which a company determines who receives a dividend.

E) The date on which a liability is recorded for a dividend.

F) When a company sells issues of stock after its IPO.

G) When owners of the company contribute additional capital beyond what they paid for their stock.

H) When cash or stock dividends are issued according to the proportion of stock owned.

I) The date on which a company authorizes a dividend payment.

J) The date on which a company debits dividends payable and credits cash.

K) Dividends that have not had income tax withheld from them.

L) The total number of shares the company has sold,whether held by stockholders or by the company.

M) The accumulation of all the past dividends the company has not paid.

N) When cash or stock dividends are issued in an equal dollar or share amount per stockholder.

P) C) and N)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The number of shares outstanding equals the number of shares:

A) issued minus the number of shares in treasury.

B) authorized minus the number of shares issued.

C) issued plus the number of shares in treasury.

D) authorized plus the number of shares issued.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harry owns 1,000 shares of stock in Xit Corporation.What is the effect on Xit Corporation if Harry dies?

A) Xit must reorganize to reflect the change in ownership.

B) Xit will cancel Harry's shares of stock.

C) Xit will have 3 months to resell the stock.

D) A stockholder's death has no effect on a corporation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Palomino Enterprises reissued 2,000 shares of its treasury stock for $20,000.Prior to the reissuance,the Treasury Stock balance was $24,000,which included the $16,000 cost of the 2,000 shares reissued.After recording this transaction:

A) Treasury Stock will equal $8,000.

B) Treasury Stock will equal $4,000.

C) Additional Paid-in Capital will be increased by $24,000.

D) Cash will be decreased by $20,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock options are given in order to:

A) increase Retained Earnings.

B) increase a corporation's liquidity.

C) provide a corporation with the choice of issuing additional stock.

D) provide incentives for employees to work harder.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Galveston,Inc.has 308,000 shares authorized,140,000 shares issued,and 14,000 shares of treasury stock.How many shares are outstanding?

A) 126,000

B) 434,000

C) 154,000

D) 406,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flanders Company has outstanding 18 million shares of $2 par value common stock and 2 million shares of $4 par value preferred stock.The preferred stock has an 8% dividend rate.The company declares $1,200,000 in total dividends for the year.Which of the following is correct if dividends in arrears are $60,000?

A) Preferred stockholders will receive $700,000;common stockholders will receive $500,000.

B) Preferred stockholders will receive $120,000;common stockholders will receive $1,080,000.

C) Preferred stockholders will receive $640,000;common stockholders will receive $560,000.

D) Preferred stockholders will receive $180,000;common stockholders will receive $1,020,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each term with the appropriate definition.Not all definitions will be used. -Par Value

A) A company that is like a partnership in nature except that it has limited liability.

B) A company that has a separate legal identity from its owners.

C) A company that issues stock on one of the major stock exchanges.

D) When companies are obligated to pay preferred stockholders past dividends not yet distributed before paying dividends to owners of common stock.

E) The nominal value per share of stock set by the company's charter.

F) The current stock price.

G) A stock that is currently selling for its original issue price.

H) Stock of companies that tend to pay relatively high dividends compared to the stock price.

I) Stock of companies that tend to reinvest earnings to provide for greater future sales and profits.

J) When stockholders prefer to receive dividends at the end of the year rather than each quarter.

K) An unincorporated business that is owned by a single individual.

L) When preferred stockholders are paid dividends before other stockholders.

M) An unincorporated business owned by two or more individuals.

O) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brazee Company has the following paid-in capital:  If the company pays a $200,000 dividend,and the preferred stock is cumulative and three years' dividends are in arrears,what is the amount the preferred stockholders will receive?

If the company pays a $200,000 dividend,and the preferred stock is cumulative and three years' dividends are in arrears,what is the amount the preferred stockholders will receive?

A) $36,000

B) $48,000

C) $12,000

D) $108,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At what governmental level are corporate charters issued?

A) State

B) Local

C) Federal

D) International

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ferris Company reported the following on its balance sheet: total contributed capital of $186,000,treasury stock of $19,500 and total stockholder's equity of $237,500.Ferris had 1,000,000 authorized shares of its $0.01 par value common stock of which 200,000 were outstanding. During the following year,Ferris Company earned net income of $75,000,issued 5,000 shares of $1 par common stock at an average market price of $44 per share,and declared dividends of $20,500.What amount was the total stockholder's equity reported on the balance sheet at the end of that year?

A) $512,000

B) $406,000

C) $297,000

D) $532,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

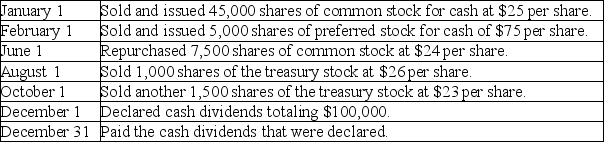

Tyler Corporation was organized in 2018.Its corporate charter authorized the issuance of 50,000 shares of common stock,par value $5 per share,and 10,000 shares of 8% preferred stock,par value $25 per share.The following transactions took place during 2018:

Required:

Part a.Prepare journal entries for each of the following transactions:

Part b.Compute the number of shares of common stock issued and outstanding at December 31,2018.

Required:

Part a.Prepare journal entries for each of the following transactions:

Part b.Compute the number of shares of common stock issued and outstanding at December 31,2018.

Correct Answer

verified

Correct Answer

verified

True/False

A corporation's charter establishes the number of shares of stock that will be issued in an initial public offering (IPO).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about issued and outstanding stock is correct?

A) Outstanding stock includes all stock issued by a corporation.

B) Issued stock equals the sum of outstanding stock and treasury stock.

C) Issued stock is equal to authorized stock.

D) Outstanding stock includes stock in the hands of investors,as well as treasury stock in the hands of the corporation.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the date of record for a dividend,the company:

A) debits Dividends and credits Dividends Payable for the amount of the dividend.

B) debits Dividend Expense and credits Cash for the dividend amount.

C) debits Dividends Payable and credits Cash for the dividend amount.

D) establishes who will receive the dividend payment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of debt financing over equity financing are that:

A) repayment of debt principal is optional.

B) interest payments on debt are not tax deductible.

C) control is not diluted.

D) more money is available.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock dividend:

A) is accounted for like a stock split.

B) will reduce stockholders' equity similar to a cash dividend.

C) will not change any of the accounts within stockholders' equity.

D) will reduce Retained Earnings similar to a cash dividend.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 278

Related Exams