A) 10.86%

B) 12.07%

C) 13.41%

D) 14.90%

E) 16.55%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the cash budget is CORRECT?

A) Depreciation expense is not explicitly included, but depreciation's effects are reflected in the estimated tax payments.

B) Cash budgets do not include financial items such as interest and dividend payments.

C) Cash budgets do not include cash inflows from long-term sources such as the issuance of bonds.

D) Changes that affect the DSO do not affect the cash budget.

E) Capital budgeting decisions have no effect on the cash budget until projects go into operation and start producing revenues.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

"Stretching" accounts payable is a widely accepted,entirely ethical,and costless financing technique,which is particularly useful when suppliers' production plants are at full capacity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the yield curve is upward sloping,then short-term debt will be cheaper than long-term debt.Thus,if a firm's CFO expects the yield curve to continue to have an upward slope,this would tend to cause the current ratio to be relatively low,other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Singal Inc.is preparing its cash budget.It expects to have sales of $30,000 in January,$35,000 in February,and $35,000 in March.If 20% of sales are for cash,40% are credit sales paid in the month after the sale,and another 40% are credit sales paid 2 months after the sale,what are the expected cash receipts for March?

A) $24,057

B) $26,730

C) $29,700

D) $33,000

E) $36,300

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The four primary elements in a firm's credit policy are (1)credit standards,(2)discounts offered,(3)credit period,and (4)collection policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is

A) used to protect cash, i.e., to keep it from being stolen.

B) used to identify inventory safety stocks.

C) used to slow down the collection of checks our firm writes.

D) used to speed up the collection of checks received.

E) used primarily by firms where currency is used frequently in transactions, such as fast food restaurants, and less frequently by firms that receive payments as checks.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Trade credit can be separated into two components: free trade credit,which is credit received after the discount period ends,and costly trade credit,which is the cost of discounts not taken.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Accruals are an expensive but commonly used way to finance working capital.

B) A conservative financing policy is one where the firm finances part of its fixed assets with short-term capital and all of its net working capital with short-term funds.

C) If a company receives trade credit under terms of 2/10, net 30, this implies that the company has 10 days of free trade credit.

D) One cannot tell if a firm has a conservative, aggressive, or moderate current asset financing policy without an examination of its cash budget.

E) If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit can be reduced by paying late.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

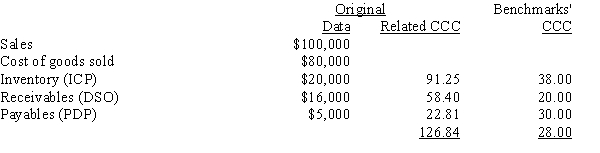

Soenen Inc.had the following data for last year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold.Soenen finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased?

A) $1,901

B) $2,092

C) $2,301

D) $2,531

E) $2,784

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

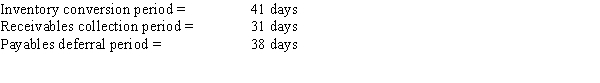

Whittington Inc.has the following data.What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 37 days

D) 41 days

E) 45 days

G) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Buskirk Construction buys on terms of 2/15,net 60 days.It does not take discounts,and it typically pays on time,60 days after the invoice date.Net purchases amount to $450,000 per year.On average,how much "free" trade credit does the firm receive during the year? (Assume a 365-day year,and note that purchases are net of discounts.)

A) $18,493

B) $19,418

C) $20,389

D) $21,408

E) $22,479

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aggarwal Inc.buys on terms of 2/10,net 30,and it always pays on the 30th day.The CFO calculates that the average amount of costly trade credit carried is $375,000.What is the firm's average accounts payable balance? Assume a 365-day year.

A) $458,160

B) $482,273

C) $507,656

D) $534,375

E) $562,500

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital,defined as current assets minus the difference between current liabilities and notes payable,is equal to the current ratio minus the quick ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Madura Inc.wants to increase its free cash flow by $180 million during the coming year,which should result in a higher EVA and stock price.The CFO has made these projections for the upcoming year: ∙EBIT is projected to equal $850 million. ∙Gross capital expenditures are expected to total to $360 million versus depreciation of $120 million,so its net capital expenditures should total $240 million. ∙The tax rate is 40%. ∙There will be no changes in cash or marketable securities,nor will there be any changes in notes payable or accruals. What increase in net operating working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

A) $ 72

B) $ 90

C) $108

D) $130

E) $156

G) A) and C)

Correct Answer

verified

B

Correct Answer

verified

True/False

The maturity matching,or "self-liquidating," approach to financing involves obtaining the funds for permanent current assets with a combination of long-term capital and short-term capital that varies depending on the level of interest rates.When short-term rates are relatively high,short-term assets will be financed with long-term debt to reduce costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Whitmer Inc.sells to customers all over the U.S.,and all receipts come in to its headquarters in New York City.The firm's average accounts receivable balance is $2.5 million,and they are financed by a bank loan at an 11% annual interest rate.The firm is considering setting up a regional lockbox system to speed up collections,and it believes this would reduce receivables by 20%.If the annual cost of the system is $15,000,what pre-tax net annual savings would be realized?

A) $29,160

B) $32,400

C) $36,000

D) $40,000

E) $44,000

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have suppliers who operate in many different parts of the country.

B) have widely dispersed manufacturing facilities.

C) have a large marketable securities portfolio, and cash, to protect.

D) receive payments in the form of currency, such as fast food restaurants, rather than in the form of checks.

E) have customers who operate in many different parts of the country.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 16.1 Zorn Corporation is deciding whether to pursue a restricted or relaxed working capital investment policy. The firm's annual sales are expected to total $3,600,000, its fixed assets turnover ratio equals 4.0, and its debt and common equity are each 50% of total assets. EBIT is $150,000, the interest rate on the firm's debt is 10%, and the tax rate is 40%. If the company follows a restricted policy, its total assets turnover will be 2.5. Under a relaxed policy its total assets turnover will be 2.2. -Refer to Exhibit 16.1.Assume now that the company believes that if it adopts a restricted policy,its sales will fall by 15% and EBIT will fall by 10%,but its total assets turnover,debt ratio,interest rate,and tax rate will all remain the same.In this situation,what's the difference between the projected ROEs under the restricted and relaxed policies?

A) 2.24%

B) 2.46%

C) 2.70%

D) 2.98%

E) 3.27%

G) B) and E)

Correct Answer

verified

A

Correct Answer

verified

Showing 1 - 20 of 126

Related Exams