A) the futures price will be higher as contract maturity increases

B) F0 < S0

C) FT > ST

D) arbitrage profits are possible

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

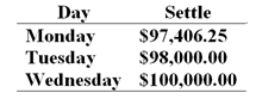

On Monday morning you sell one June T-bond futures contract at 97: 27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  At the close of day Tuesday your cumulative rate of return on your investment is

At the close of day Tuesday your cumulative rate of return on your investment is

A) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You believe that the spread between the September T-bond contract and the June T-bond futures contract is too large and will soon correct. This market exhibits positive cost of carry for all contracts. To take advantage of this you should ________.

A) buy the September contract and sell the June contract

B) sell the September contract and buy the June contract

C) sell the September contract and sell the June contract

D) buy the September contract and buy the June contract

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Initial margin is usually set in the region of ________ of the total value of a futures contract.

A) 5-15%

B) 10-20%

C) 15-25%

D) 20-30%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A market timer now believes that the economy will soften over the rest of the year as the housing market slump continues and he also believes that foreign investors will stop buying US fixed income securities in such large quantities as they have in the past. One way the timer could take advantage of this forecast is to ________.

A) buy T-bond futures and sell stock index futures

B) sell T-bond futures and but stock index futures

C) buy stock index futures and buy T-bond futures

D) sell stock index futures and sell T-bond futures

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A wheat farmer should ________ in order to reduce his exposure to risk associated with fluctuations in wheat prices.

A) sell wheat futures

B) buy wheat futures

C) buy a contract for delivery of wheat now and sell a contract for delivery of wheat at harvest time

D) sell wheat futures if the basis is currently positive and buy wheat futures if the basis is currently negative

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When dividend paying assets are involved, the spot-futures parity relationship can be stated as ________.

A) F1 = S0(1 + rf)

B) F0 = S0(1 + rf - d) T

C) F0 = S0(1 + rf + d) T

D) F0 = S0(1 + rf) T

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An established value below which a trader's margin may not fall is called the ________.

A) daily limit

B) daily margin

C) maintenance margin

D) convergence limit

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The daily settlement of obligations on futures positions is called ________.

A) a margin call

B) marking to market

C) a variation margin check

D) initial margin requirement

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A long hedger will ________ from an increase in the basis a short hedger will ________.

A) be hurt; be hurt

B) be hurt; profit

C) profit; be hurt

D) profit; profit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the context of a futures contract, the basis is defined as ________.

A) the futures price minus the spot price

B) the spot price minus the futures price

C) the futures price minus the initial margin

D) the profit on the futures contract

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A futures contract ________.

A) is a contract to be signed in the future by the buyer and the seller of a commodity

B) is an agreement to buy or sell a specified amount of an asset at a predetermined price on the expiration date of the contract

C) is an agreement to buy or sell a specified amount of an asset at whatever the spot price happens to be on the expiration date of the contract

D) gives the buyer the right, but not the obligation, to buy an asset at some time in the future

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation will be issuing bonds in 6 months and the Treasurer is concerned about unfavorable interest rate moves in the interim. The best way for her to hedge the risk is to ________.

A) buy T-bond futures

B) sell T-bond futures

C) buy stock index futures

D) sell stock index futures

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a corn futures contract is $2.65 per bushel when the contract is issued and the commodity spot price is $2.55. When the contract expires, the two prices are identical. What principle is represented by this price behavior?

A) Convergence

B) Margin

C) Basis

D) Volatility

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A short hedge is a simultaneous ________ position in the spot market and a ________ position in the futures market.

A) long; long

B) long; short

C) short; long

D) short; short

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ignoring the transaction costs, how much did the farmer improve his cash flow by hedging sales with the futures contracts?

A) $0

B) $2 000

C) $31 875

D) $33 875

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest rate swaps involve the exchange of ________.

A) fixed rate bonds for floating rate bonds

B) floating rate bonds for fixed rate bonds

C) net interest payments and an actual principal swap

D) net interest payments based on notional principal, but no exchange of principal

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor establishes a long position in a futures contract now (time 0) and holds the position until maturity (Time T) . The sum of all daily settlements will be ________.

A) F0 - FT

B) F0 - S0

C) FT - F0

D) FT - S0

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The open interest on silver futures at a particular time is the number of ________.

A) all outstanding silver futures contracts

B) long and short silver futures positions counted separately on a particular trading day

C) silver futures contracts traded during the day

D) silver futures contracts traded the previous day

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The clearing corporation has a net position equal to ________.

A) the open interest

B) the open interest times two

C) the open interest divided by two

D) zero

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 60

Related Exams