A) Number of shares issued

B) Number of shares authorized

C) Par value

D) Number of shares outstanding

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

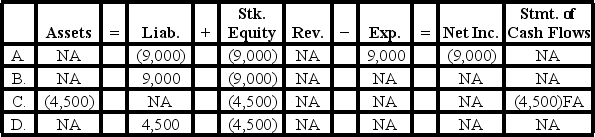

What effect will the declaration and distribution of a stock dividend have on net income and cash flows?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the year,Todd Corporation issued 200 shares of $20 par value common stock for $50 a share.A total of 500 shares were authorized.In addition,the company purchased 75 shares of treasury stock at $44 a share.Which of the following best presents the related lines in the stockholders' equity section of the company's balance sheet?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following is not considered an advantage of the corporate form of business organization?

A) Ability to raise capital

B) Continuity of existence

C) Ease of transferability of ownership

D) Lack of government regulation

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a closely held corporation,exchanges of stock are limited to transactions between individuals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not normally a preference given to the holders of preferred stock?

A) The right to receive a specified amount of dividends prior to any being paid to common stockholders.

B) The right to vote before the common stockholders at the corporation's annual meeting.

C) The right to receive preference over common stockholders as to the distribution of assets during a liquidation process.

D) All of these are preferences given to preferred stock.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about why companies choose not to pay cash dividends is (are) true?

A) The board and management prefer to reinvest all net income for future growth.

B) The corporation does not have sufficient cash.

C) The corporation does not have sufficient retained earnings.

D) All of these statements are true.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Montana Company was authorized to issue 200,000 shares of common stock.The company had issued 50,000 shares of stock when it purchased 10,000 shares of treasury stock.After the purchase of treasury stock,the number of outstanding shares of common stock was which of the following?

A) 190,000

B) 60,000

C) 40,000

D) 50,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is the price-earnings ratio calculated?

A) Market price per share of stock divided by earnings per share

B) The interest rate on borrowed money divided by the current prime rate

C) The price of a company's products as compared to its net income

D) The market value of a company's stock divided by average earnings over the past three years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes how each share of par value stock issued is reported in the Common Stock account?

A) Current market value

B) Average issue price

C) Par or stated value

D) Lower of cost or market

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the issuance of a common stock dividend normally impact the calculation of a company's price-earnings (P/E) ratio?

A) It decreases the P/E ratio.

B) It would not be expected to impact the P/E ratio.

C) It increase the P/E ratio.

D) The impact on the P/E ratio cannot be determined.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is meant by the term "double taxation?"

A) Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on their dividends.

B) In a partnership, both partners are required to claim their share of net income on their tax returns.

C) A sole proprietorship must pay income taxes on its net income and the owner is also required to pay income taxes on withdrawals.

D) A sole proprietorship must pay income taxes to both the state government and the federal government.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation might buy some of its own stock to help keep the market price from falling.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An appropriation of retained earnings restricts the amount of dividends that a corporation can declare in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Articles of incorporation,prepared by a business that wishes to incorporate,normally include,but are not limited to,the corporation's name and purpose,its location,and provisions for capital stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is treasury stock reported on a corporation's balance sheet?

A) As an addition to total paid-in capital

B) As a deduction in determining total stockholders' equity

C) As a deduction from total paid-in capital

D) As a deduction from retained earnings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How will the entry to record the declaration of the dividend on March 1 affect the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

Treasury Stock is a contra equity account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A high price-earnings ratio generally means that investors are optimistic about a company's future growth.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entities would report income tax expense on its income statement?

A) Sole proprietorship.

B) Corporation.

C) Partnership.

D) All of these answer choices are correct.

F) A) and B)

Correct Answer

verified

B

Correct Answer

verified

Showing 1 - 20 of 88

Related Exams