A) $3,200 and $14,000

B) $16,000 and $16,350

C) $16,000 and $13,273

D) $20,625 and $16,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company chooses to call some of its callable bonds before their maturity,generally it will have to pay an amount that is greater than the carrying value of the bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kier Company issued $200,000 in bonds on January 1,Year 1.The bonds were issued at face value and carried a 4-year term to maturity.The bonds have a 6.5% stated rate of interest and interest is payable in cash on December 31 each year.Based on this information alone,what are the amounts of interest expense and cash flows from operating activities,respectively,that will be reported in the financial statements for the year ending December 31,Year 1?

A) $13,000 and Zero

B) Zero and $13,000

C) $13,000 and $13,000

D) Zero and Zero

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The times-interest-earned ratio is calculated by which of the following?

A) Total assets divided by interest expense.

B) Net income divided by interest expense.

C) Earnings before interest and taxes divided by interest expense.

D) None of these answer choices are correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the name used for the type of secured bond that requires a pledge of a designated piece of property in case of default?

A) Debenture bond

B) Indenture bond

C) Mortgage bond

D) Registered bond

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The times-interest-earned ratio is usually calculated as the ratio of net income to interest expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The effective rate of interest for a particular bond issue is the market rate of interest for other investments with similar levels of risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Loans that require payment of interest at regular intervals and payment of principal at maturity are installment notes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

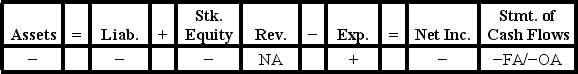

King Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on King's statements?

Which of the following accounting events could have caused these effects on King's statements?

A) Repaid a bond issued at a discount.

B) Borrowed funds through a line-of-credit.

C) Made a payment on an installment loan.

D) Issued a bond at a discount.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the stated rate of interest is true if a bond is sold at 101?

A) The stated rate equals the market rate.

B) The state rate is unrelated to the market rate.

C) The stated rate is higher than the market rate.

D) The stated rate is lower than the market rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a bond issuer's bond ratings drop,the company probably will have to pay higher interest rates on bonds that have already been issued.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Hanover Corporation issued bonds with a $70,500 face value,a stated rate of interest of 8%,and a 5-year term to maturity.The bonds were issued at 97.Hanover uses the straight-line method to amortize bond discounts and premiums.Interest is payable in cash on December 31 each year. How much interest expense will Hanover report on its income statement on December 31,Year 1?

A) $423

B) $2,115

C) $5,640

D) $6,063

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 112 of 112

Related Exams