A) Utilitarianism suggests that government policies should strive to maximize Ulyana's utility.

B) Liberalism suggests that government policies should strive to increase Ulyana's utility.

C) Libertarianism suggests that government policies should strive to improve Tristan's utility at the cost of Sam's utility.

D) Libertarianism suggests that government policies should strive to make Sam, Tristan, and Ulyana equally well off.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"The government should punish crimes and enforce voluntary agreements but not redistribute income." This statement is most closely associated with which political philosophy?

A) liberalism

B) utilitarianism

C) libertarianism

D) welfarism

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. welfare system was revised by a 1996 law that

A) consolidated all of the previous assistance programs into a single program.

B) limited the amount of time that people could receive assistance.

C) said it was no longer necessary for poor people to demonstrate an additional "need," such as small children or a disability, to qualify for assistance.

D) turned all federally-run welfare programs over to the states.

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: taxes owed equal 30% of income less 12,000. A family that earns an income of $60,000 will

A) pay $6,000 in taxes.

B) receive an income subsidy of $6,000.

C) receive an income subsidy of $12,000.

D) have an after-tax income of $48,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

An advantage of a negative income tax is that it does not encourage the breakup of families because the only criterion for assistance is family income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

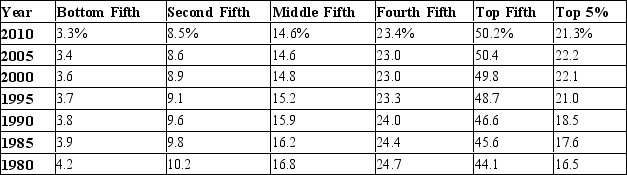

Table 20-9

Income Inequality in the United States

The values in the table reflect the percentages of pre-tax-and transfer income.

Source: US Census Bureau

-Refer to Table 20-9. Which of the following statements best describes the trends in the table?

Source: US Census Bureau

-Refer to Table 20-9. Which of the following statements best describes the trends in the table?

A) From 1980 to 2010, the distribution of income has become less equal.

B) From 1980 to 2010, the distribution of income has remained the same.

C) From 1980 to 2010, the distribution of income has become more equal.

D) None of the above is correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has more income inequality than Japan, Germany, and France.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Binding minimum-wage laws

A) are costly for the government to impose.

B) force a market imbalance between the supply and demand for labor.

C) have the potential to provide benefits to all poor people, whereas a negative tax can only benefit some poor people.

D) do not affect segments of the population who are not poor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Critics argue that a disadvantage of the Earned Income Tax Credit is that it does not effectively target the working poor because many recipients are the teenage children of middle-income families.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the United States in 2011, the bottom fifth of the income distribution had incomes below $27,218.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of diminishing marginal utility is embedded in the utilitarian rationale for

A) trickle-down effects.

B) enhancing market efficiency.

C) redistributing income.

D) maintaining the status quo income distribution.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax provision that works much like a negative income tax is the

A) Earned Income Tax Credit (EITC) .

B) Temporary Assistance for Needy Families (TANF) .

C) deduction for charitable contributions.

D) mortgage interest rate deduction.

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Government programs that take money from high-income people and give it to low-income people typically

A) improve economic efficiency by reducing poverty.

B) reduce economic efficiency because they distort incentives.

C) have no effect on economic efficiency because they both reduce poverty and distort incentives.

D) sometimes improve, sometimes reduce, and sometimes have no effect on economic efficiency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups has the highest poverty rate?

A) blacks

B) Asians

C) children (under age 18)

D) female households, no spouse present

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When designing public policies, which income group would philosopher John Rawls argue needs the most attention?

A) Individuals located in the bottom fifth of the income distribution.

B) Individuals located at the average income level.

C) Individuals located in the top fifth of the income distribution.

D) Individuals located in the top five percent of the income distribution.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

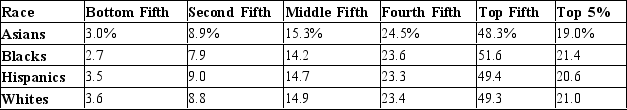

Table 20-15

Income Inequality in 2010 in the United States by Race

The values in the table reflect the percentages of pre-tax-and-transfer income.

Source: US Census Bureau

-Refer to Table 20-15. Which race shows the least equal distribution of income?

Source: US Census Bureau

-Refer to Table 20-15. Which race shows the least equal distribution of income?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

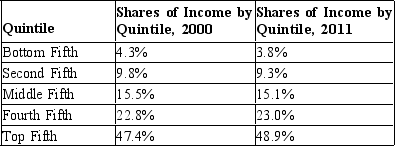

Table 20-8

Source: U.S. Bureau of Census

-Refer to Table 20-8. Comparing data from 2000 and 2011, which of the following statements is correct?

Source: U.S. Bureau of Census

-Refer to Table 20-8. Comparing data from 2000 and 2011, which of the following statements is correct?

A) The bottom 40% of the population had a greater share of the income in 2011 than it did in 2001.

B) The top 40% of the population had a greater share of the income in 2011 than it did in 2001.

C) The middle 60% of the population had a greater share of the income in 2011 than it did in 2001.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Libertarians believe that in considering economic fairness, one should primarily consider the

A) outcome of the system.

B) process by which outcomes arise.

C) maximin criterion.

D) maximization total social utility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One existing government program that works much like a negative income tax is the Earned Income Tax Credit.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

A government's policy of redistributing income makes the income distribution

A) more equal, distorts incentives, alters behavior, and makes the allocation of resources more efficient.

B) more equal, distorts incentives, alters behavior, and makes the allocation of resources less efficient.

C) less equal, distorts incentives, alters behavior, and makes the allocation of resources more efficient.

D) less equal, distorts incentives, alters behavior, and makes the allocation of resources less efficient.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 457

Related Exams