B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

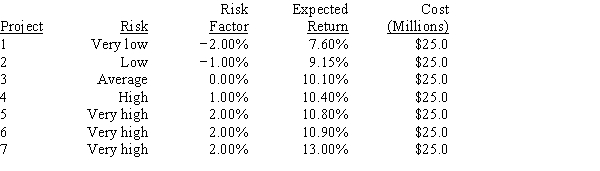

Vang Enterprises,which is debt-free and finances only with equity from retained earnings,is considering 7 equal-sized capital budgeting projects.Its CFO hired you to assist in deciding whether none,some,or all of the projects should be accepted.You have the following information: rRF = 4.50%; RPM = 5.50%; and b = 0.92.The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above- or below-average risk.Data on the 7 projects are shown below.If these are the only projects under consideration,how large should the capital budget be?

A) $100

B) $ 75

C) $ 50

D) $ 25

E) $ 0

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You were recently hired by Scheuer Media Inc.to estimate its cost of capital.You obtained the following data: D1 = $1.75; P0 = $42.50; g = 7.00% (constant) ; and F = 5.00%.What is the cost of equity raised by selling new common stock?

A) 10.77%

B) 11.33%

C) 11.90%

D) 12.50%

E) 13.12%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since debt capital can cause a company to go bankrupt but equity capital cannot, debt is riskier than equity, and thus the after-tax cost of debt is always greater than the cost of equity.

B) The tax-adjusted cost of debt is always greater than the interest rate on debt, provided the company does in fact pay taxes.

C) If a company assigns the same cost of capital to all of its projects regardless of each project's risk, then the company is likely to reject some safe projects that it actually should accept and to accept some risky projects that it should reject.

D) Because no flotation costs are required to obtain capital as retained earnings, the cost of retained earnings is generally lower than the after-tax cost of debt.

E) Higher flotation costs tend to reduce the cost of equity capital.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Since 70% of the preferred dividends received by a corporation are excluded from taxable income,the component cost of equity for a company that pays half of its earnings out as common dividends and half as preferred dividends should,theoretically,be Cost of equity = rs(0.30)(0.50)+ rps(1 − T)(0.70)(0.50).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When calculating the cost of debt, a company needs to adjust for taxes, because interest payments are deductible by the paying corporation.

B) When calculating the cost of preferred stock, companies must adjust for taxes, because dividends paid on preferred stock are deductible by the paying corporation.

C) Because of tax effects, an increase in the risk-free rate will have a greater effect on the after-tax cost of debt than on the cost of common stock as measured by the CAPM.

D) If a company's beta increases, this will increase the cost of equity used to calculate the WACC, but only if the company does not have enough retained earnings to take care of its equity financing and hence must issue new stock.

E) Higher flotation costs reduce investors' expected returns, and that leads to a reduction in a company's WACC.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Duval Inc.uses only equity capital,and it has two equally-sized divisions.Division A's cost of capital is 10.0%,Division B's cost is 14.0%,and the corporate (composite) WACC is 12.0%.All of Division A's projects are equally risky,as are all of Division B's projects.However,the projects of Division A are less risky than those of Division B.Which of the following projects should the firm accept?

A) A Division B project with a 13% return.

B) A Division B project with a 12% return.

C) A Division A project with an 11% return.

D) A Division A project with a 9% return.

E) A Division B project with an 11% return.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's perpetual preferred stock currently sells for $92.50 per share,and it pays an $8.00 annual dividend.If the company were to sell a new preferred issue,it would incur a flotation cost of 5.00% of the issue price.What is the firm's cost of preferred stock?

A) 7.81%

B) 8.22%

C) 8.65%

D) 9.10%

E) 9.56%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

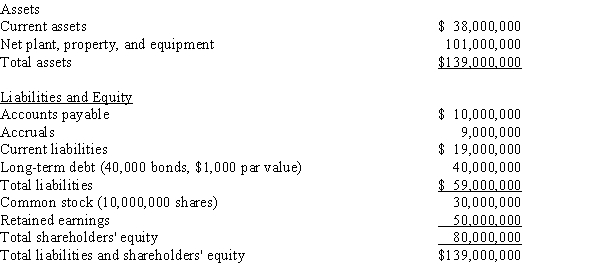

Exhibit 10.1

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC?

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC?

A) 10.85%

B) 11.19%

C) 11.53%

D) 11.88%

E) 12.24%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If the expected dividend growth rate is zero,then the cost of external equity capital raised by issuing new common stock (re)is equal to the cost of equity capital from retaining earnings (rs)divided by one minus the percentage flotation cost required to sell the new stock,(1 − F).If the expected growth rate is not zero,then the cost of external equity must be found using a different formula.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Although some methods used to estimate the cost of equity are subject to severe limitations, the CAPM is a simple, straightforward, and reliable model that consistently produces accurate cost of equity estimates. In particular, academics and corporate finance people generally agree that its key inputs: beta, the risk-free rate, and the market risk premium: can be estimated with little error.

B) The DCF model is generally preferred by academics and financial executives over other models for estimating the cost of equity. This is because of the DCF model's logical appeal and also because accurate estimates for its key inputs, the dividend yield and the growth rate, are easy to obtain.

C) The bond-yield-plus-risk-premium approach to estimating the cost of equity may not always be accurate, but it has the advantage that its two key inputs, the firm's own cost of debt and its risk premium, can be found by using standardized and objective procedures.

D) Surveys indicate that the CAPM is the most widely used method for estimating the cost of equity. However, other methods are also used because CAPM estimates may be subject to error, and people like to use different methods as checks on one another. If all of the methods produce similar results, this increases the decision maker's confidence in the estimated cost of equity.

E) The DCF model is preferred by academics and finance practitioners over other cost of capital models because it correctly recognizes that the expected return on a stock consists of a dividend yield plus an expected capital gains yield.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

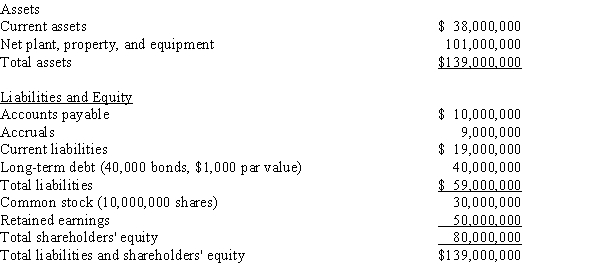

Exhibit 10.1

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.Based on the CAPM,what is the firm's cost of equity?

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.Based on the CAPM,what is the firm's cost of equity?

A) 11.15%

B) 11.73%

C) 12.35%

D) 13.00%

E) 13.65%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm is privately owned,and its stock is not traded in public markets,then we cannot measure its beta for use in the CAPM model,we cannot observe its stock price for use in the DCF model,and we don't know what the risk premium is for use in the bond-yield-plus-risk-premium method.All this makes it especially difficult to estimate the cost of equity for a private company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a capital component when calculating the weighted average cost of capital (WACC) for use in capital budgeting?

A) Long-term debt.

B) Accounts payable.

C) Retained earnings.

D) Common stock.

E) Preferred stock.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 94 of 94

Related Exams