A) If Firms X and Y have the same P/E ratios, then their market-to-book ratios must also be equal.

B) If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their P/E ratios must also be the same.

C) If Firms X and Y have the same earnings per share and market-to-book ratio, they must have the same price/earnings ratio.

D) If Firm X's P/E ratio exceeds that of Firm Y, then Y is likely to be less risky and/or be expected to grow at a faster rate.

E) If Firms X and Y have the same net income, number of shares outstanding, and price per share, then their market-to-book ratios must also be the same.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duffert Industries has total assets of $1,000,000 and total current liabilities (consisting only of accounts payable and accruals) of $125,000.Duffert finances using only long-term debt and common equity.The interest rate on its debt is 8% and its tax rate is 40%.The firm's basic earning power ratio is 15% and its debt-to capital rate is 40%.What are Duffert's ROE and ROIC?

A) 12.00%; 10.29%

B) 12.57%; 10.29%

C) 13.94%; 9.86%

D) 13.94%; 10.29%

E) 13.94%; 11.50%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position,i.e.,that it is becoming more liquid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

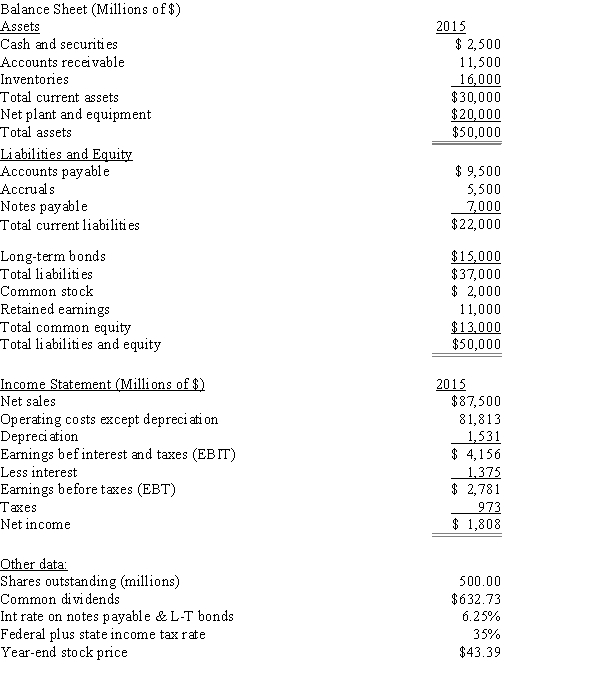

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's total debt to total capital ratio?

-Refer to Exhibit 4.1.What is the firm's total debt to total capital ratio?

A) 48.55%

B) 53.95%

C) 59.94%

D) 62.80%

E) 68.11%

G) A) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant, the more debt a firm uses, the higher its operating margin will be.

B) Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage.

C) Other things held constant, the more debt a firm uses, the higher its profit margin will be.

D) Other things held constant, the higher a firm's total debt to total capital ratio, the higher its TIE ratio will be.

E) Debt management ratios show the extent to which a firm's managers are attempting to reduce risk through the use of financial leverage. The higher the total debt to total capital ratio, the lower the risk.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The return on invested capital (ROIC)differs from the return on assets (ROA).First,ROIC is based on total invested capital rather than total assets.Second,the numerator of the ROIC is after-tax operating income rather than net income.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Zero Corp's total common equity at the end of last year was $405,000 and its net income was $70,000.What was its ROE?

A) 14.82%

B) 15.60%

C) 16.42%

D) 17.28%

E) 18.15%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One problem with ratio analysis is that relationships can sometimes be manipulated.For example,if our current ratio is greater than 1.5,then borrowing on a short-term basis and using the funds to build up our cash account would cause the current ratio to INCREASE.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

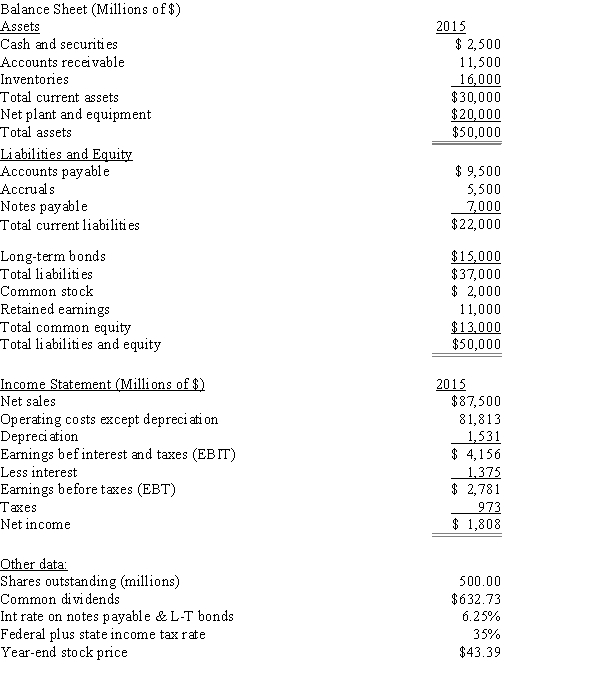

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's ROA?

-Refer to Exhibit 4.1.What is the firm's ROA?

A) 3.62%

B) 3.98%

C) 4.37%

D) 4.81%

E) 5.29%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. The firm finances using only debt and common equity and total assets equal total invested capital. Under these conditions, the ROE will increase.

B) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10% and its debt increases from 40% of total assets to 60%. The firm finances using only debt and common equity and total assets equal total invested capital. Without additional information, we cannot tell what will happen to the ROE.

C) The DuPont equation provides information about how operations affect the ROE, but the equation does not include the effects of debt on the ROE.

D) Other things held constant, an increase in the total debt to total capital ratio will result in an increase in the profit margin.

E) Suppose a firm's total assets turnover ratio falls from 1.0 to 0.9, but at the same time its profit margin rises from 9% to 10%, and its debt increases from 40% of total assets to 60%. The firm finances using only debt and common equity and total assets equal total invested capital. Under these conditions, the ROE will decrease.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

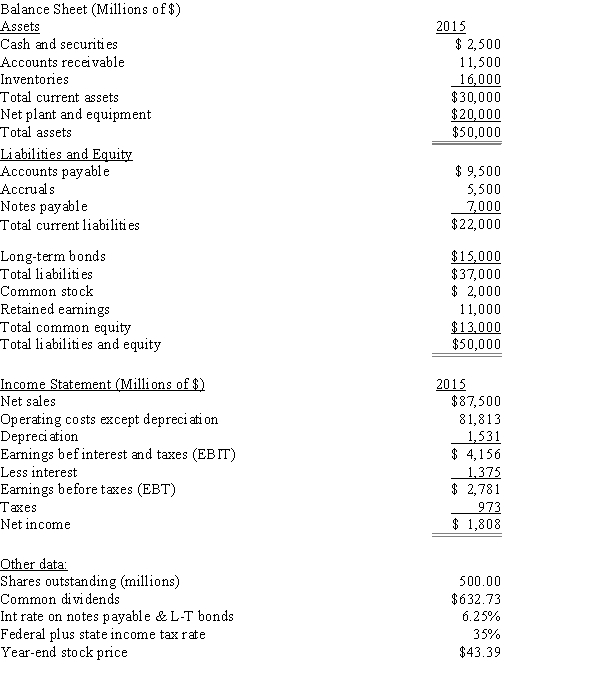

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's ROE?

-Refer to Exhibit 4.1.What is the firm's ROE?

A) 13.21%

B) 13.91%

C) 14.60%

D) 15.33%

E) 16.10%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hoagland Corp's stock price at the end of last year was $33.50,and its book value per share was $25.00.What was its market/book ratio?

A) 1.34

B) 1.41

C) 1.48

D) 1.55

E) 1.63

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In general,it's better to have a low inventory turnover ratio than a high one,as a low ratio indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In general, if investors regard a company as being relatively risky and/or having relatively poor growth prospects, then it will have relatively high P/E and M/B ratios.

B) The basic earning power ratio (BEP) reflects the earning power of a firm's assets after giving consideration to financial leverage and tax effects.

C) The "apparent," but not necessarily the "true," financial position of a company whose sales are seasonal can change dramatically during a given year, depending on the time of year when the financial statements are constructed.

D) The market/book (M/B) ratio tells us how much investors are willing to pay for a dollar of accounting book value. In general, investors regard companies with higher M/B ratios as being more risky and/or less likely to enjoy higher future growth.

E) It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sold some inventory for cash and left the funds in its bank account,its current ratio would probably not change much,but its quick ratio would decline.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A decline in a firm's inventory turnover ratio suggests that it is improving both its inventory management and its liquidity position, i.e., that it is becoming more liquid.

B) In general, it's better to have a low inventory turnover ratio than a high one, as a low one indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock.

C) If a firm's fixed assets turnover ratio is significantly lower than its industry average, this could indicate that it uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets.

D) The more conservative a firm's management is, the higher its total debt to total capital ratio is likely to be.

E) The days sales outstanding ratio tells us how long it takes, on average, to collect after a sale is made. The DSO can be compared with the firm's credit terms to get an idea of whether customers are paying on time.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all the firms being compared have the same proportion of fixed assets to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position.Which of the following actions would increase its quick ratio?

A) Offer price reductions along with generous credit terms that would (1) enable the firm to sell some of its excess inventory and (2) lead to an increase in accounts receivable.

B) Issue new common stock and use the proceeds to increase inventories.

C) Speed up the collection of receivables and use the cash generated to increase inventories.

D) Use some of its cash to purchase additional inventories.

E) Issue new common stock and use the proceeds to acquire additional fixed assets.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wie Corp's sales last year were $315,000,and its year-end total assets were $355,000.The average firm in the industry has a total assets turnover ratio (TATO) of 2.4.The firm's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales.By how much must the assets be reduced to bring the TATO to the industry average,holding sales constant?

A) $201,934

B) $212,563

C) $223,750

D) $234,938

E) $246,684

G) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Chang Corp.has $375,000 of assets,and it uses only common equity capital (zero debt) .Its sales for the last year were $595,000,and its net income was $25,000.Stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%.What profit margin would the firm need in order to achieve the 15% ROE,holding everything else constant?

A) 9.45%

B) 9.93%

C) 10.42%

D) 10.94%

E) 11.49%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 133

Related Exams