A) $17,000 and $17,000

B) $17,000 and $68,000

C) $68,000 and $17,000

D) $17,000 and $51,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. -What value will be reported for the building on the balance sheet?

A) $175,000

B) $950,000

C) $800,000

D) $1,100,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance sheet of Flo's Restaurant showed total assets of $600,000,liabilities of $160,000 and stockholders' equity of $540,000.An appraiser estimated the fair value of the restaurant assets at $680,000.If Alice Company pays $770,000 cash for the restaurant,what is the amount of goodwill?

A) $90,000

B) $170,000

C) $250,000

D) $230,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glick Company purchased oil rights on July 1,Year 1 for $2,400,000.A total of 200,000 barrels of oil are expected to be extracted over the assets life,and 30,000 barrels are extracted and sold in Year 1.Which of the following correctly summarizes the effect of the Year 1 depletion expense on the elements of the financial statements?

A) A decrease in stockholders' equity of $200,000

B) A decrease in assets of $360,000

C) A decrease in assets of $300,000

D) An increase in stockholders' equity of $400,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1 Missouri Co.purchased a truck that cost $57,000.The truck had an expected useful life of 10 years and a $6,000 salvage value.Missouri uses the double declining-balance method.What is the amount of depreciation expense recognized in Year 2?

A) $9,120

B) $11,400

C) $10,200

D) $8,160

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

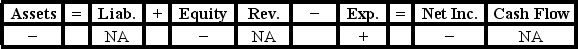

Byrd Company experienced an accounting event that affected the elements of its financial statements as indicated below:

Which of the following accounting events could have caused these effects?

Which of the following accounting events could have caused these effects?

A) Recognized depletion expense under the units-of-production method.

B) Recognized depreciation expense under the double-declining-balance method.

C) Amortized patent cost under the straight-line method.

D) All of these answer choices are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is considered an accelerated depreciation method?

A) Double-declining balance

B) Units-of-production

C) MACRS

D) Both double-declining-balance and MACRS

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses are reported as part of operating income on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

Rupert Company purchased a delivery van on January 1,Year 1 for $45,000.Rupert uses the straight-line method for the asset,which has a five-year estimated useful life and a salvage value estimated at $9,000.On January 1,Year 3,the asset was sold for $33,300 cash.Indicate whether each of the following items related to Rupert Company is true or false.

Correct Answer

Multiple Choice

Z Company purchased an asset for $24,000 on January 1,Year 1.The asset was expected to have a four-year life and a $4,000 salvage value.What is the amount of depreciation expense for Year 1 using the double-declining-balance method?

A) $2,000

B) $3,000

C) $6,000

D) $12,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following intangible assets does not convey a specific legal right or privilege?

A) Copyrights

B) Franchises

C) Goodwill

D) Trademarks

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Expenditures that extend the useful life of a plant asset increase the accumulated depreciation on the asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a tangible asset?

A) Land

B) Goodwill

C) Copyright

D) Trademark

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following terms is used to describe the process of expense recognition for property,plant and equipment?

A) Amortization

B) Depreciation

C) Depletion

D) Revision

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A copyright is an intangible asset with an indefinite useful life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which financial statement reports the amount of accumulated depreciation?

A) Income statement

B) Balance sheet

C) Statement of cash flows

D) Statement of stockholders' equity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The term used to recognize expense for property,plant,and equipment assets is depletion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

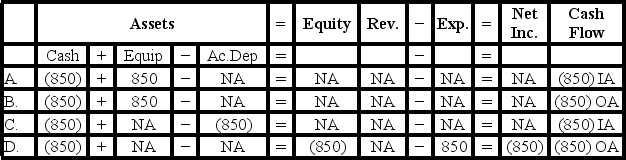

On January 1,Year 2,Ruiz Company spent $850 on a plant asset to improve its quality.Which of the following correctly shows the effects of the Year 2 expenditure on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jing Company purchased office equipment that cost $34,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,000. The equipment had a five-year useful life and a $12,000 expected salvage value. -Assume that Jing Company earned $30,000 cash revenue and incurred $19,000 in cash expenses in Year 3.The company uses the straight-line method.The office equipment was sold on December 31,Year 3 for $16,000.What is the company's net income (loss) for Year 3?

A) ($6,600)

B) $6,600

C) $600

D) $5,400

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hardwick Company purchased a truck that cost $53,000.The company expected to drive the truck 200,000 miles over its 5-year useful life,and the truck had an estimated salvage value of $3,000.If the truck is driven 30,000 miles in the current accounting period,what would be the amount of depreciation expense for the year?

A) $7,500

B) $10,000

C) $10,600

D) $12,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 122

Related Exams