A) When firms are deciding on the size of stock splits--say whether to declare a 2-for-1 split or a 3-for-1 split, it is best to declare the smaller one, in this case the 2-for-1 split, because then the after-split price will be higher than if the 3-for-1 split had been used.

B) Back before the SEC was created in the 1930s, companies would declare reverse splits in order to boost their stock prices. However, this was determined to be a deceptive practice, and reverse splits are illegal today.

C) Stock splits create more administrative problems for investors than stock dividends, especially determining the tax basis of their shares when they decide to sell them, so today stock dividends are used far more often than stock splits.

D) When a company declares a stock split, the price of the stock typically declines--for example, by about 50% after a 2-for-1 split--and this necessarily reduces the total market value of the firm's equity.

E) If a firm's stock price is quite high relative to most stocks--say $500 per share--then it can declare a stock split of say 20-for-1 so as to bring the price down to something close to $25. Moreover, if the price is relatively low--say $2 per share--then it can declare a "reverse split" of say 1-for-10 so as to bring the price up to somewhere around $20 per share.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Stock repurchases can be used by a firm as part of a plan to change its capital structure.

B) After a 3-for-1 stock split, a company's price per share should fall, but the number of shares outstanding will rise.

C) Investors may interpret a stock repurchase program as a signal that the firm's managers believe the stock is undervalued, or, alternatively, as a signal that the firm does not have many good investment opportunities.

D) A company can repurchase stock to distribute a large one-time cash inflow, say from the sale of a division, to stockholders without having to increase its regular dividend.

E) Stockholders pay no income tax on dividends if the dividends are used to purchase stock through a dividend reinvestment plan.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The announcement of an increase in the cash dividend should,according to MM,lead to an increase in the price of the firm's stock,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

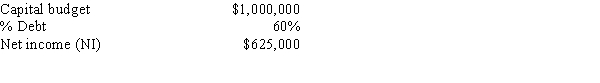

Pavlin Corp.'s projected capital budget is $2,000,000,its target capital structure is 40% debt and 60% equity,and its forecasted net income is $900,000.If the company follows the residual dividend model,how much dividends will it pay or,alternatively,how much new stock must it issue?

A) $462,983; $244,352

B) $487,350; $257,213

C) $513,000; $270,750

D) $540,000; $285,000

E) $ 0; $300,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A "reverse split" reduces the number of shares outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Torrence Inc.has the following data.If it uses the residual dividend model,how much total dividends,if any,will it pay out?

A) $183,264

B) $192,909

C) $203,063

D) $213,750

E) $225,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Underlying the dividend irrelevance theory proposed by Miller and Modigliani is their argument that the value of the firm is determined only by its basic earning power and its business risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm uses the residual dividend model to set dividend policy,then dividends are determined as a residual after providing for the equity required to fund the capital budget.Under this model,the higher the firm's debt ratio,the lower its payout ratio will be,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ring Technology has a capital budget of $850,000,it wants to maintain a target capital structure of 35% debt and 65% equity,and it also wants to pay a dividend of $400,000.If the company follows the residual dividend model,how much net income must it earn to meet its capital budgeting requirements and pay the dividend,all while keeping its capital structure in balance?

A) $ 904,875

B) $ 952,500

C) $1,000,125

D) $1,050,131

E) $1,102,638

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm declares a 20: 1 stock split,and the pre-split price was $500,then we might expect the post-split price to be $25.However,it often turns out that the post-split price will be higher than $25.This higher price could be due to signaling effects investors believe that management split the stock because they think the firm is going to do better in the future.The higher price could also be because investors like lower-priced shares.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

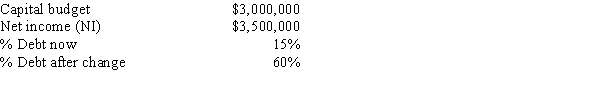

Purcell Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Purcell family members would like for the dividend payout ratio to be increased.If Purcell increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend payout ratio be increased,holding other things constant?

A) 38.6%

B) 40.5%

C) 42.5%

D) 44.7%

E) 46.9%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A 100% stock dividend and a 2: 1 stock split should,at least conceptually,have the same effect on the firm's stock price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose you plotted a curve which showed a Firm U's WACC on the vertical axis and its debt ratio on the horizontal axis.Then you plotted a similar curve for Firm V.The curve for firm U resembled a shallow "U," while that for Firm V resembled a sharp "V." Both firms have debt ratios that cause their WACCs to be minimized.Other things held constant,it would be easier for Firm V than for Firm U to maintain a steady dividend in the face of varying investment opportunities and earnings from year to year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The optimal distribution policy strikes that balance between current dividends and capital gains that maximizes the firm's stock price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm adheres strictly to the residual dividend model,the issuance of new common stock would suggest that

A) the dividend payout ratio has remained constant.

B) the dividend payout ratio is increasing.

C) no dividends will be paid during the year.

D) the dividend payout ratio is decreasing.

E) the dollar amount of capital investments had decreased.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 75 of 75

Related Exams