A) $790.48

B) $830.01

C) $871.51

D) $915.08

E) $960.84

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Leasing is often referred to as off-balance-sheet financing because lease payments are shown as operating expenses on a firm's income statement and,under certain conditions,leased assets and associated liabilities do not appear on the firm's balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Leasing is typically a financing decision and not a capital budgeting decision.The decision to acquire the asset is a "done deal" before the lease analysis begins.Therefore,in a lease analysis,we are concerned simply with whether to finance the asset with a lease or with a loan.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Operating leases help to shift the risk of obsolescence from the user to the lessor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning warrants is most CORRECT?

A) Bonds with warrants and convertible bonds both have option features that their holders can exercise if the underlying stock's price increases. However, if the option is exercised, the issuing company's debt declines if warrants are used but remains the same if convertibles are used.

B) Warrants are long-term put options that have value because holders can sell the firm's common stock at the exercise price regardless of how low the market price drops.

C) Warrants are long-term call options that have value because holders can buy the firm's common stock at the exercise price regardless of how high the stock's price has risen.

D) A firm's investors would generally prefer to see it issue bonds with warrants than straight bonds because the warrants dilute the value of new shareholders, and that value is transferred to existing shareholders.

E) A drawback to using warrants is that if the firm is very successful, investors will be less likely to exercise the warrants, and this will deprive the firm of receiving any new capital.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carolina Trucking Company (CTC) is evaluating a potential lease for a truck with a 4-year life that costs $40,000 and falls into the MACRS 3-year class.If the firm borrows and buys the truck,the loan rate would be 9%,and the loan would be amortized over the truck's 4-year life.The loan payments would be made at the end of each year.The truck will be used for 4 years,at the end of which time it will be sold at an estimated residual value of $12,000.If CTC buys the truck,it would purchase a maintenance contract that costs $1,500 per year,payable at the end of each year.The lease terms,which include maintenance,call for a $10,000 lease payment (4 payments total) at the beginning of each year.CTC's tax rate is 35%.What is the net advantage to leasing? (Note: MACRS rates for Years 1 to 4 are 0.33,0.45,0.15,and 0.07.)

A) $609

B) $642

C) $678

D) $715

E) $751

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

FAS 13 requires that for an unqualified audit report,financial (or capital) leases must be included in the balance sheet by reporting the

A) residual value as a fixed asset.

B) residual value as a liability.

C) present value of future lease payments as an asset and also showing this same amount as an offsetting liability.

D) undiscounted sum of future lease payments as an asset and as an offsetting liability.

E) undiscounted sum of future lease payments, less the residual value, as an asset and as an offsetting liability.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Corporations that invest surplus funds in floating-rate preferred stock benefit from getting a relatively stable price,and they also benefit from the 70% tax exemption on preferred dividends received.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The problem of dilution of stockholders' earnings never results from the sale of call options,but it can arise if warrants are used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Herbert Engineering is issuing new 15-year bonds that have warrants attached.If not for the attached warrants,the bonds would carry a 9% annual interest rate.However,with the warrants attached the bonds will pay a 6% annual coupon.There are 30 warrants attached to each bond,which has a par value of $1,000.What is the value of the straight-debt portion of the bonds?

A) $720.27

B) $758.18

C) $796.09

D) $835.89

E) $877.69

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sutton Corporation,which has a zero tax rate due to tax loss carry-forwards,is considering a 5-year,$6,000,000 bank loan to finance service equipment.The loan has an interest rate of 10% and would be amortized over 5 years,with 5 end-of-year payments.Sutton can also lease the equipment for 5 end-of-year payments of $1,790,000 each.How much larger or smaller is the bank loan payment than the lease payment? Note: Subtract the loan payment from the lease payment.

A) $177,169

B) $196,854

C) $207,215

D) $217,576

E) $228,455

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most CORRECT?

A) Warrants have an option feature but convertibles do not.

B) One important difference between warrants and convertibles is that convertibles bring in additional funds when they are converted, but exercising warrants does not bring in any additional funds.

C) The coupon rate on convertible debt is normally set below the coupon rate that would be set on otherwise similar straight debt even though investing in convertibles is more risky than investing in straight debt.

D) The value of a warrant to buy a safe, stable stock should exceed the value of a warrant to buy a risky, volatile stock, other things held constant.

E) Warrants can sometimes be detached and traded separately from the security with which they were issued, but this is unusual.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Upstate Water Company just sold a bond with 50 warrants attached.The bonds have a 20-year maturity and an annual coupon of 12%,and they were issued at their $1,000 par value.The current yield on similar straight bonds is 15%.What is the implied value of each warrant?

A) $3.76

B) $3.94

C) $4.14

D) $4.35

E) $4.56

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thomson Engineering is issuing new 20-year bonds that have warrants attached.If not for the attached warrants,the bonds would carry an 11% annual interest rate.However,with the warrants attached the bonds will pay an 8% annual coupon.There are 30 warrants attached to each bond,which have a par value of $1,000.What is the value of the straight-debt portion of the bonds?

A) $652.55

B) $686.89

C) $723.05

D) $761.10

E) $799.16

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most CORRECT?

A) Preferred stock generally has a higher component cost of capital to the firm than does common stock.

B) By law in most states, all preferred stock must be cumulative, meaning that the compounded total of all unpaid preferred dividends must be paid before any dividends can be paid on the firm's common stock.

C) From the issuer's point of view, preferred stock is less risky than bonds.

D) Whereas common stock has an indefinite life, preferred stocks always have a specific maturity date, generally 25 years or less.

E) Unlike bonds, preferred stock cannot have a convertible feature.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Most convertible securities are bonds or preferred stocks that,under specified terms and conditions,can be exchanged for common stock at the option of the holder.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Moniker Manufacturing's bonds were recently issued at their $1,000 par value.At any time prior to maturity (20 years from now) ,a bondholder can exchange a bond for a share of common stock at a conversion price of $40.What is the conversion ratio?

A) 22.56

B) 23.75

C) 25.00

D) 26.25

E) 27.56

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

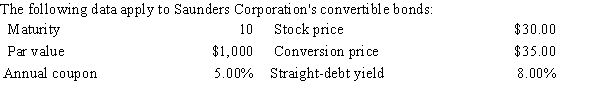

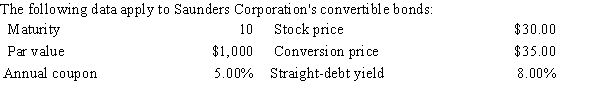

The next 4 problems must be kept together; all use the data in Exhibit 20.1.

Exhibit 20.1

-Refer to Exhibit 20.1.What is the minimum price (or "floor" price) at which the Saunders' bonds should sell?

-Refer to Exhibit 20.1.What is the minimum price (or "floor" price) at which the Saunders' bonds should sell?

A) $698.15

B) $734.89

C) $773.57

D) $814.29

E) $857.14

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lease-versus-purchase analysis should compare the cost of leasing to the cost of owning,assuming that the asset purchased

A) is financed with short-term debt.

B) is financed with long-term debt.

C) is financed with debt whose maturity matches the term of the lease.

D) is financed with a mix of debt and equity based on the firm's target capital structure, i.e., at the WACC.

E) is financed with retained earnings.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The next 4 problems must be kept together; all use the data in Exhibit 20.1.

Exhibit 20.1

-Refer to Exhibit 20.1.What is the bond's straight-debt value at the time of issue?

-Refer to Exhibit 20.1.What is the bond's straight-debt value at the time of issue?

A) $684.78

B) $720.82

C) $758.76

D) $798.70

E) $838.63

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 60

Related Exams