A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Henriksson (1984) found that, on average, betas of funds __________ during market advances.

A) increased very significantly

B) increased slightly

C) decreased slightly

D) decreased very significantly

E) did not change

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hedge funds I) are appropriate as a sole investment vehicle for an investor. II. should only be added to an already well-diversified portfolio. III. pose performance evaluation issues due to nonlinear factor exposures. IV. have down-market betas that are typically larger than up-market betas. V. have symmetrical betas.

A) I only

B) II and V

C) I, III, and IV

D) II, III, and IV

E) I, III, and V

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In measuring the comparative performance of different fund managers, the preferred method of calculating rate of return is

A) internal rate of return.

B) arithmetic average.

C) dollar weighted.

D) time weighted.

E) None of the options

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Value Line Index is an equally weighted geometric average of the returns of about 1,700 firms.The value of an index based on the geometric average returns of three stocks where the returns on the three stocks during a given period were 32%, 5%, and -10%, respectively, is

A) 4.3%.

B) 7.6%.

C) 9.0%.

D) 13.4%.

E) 5.0%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Modigliani M2 measure and the Treynor T2 measure

A) are identical.

B) are nearly identical and will rank portfolios the same way.

C) are nearly identical, but might rank portfolios differently.

D) are somewhat different; M2 can be used to rank portfolios, but T2 cannot.

E) are somewhat different; T2 can be used to rank portfolios, but M2 cannot.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return, the same standard deviation of returns, but portfolio A has a higher beta than portfolio B.According to the Sharpe measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor has a portfolio that has constant proportions in T-bills and the market portfolio, the portfolio's characteristic line will plot as a line with ___________; if the investor can time bull markets, the characteristic line will plot as a line with ___________.

A) a positive slope; a negative slope

B) a negative slope; a positive slope

C) a constant slope; a negative slope

D) a negative slope; a constant slope

E) a constant slope; a positive slope

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The comparison universe is not

A) a concept found only in astronomy.

B) the set of all mutual funds in the world.

C) the set of all mutual funds in the U.S.

D) a set of mutual funds with similar risk characteristics to your mutual fund.

E) a concept found only in astronomy, the set of all mutual funds in the world, or the set of all mutual funds in the U.S.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return, the same standard deviation of returns, but portfolio A has a higher beta than portfolio B.According to the Treynor measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return, the same standard deviation of returns, but portfolio A has a lower beta than portfolio B.According to the Treynor measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

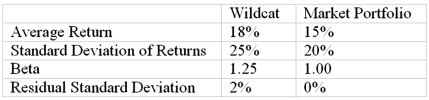

The following data are available relating to the performance of Wildcat Fund and the market portfolio:  The risk-free return during the sample period was 7%. What is the information ratio measure of performance evaluation for Wildcat Fund

The risk-free return during the sample period was 7%. What is the information ratio measure of performance evaluation for Wildcat Fund

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you purchase one share of the stock of Volatile Engineering Corporation at the beginning of year 1 for $36.At the end of year 1, you receive a $2 dividend and buy one more share for $30.At the end of year 2, you receive total dividends of $4 (i.e., $2 for each share) and sell the shares for $36.45 each.The dollar-weighted return on your investment is

A) -1.75%.

B) 4.08%.

C) 8.53%.

D) 8.00%.

E) 12.35%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return, the same standard deviation of returns, but Buckeye Fund has a lower beta than Gator Fund.According to the Sharpe measure, the performance of Buckeye Fund

A) is better than the performance of Gator Fund.

B) is the same as the performance of Gator Fund.

C) is poorer than the performance of Gator Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The __________ measures the reward to volatility trade-off by dividing the average portfolio excess return by the standard deviation of returns.

A) Sharpe measure

B) Treynor measure

C) Jensen measure

D) information ratio

E) None of the options

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

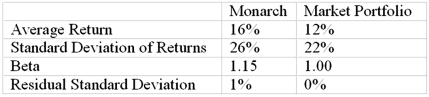

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:  The risk-free return during the sample period was 4%. Calculate Sharpe's measure of performance for Monarch Stock Fund.

The risk-free return during the sample period was 4%. Calculate Sharpe's measure of performance for Monarch Stock Fund.

A) 1%

B) 46%

C) 44%

D) 50%

E) None of the options

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

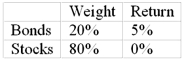

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.  The total excess return on the Razorback Fund's managed portfolio was

The total excess return on the Razorback Fund's managed portfolio was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you buy 100 shares of Abolishing Dividend Corporation at the beginning of year 1 for $80.Abolishing Dividend Corporation pays no dividends.The stock price at the end of year 1 is $100, $120 at the end of year 2, and $150 at the end of year 3.The stock price declines to $100 at the end of year 4, and you sell your 100 shares.For the four years, your geometric average return is

A) 0.0%.

B) 1.0%.

C) 5.7%.

D) 9.2%.

E) 34.5%.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the risk-free return is 3%.The beta of a managed portfolio is 1.75, the alpha is 0%, and the average return is 16%.Based on Jensen's measure of portfolio performance, you would calculate the return on the market portfolio as

A) 12.3%.

B) 10.4%.

C) 15.1%.

D) 16.7%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rodney holds a portfolio of risky assets that represents his entire risky investment.To evaluate the performance of Rodney's portfolio, in which order would you complete the steps listed I. Compare the Sharpe measure of Rodney's portfolio to the Sharpe measure of the best portfolio. II. State your conclusions. III. Assume that past security performance is representative of expected performance. IV. Determine the benchmark portfolio that Rodney would have held if he had chosen a passive strategy.

A) I, III, IV, II

B) III, IV, I, II

C) IV, III, I, II

D) III, II, I, IV

E) III, I, IV, II

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 83

Related Exams