A) 1.97%

B) 2.19%

C) 2.43%

D) 2.70%

E) 3.00%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

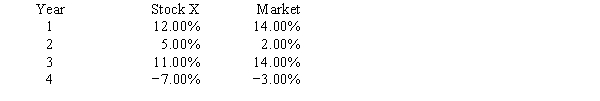

Stock X and the "market" have had the following rates of returns over the past four years. 60% of your portfolio is invested in Stock X and the remaining 40% is invested in Stock Y.The risk-free rate is 6% and the market risk premium is also 6%.You estimate that 14% is the required rate of return on your portfolio.What is the beta of Stock Y?

A) 1.72

B) 1.91

C) 2.10

D) 2.31

E) 2.54

G) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

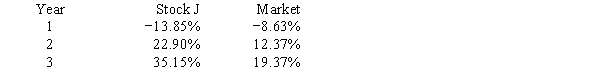

Given the following returns on Stock J and the "market" during the last three years,what is the beta coefficient of Stock J? (Hint: Think rise over run.)

A) 1.58

B) 1.66

C) 1.75

D) 1.84

E) 1.93

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

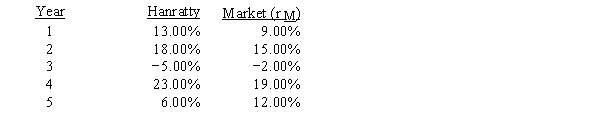

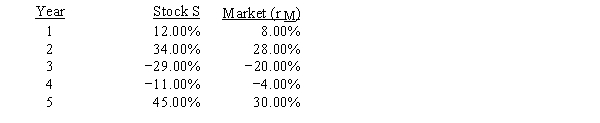

Hanratty Inc.'s stock and the stock market have generated the following returns over the past five years:

What is the estimated beta of Hanratty Inc.'s stock?

A) 1.0333

B) 1.1481

C) 1.2757

D) 1.4032

E) 1.5436

G) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

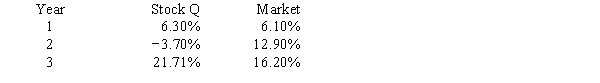

Given the following returns on Stock Q and "the market" during the last three years,what is the difference in the calculated beta coefficient of Stock Q when Year 1 and Year 2 data are used as compared to Year 2 and Year 3 data? (Hint: Think rise over run.)

A) 9.17

B) 9.63

C) 10.11

D) 10.62

E) 11.15

G) C) and E)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The CAPM is an ex ante model, which means that all of the variables should be historical values that can reasonably be projected into the future.

B) The beta coefficient used in the SML equation should reflect the expected volatility of a given stock's return versus the return on the market during some future period.

C) The general equation: Y = a + bX + e, is the standard form of a simple linear regression where b = beta, and X equals the independent return on an individual security being compared to Y, the return on the market, which is the dependent variable.

D) The rise-over-run method is not a legitimate method of estimating beta because it measures changes in an individual security's return regressed against time.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Below are the returns for the past five years for Stock S and for the overall market:

What is the estimated beta of Stock S?

A) 1.4320

B) 1.5036

C) 1.5788

D) 1.6577

E) 1.7406

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

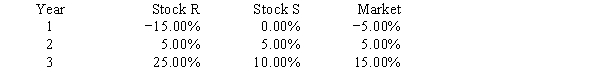

Exhibit 8A.1

You have been asked to use a CAPM analysis to choose between Stocks R and S, with your choice being the one whose expected rate of return exceeds its required return by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or the "market") is 10%. Your security analyst tells you that Stock S's expected rate of return is equal to 11%, while Stock R's expected rate of return is equal to 12%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Calculate both stocks' betas.What is the difference between the betas? That is,what is the value of betaR − betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 − Y1) divided by (X2 − X1) may aid you.)

-Refer to Exhibit 8A.1.Calculate both stocks' betas.What is the difference between the betas? That is,what is the value of betaR − betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 − Y1) divided by (X2 − X1) may aid you.)

A) 1.3538

B) 1.4250

C) 1.5000

D) 1.5750

E) 1.6538

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 8 of 8

Related Exams