A) Income approach

B) Sales comparison approach

C) Cost approach

D) Investment approach

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be categorized as a cause of external obsolescence?

A) Lack of adequate insulation

B) Deterioration of indoor carpets

C) Increased traffic flow due to more intensive use in the local area

D) Outdated fixtures

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A comparable property sold 15 months ago for $105,000.If the appropriate adjustment for market conditions is 0.25% per month (without compounding) ,what would be the adjusted price of the comparable property?

A) $105,262.50

B) $105,393.80

C) $108,937.50

D) $144,375

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Several techniques can be used to obtain an indication of land value.The cost approach to valuation would most likely be used for which of the following properties?

A) One-family residential property

B) Retail office space

C) Education facility

D) High-rise apartments

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As part of the data analysis step in the appraisal process,it is necessary to consider the highest and best use of the property in question.In regards to determining highest and best use,all of the following statements are true EXCEPT:

A) The proposed property use must be legally permissible

B) It must be physically possible for the property to be used in the manner specified.

C) No financial limits are considered when determining the property's best use.

D) The property use must provide the greatest benefit to the owner.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sequence of adjustments to the transaction price of a comparable property would make no difference if all adjustments were dollar adjustments.However,if percentage adjustments are involved then the sequence does matter.In making adjustments to a comparable property to arrive at a final adjusted sales price,the proper sequence for the following adjustments would be:

A) Financing terms,market conditions,location.

B) Location,market conditions,financing terms.

C) Market conditions,location,financing terms.

D) Location,financing terms,market conditions.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the conclusion of the traditional sales comparison approach to valuation,the appraiser evaluates and reconciles the final adjusted sale prices into a single value for the subject property.This single value is commonly referred to as:

A) indicated value

B) investment value

C) transaction value

D) replacement value

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real estate appraisers generally distinguish among the concepts of market value,investment value,and transaction value.Which of the following statements best describes the concept of market value?

A) It is an estimate of the most probable selling price of a property in a competitive market.

B) It is the value a particular investor places on a property.

C) It is the price we observe when a property is sold.

D) It is the maximum amount that a seller would be willing to accept.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

While it is often sufficient to rely on informal methods of estimating the market value of real estate assets,the complexity and large dollar value of many real estate decisions dictate that formal estimates based on methodical collection and analysis of relevant market data should be utilized.The unbiased written estimate of the market value of a property is Commonly referred to as a(n) :

A) arm's length transaction

B) appraisal

C) property adjustment

D) reconciliation

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real estate appraisal is often considered "more art than science," since identifying truly comparable properties is a subjective process.Therefore,it is essential that a comparable property transaction at least meets the requirement that it was fairly negotiated under typical market conditions.Which of the following types of transactions would be most appropriate for use in the sales comparison approach to valuation?

A) Commingled business transactions

B) Low-interest financing programs

C) Real estate auctions

D) Arm's-length transactions

F) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

If all appraisal methods are appropriate for use in valuing a particular property,there is a clear order of preference that real estate professionals adhere to.Which of the following depicts the preferred order,with the most preferable approach being listed first and the least preferable listed last?

A) Sales comparison approach,cost approach,income approach

B) Income approach,Sales comparison approach,cost approach

C) Cost approach,income approach,sales comparison approach

D) Sales comparison approach,income approach,cost approach

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

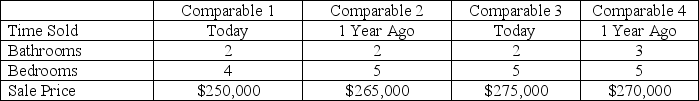

Given the following information,determine the value of having an additional bedroom.Assume that the comparable properties are similar in all other attributes besides those listed in the table below.

A) $5,000

B) $15,000

C) $20,000

D) $25,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Estimating the market value of real estate is complicated by the unique characteristics of real estate markets.In contrast to stock markets,real estate markets are characterized by all of the following EXCEPT:

A) No two assets are considered perfect substitutes for one another.

B) Market prices are revealed almost instantaneously to prospective buyers.

C) Transactions occur infrequently.

D) The physical location of the asset being sold plays an important role in the pricing process.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adjustments for physical characteristics are intended to capture the dimensions in which a comparable property differs physically from the subject property.If the only physical difference between the subject property and the comparable is that the comparable does not have a fireplace,which of the following adjustments should take place?

A) The transaction price of the comparable property should be adjusted downward.

B) The transaction price of the comparable property should be adjusted upward.

C) The transaction price of the subject property should be adjusted downward.

D) The transaction price of the subject property should be adjusted upwarD.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Real estate professionals have long supported strict standards of ethics and practice.Followed by all states and federal regulatory agencies,which of the following imposes ethical obligations and minimum standards that must be followed by all real estate professionals providing formal estimates of market value?

A) Uniform Standards of Professional Appraisal Practice (USPAP)

B) Multiple Listing Services (MLS)

C) Department of Housing and Urban Development (HUD)

D) Office of Federal Housing Enterprise Oversight (OFHEO)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When employing the sales comparison approach,appraisers must consider numerous adjustments to convert each comparable sale transaction into an approximation of the subject property.Adjustments are divided into two groups: transactional adjustments and property adjustments.All of the following are transactional adjustments EXCEPT:

A) Financing terms

B) Market conditions

C) Conditions of Sale

D) Location

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that we observe two comparable properties that have each sold twice within the past two years.Property A sold 24 months ago for $350,000 and Property B sold 18 months ago for $325,000.If the two properties were sold today at $375,000 and $340,000,respectively,estimate the change in market conditions (percentage change in price) per month,assuming we equally weight the two properties in our analysis?

A) 0.19%

B) 0.24%

C) 0.28%

D) 0.33%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Favorable mortgage financing may have a significant impact on the transaction price of the particular property.If the comparable property was known to have had favorable financing terms negotiated into the transaction price,which of the following adjustments should take place? (Note: Assume that the comparable property cannot be dropped from the analysis as there are already limited comparable sales transactions)

A) The transaction price of the comparable property should be adjusted downward.

B) The transaction price of the comparable property should be adjusted upward.

C) The transaction price of the subject property should be adjusted downward.

D) The transaction price of the subject property should be adjusted upwarD.

F) All of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

It may be appropriate for a real estate professional to utilize different approaches for estimating the market value of a property depending upon the particular property type and use.Which of the following approaches would be most applicable when considering the valuation of retail office space (i.e. ,which approach would receive the most weight in the valuation process) ?

A) Income approach

B) Sales comparison approach

C) Cost approach

D) Investment approach

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that an appraiser has come to the following conclusions in evaluating the subject property.Due to the dramatic shift in the perceived safety of the neighborhood,values of any residential properties in the area of the subject property have fallen by $10,000,on average.Due to the subject property's age,physical deterioration to the building accounts for an estimate of $50,000 in lost value.An evaluation of the floor plan reveals that it is quite obsolete relative to current homebuyer preferences.This has a detrimental effect on the value of the property that is estimated to be approximately $15,000.Based on your understanding of adjustments related to accrued depreciation,which of the following pertains to the adjustment for external obsolescence?

A) $10,000

B) $15,000

C) $50,000

D) $75,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 30

Related Exams