B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the debt ratio will generally have no effect on which of these items?

A) Business risk.

B) Total risk.

C) Financial risk.

D) Market risk.

E) The firm's beta.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

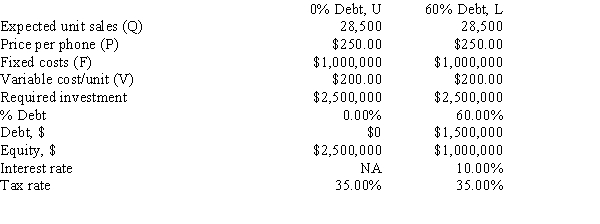

You were hired as the CFO of a new company that was founded by three professors at your university.The company plans to manufacture and sell a new product,a cell phone that can be worn like a wrist watch.The issue now is how to finance the company,with equity only or with a mix of debt and equity.The price per phone will be $250.00 regardless of how the firm is financed.The expected fixed and variable operating costs,along with other data,are shown below.How much higher or lower will the firm's expected ROE be if it uses 60% debt rather than only equity,i.e.,what is ROEL − ROEU?

A) 5.68%

B) 5.94%

C) 6.22%

D) 6.52%

E) 6.83%

G) A) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) In general, a firm with low operating leverage also has a small proportion of its total costs in the form of fixed costs.

B) There is no reason to think that changes in the personal tax rate would affect firms' capital structure decisions.

C) A firm with a relatively high business risk is more likely to increase its use of financial leverage than a firm with low business risk, assuming all else equal.

D) If a firm's after-tax cost of equity exceeds its after-tax cost of debt, it can always reduce its WACC by increasing its use of debt.

E) Suppose a firm has less than its optimal amount of debt. Increasing its use of debt to the point where it is at its optimal capital structure will decrease the costs of both debt and equity.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's business risk is largely determined by the financial characteristics of its industry,especially by the amount of debt the average firm in the industry uses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same total assets,total investor-supplied capital,operating income (EBIT) ,tax rate,and business risk.Company HD,however,has a much higher debt ratio than LD.Also,both companies' returns on investors' capital (ROIC) exceed their after-tax costs of debt,rd(1 − T) .Which of the following statements is CORRECT?

A) HD should have a higher return on assets (ROA) than LD.

B) HD should have a higher times interest earned (TIE) ratio than LD.

C) HD should have a higher return on equity (ROE) than LD, but its risk, as measured by the standard deviation of ROE, should also be higher than LD's.

D) Given that ROIC > rd(1 − T) , HD's stock price must exceed that of LD.

E) Given that ROIC > rd(1 − T) , LD's stock price must exceed that of HD.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major contribution of the Miller model is that it demonstrates,other things held constant,that

A) personal taxes increase the value of using corporate debt.

B) personal taxes lower the value of using corporate debt.

C) personal taxes have no effect on the value of using corporate debt.

D) financial distress and agency costs reduce the value of using corporate debt.

E) debt costs increase with financial leverage.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would tend to increase a firm's target debt ratio,other things held constant?

A) The costs associated with filing for bankruptcy increase.

B) The corporate tax rate is increased.

C) The personal tax rate is increased.

D) The Federal Reserve tightens interest rates in an effort to fight inflation.

E) The company's stock price hits a new low.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT,holding other things constant?

A) Firms whose assets are relatively liquid tend to have relatively low bankruptcy costs, hence they tend to use relatively little debt.

B) An increase in the personal tax rate is likely to increase the debt ratio of the average corporation.

C) If changes in the bankruptcy code make bankruptcy less costly to corporations, then this would likely lead to lower debt ratios for corporations.

D) An increase in the company's degree of operating leverage would tend to encourage the firm to use more debt in its capital structure so as to keep its total risk unchanged.

E) An increase in the corporate tax rate would in theory encourage companies to use more debt in their capital structures.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Some people--including the former chairman of the Federal Reserve Board of Governors (Ben Bernanke)--have argued that one advantage of corporate debt from the stockholders' standpoint is that the existence of debt forces managers to focus on cash flow and to refrain from spending too much of the firm's money on private plane and other "perks." This is one of the factors that led to the rise of LBOs and private equity firms.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

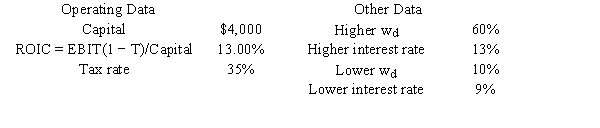

You have been hired by a new firm that is just being started.The CFO wants to finance with 60% debt,but the president thinks it would be better to hold the percentage of debt in the capital structure (wd) to only 10%.Other things held constant,and based on the data below,if the firm uses more debt,by how much would the ROE change,i.e.,what is ROENew − ROEOld?

A) 5.44%

B) 5.73%

C) 6.03%

D) 6.33%

E) 6.65%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The trade-off theory states that capital structure decisions involve a tradeoff between the costs and benefits of debt financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

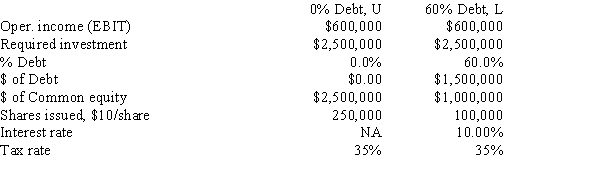

You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $600,000.Other data for the firm are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e.,what is EPSL − EPSU?

A) $1.00

B) $1.11

C) $1.23

D) $1.37

E) $1.50

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monroe Inc.is an all-equity firm with 500,000 shares outstanding.It has $2,000,000 of EBIT,and EBIT is expected to remain constant in the future.The company pays out all of its earnings,so earnings per share (EPS) equal dividends per shares (DPS) ,and its tax rate is 40%.The company is considering issuing $5,000,000 of 9.00% bonds and using the proceeds to repurchase stock.The risk-free rate is 4.5%,the market risk premium is 5.0%,and the firm's beta is currently 0.90.However,the CFO believes the beta would rise to 1.10 if the recapitalization occurs.Assuming the shares could be repurchased at the price that existed prior to the recapitalization,what would the price per share be following the recapitalization? (Hint: P0 = EPS/rs because EPS = DPS.)

A) $28.27

B) $29.76

C) $31.25

D) $32.81

E) $34.45

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller (MM),in their second article,took account of taxes,bankruptcy,and other factors that were assumed away in their original article.Once they took account of all these assumptions,they concluded that every firm has a unique optimal capital structure.Moreover,a manager can use the second MM model to determine his or her firm's optimal debt ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Modigliani and Miller's first article led to the conclusion that capital structure is extremely important,and that every firm has an optimal capital structure that maximizes its value and minimizes its cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your firm has $500 million of investor-supplied capital,its return on investors' capital (ROIC) is 15%,and it currently has no debt in its capital structure .The CFO is contemplating a recapitalization where it would issue debt at an after-tax cost of 10% and use the proceeds to buy back some of its common stock,such that the percentage of common equity in the capital structure (wc) is 1 − wd.If the company goes ahead with the recapitalization,its operating income,the size of the firm (i.e.,total assets) ,total investor-supplied capital,and tax rate would remain unchanged.Which of the following is most likely to occur as a result of the recapitalization?

A) The ROA would increase.

B) The ROA would remain unchanged.

C) The return on investors' capital would decline.

D) The return on investors' capital would increase.

E) The ROE would increase.

G) B) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? As a firm increases the operating leverage used to produce a given quantity of output,this

A) normally leads to an increase in its fixed assets turnover ratio.

B) normally leads to a decrease in its business risk.

C) normally leads to a decrease in the standard deviation of its expected EBIT.

D) normally leads to a decrease in the variability of its expected EPS.

E) normally leads to a reduction in its fixed assets turnover ratio.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,an increase in financial leverage will increase a firm's market (or systematic)risk as measured by its beta coefficient.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to Modigliani and Miller (MM),in a world without taxes the optimal capital structure for a firm is approximately 100% debt financing.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 88

Related Exams