Filters

Question type

A) 31 days

B) 34 days

C) 38 days

D) 42 days

E) 46 days

F) B) and D)

G) None of the above

G) None of the above

Correct Answer

verified

Correct Answer

verified

Question 72

True/False

Since depreciation is a non-cash charge,it neither appears on nor has any effect on the cash budget.Thus,if the depreciation charge for the coming year doubled or halved,this would have no effect on the cash budget.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 73

True/False

A line of credit can be either a formal or an informal agreement between a borrower and a bank regarding the maximum amount of credit the bank will extend to the borrower during some future period,assuming the borrower maintains its financial strength.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 74

Multiple Choice

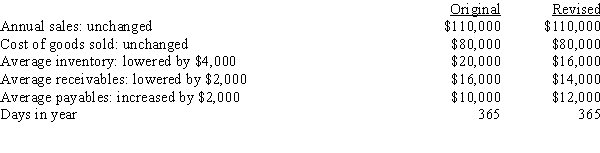

Zervos Inc.had the following data for last year (in millions) .The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000,(2) that improvements in the credit department could reduce receivables by $2,000,and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000.Furthermore,she thinks that these changes would not affect either sales or the costs of goods sold.If these changes were made,by how many days would the cash conversion cycle be lowered?

A) 34.0 days

B) 37.4 days

C) 41.2 days

D) 45.3 days

E) 49.8 days

F) A) and B)

G) B) and D)

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Question 75

True/False

Not taking cash discounts is costly,and as a result,firms that do not take them are usually those that are performing poorly and have inadequate cash balances.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 76

True/False

If a firm sells on terms of 2/10,net 30 days,and its DSO is 28 days,then the fact that the 28-day DSO is less than the 30-day credit period tell us that the credit department is functioning efficiently and there are no past due accounts.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 126 of 126

Related Exams