A) $210

B) $345

C) $420

D) $480

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the burden of a tax divided? (i) When the tax is levied on the sellers,the sellers bear a higher proportion of the tax burden. (ii) When the tax is levied on the buyers,the buyers bear a higher proportion of the tax burden. (iii) Regardless of whether the tax is levied on the buyers or the sellers,the buyers and sellers bear an equal proportion of the tax burden. (iv) Regardless of whether the tax is levied on the buyers or the sellers,the buyers and sellers bear some proportion of the tax burden.

A) (i) and (ii) only

B) (iv) only

C) (i) ,(ii) ,and (iii) only

D) (i) ,(ii) ,and (iv) only

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government wants to reduce the burning of fossil fuels,it should impose a tax on

A) buyers of gasoline.

B) sellers of gasoline.

C) either buyers or sellers of gasoline.

D) whichever side of the market is less elastic.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a binding price ceiling from a market,then the price received by sellers will

A) decrease,and the quantity sold in the market will decrease.

B) decrease,and the quantity sold in the market will increase.

C) increase,and the quantity sold in the market will decrease.

D) increase,and the quantity sold in the market will increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When a tax is imposed on a good,the result is always a shortage of the good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of a product,buyers pay

A) more and sellers receive more than they did before the tax.

B) more and sellers receive less than they did before the tax.

C) less and sellers receive more than they did before the tax.

D) less and sellers receive less than they did before the tax.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

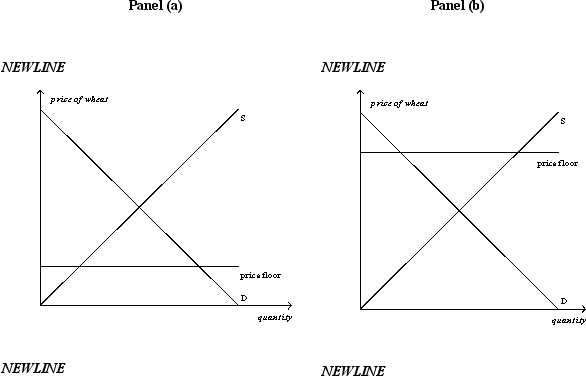

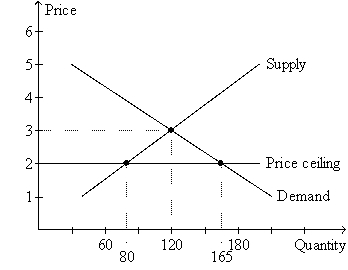

Figure 6-2  -Refer to Figure 6-2.The price ceiling

-Refer to Figure 6-2.The price ceiling

A) is binding.

B) causes a shortage.

C) causes the quantity demanded to exceed the quantity supplied.

D) All of the above are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal maximum on the price at which a good can be sold is called a price

A) floor.

B) subsidy.

C) support.

D) ceiling.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of cell phones,the size of the cell phone market

A) and the effective price received by sellers both decrease.

B) decreases,but the effective price received by sellers increases.

C) increases,but the effective price received by sellers decreases.

D) and the effective price received by sellers both increase.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then there will be a(n)

A) upward shift of the demand curve.

B) downward shift of the demand curve.

C) movement up and to the left along the demand curve.

D) movement down and to the right along the demand curve.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

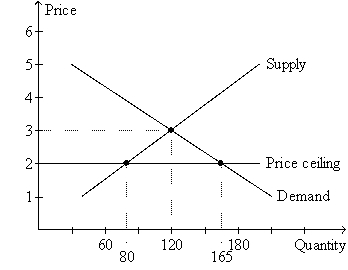

Table 6-1

-Refer to Table 6-1.Suppose the government imposes a price floor of $1 on this market.What will be the size of the surplus in this market?

-Refer to Table 6-1.Suppose the government imposes a price floor of $1 on this market.What will be the size of the surplus in this market?

A) 0 units

B) 2 units

C) 8 units

D) 10 units

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

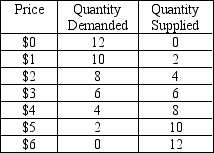

Figure 6-3

-Refer to Figure 6-3.A nonbinding price floor is shown in

-Refer to Figure 6-3.A nonbinding price floor is shown in

A) both panel (a) and panel (b) .

B) panel (a) only.

C) panel (b) only.

D) neither panel (a) nor panel (b) .

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When policymakers set prices by legal decree,they

A) are usually following the advice of mainstream economists.

B) improve the organization of economic activity.

C) obscure the signals that normally guide the allocation of society's resources.

D) are demonstrating a willingness to sacrifice fairness for the sake of a gain in efficiency.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-2  -Refer to Figure 6-2.The price ceiling causes quantity

-Refer to Figure 6-2.The price ceiling causes quantity

A) supplied to exceed quantity demanded by 45 units.

B) supplied to exceed quantity demanded by 85 units.

C) demanded to exceed quantity supplied by 45 units.

D) demanded to exceed quantity supplied by 85 units.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a binding price floor is imposed on the video game market,then

A) the quantity of video games demanded will decrease.

B) the quantity of video games supplied will increase.

C) a surplus of video games will develop.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

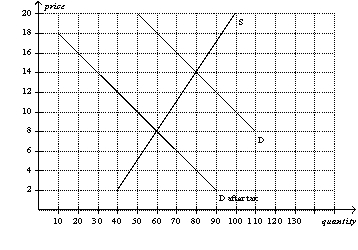

Figure 6-23  -Refer to Figure 6-23.The amount of the tax per unit is

-Refer to Figure 6-23.The amount of the tax per unit is

A) $4.

B) $5.

C) $6.

D) $10.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling caused the gasoline shortage of 1973 in the United States.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers increases supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have responsibility for economic policy in the country of Freedonia.Recently,the neighboring country of Sylvania has cut off all exports of oranges to Freedonia.Harpo,who is one of your advisors,suggests that you should impose a binding price ceiling in order to avoid a shortage of oranges.Chico,another one of your advisors,argues that without a binding price floor,a shortage will certainly develop.Zeppo,a third advisor,says that the best way to avoid a shortage of oranges is to take no action at all.Which of your three advisors is most likely to have studied economics?

A) Harpo

B) Chico

C) Zeppo

D) Apparently,all three advisors have studied economics,but their views on positive economics are different.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The impact of the minimum wage depends on the skill and experience of the worker.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 553

Related Exams