A) Add the amount goods available for sale to estimated cost of goods sold

B) Add estimated gross margin to sales

C) Subtract estimated goods available for sale from beginning inventory

D) Subtract estimated cost of goods sold from the amount of goods available for sale

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carson Company has an inventory turnover of 12.75,and its inventory amounts to $2,400,000.What is the amount of cost of goods sold?

A) $30,600,000

B) $188,235

C) $26,666,667

D) $51,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company is using the lower-of-cost-or-market rule and a write-down is required,how will that write-down affect the elements of the company's financial statements?

A) Net income will increase.

B) Gross margin will decrease.

C) Total assets will decrease.

D) Gross margin and total assets will both decrease.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stubbs Company uses the perpetual inventory method and the weighted-average cost flow method.On January 1,Year 2,Stubbs purchased 400 units of inventory that cost $8.00 each.On January 10,Year 2,the company purchased an additional 600 units of inventory that cost $9.00 each.If the company sells 700 units of inventory for $16.00 each,what is the amount of gross margin reported on the income statement?

A) $5,180

B) $5,250

C) $5,000

D) $6,020

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If the replacement cost of inventory is greater than its historical cost,the increase in value does not affect the company's financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct regarding the importance of inventory turnover to a company's profitability?

A) Companies will prefer to have a low inventory turnover rather than a high inventory turnover.

B) It is sometimes more desirable to sell a large amount of merchandise with a small amount of gross margin than a small amount of merchandise with a large amount of gross margin.

C) A company's profitability is affected by how rapidly inventory sells.

D) A company's profitability is affected by the spread between cost and selling price.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

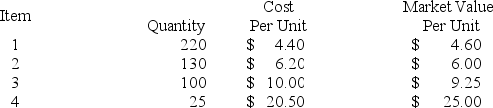

Rowan Company has four different categories of inventory.The quantity,cost,and market value for each of the inventory categories are as follows:

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate.How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate.How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

A) Increase total assets and stockholders' equity by $55.50.

B) Decrease total assets and stockholders' equity by $101.00.

C) Decrease total assets and stockholders' equity by $79.00.

D) Have no effect on total assets or stockholders' equity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Melbourne Company uses the perpetual inventory system and LIFO cost flow method.Melbourne purchased 500 units of inventory that cost $4.00 each.At a later date,the company purchased an additional 600 units of inventory that cost $5.00 each.If the company sells 800 units of inventory,what amount of ending inventory will appear on a balance sheet prepared immediately after the sale?

A) $3,800

B) $1.350

C) $1,500

D) $1,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the perpetual inventory system is used,where can the best estimate of the amount of inventory on hand be found?

A) On the previous period's balance sheet

B) In the Inventory account in the general ledger

C) By applying the gross margin method

D) By subtracting sales for the period from the beginning Inventory account balance

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blake Company purchased two identical inventory items.The item purchased first cost $16.00,and the item purchased second cost $18.00.Blake sold one of the items for $24.00.Which of the following statements is true?

A) Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method.

B) Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C) The dollar amount assigned to ending inventory will be the same no matter which inventory cost flow method is used.

D) Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

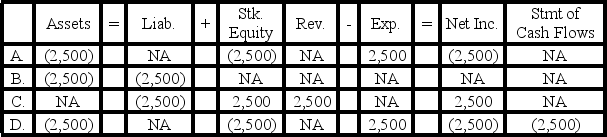

Nelson Corporation is required to record an inventory write-down of $2,500 as a result of using the lower-of-cost-or-market rule.Which of the following shows how this business event would affect the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Phipps Corporation overstated its ending inventory on December 31,Year 1.Which of the following correctly identifies the effect of the error on Year 2 financial statements?

A) Cost of goods sold is overstated.

B) Gross margin overstated.

C) Ending inventory is understated.

D) Net income is overstated.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

During a period of rising inventory prices the LIFO cost flow method will result in higher total assets than FIFO.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company overstates its Inventory balance at the end of Year 1 due to an error,its Retained Earnings will also be overstated on the Year 1 balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vargas Company uses the perpetual inventory system and the FIFO cost flow method.During the current year,Vargas purchased 400 units of inventory that cost $15.00 each.At a later date during the year,the company purchased an additional 800 units of inventory that cost $18.00 each.Vargas sold 500 units of inventory for $27.00.What is the amount of cost of goods sold that will appear on the current year's income statement?

A) $7,800

B) $6,000

C) $4,500

D) $5,700

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anton Co.uses the perpetual inventory system and FIFO cost flow method.During the year,Anton purchased 400 units of inventory that cost $12.00 each and then purchased an additional 600 units of inventory that cost $16.00 each.If Anton sells 700 units of inventory,what is the amount of cost of goods sold?

A) $11,200

B) $10,400

C) $8,400

D) $9,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is meant by "market" in the lower-of-cost-or-market rule?

A) The amount of gross margin earned by selling merchandise.

B) The amount the goods were sold for during the period.

C) The amount that would have to be paid to replace the merchandise.

D) The amount originally paid for the merchandise.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A discount merchandiser is likely to have a higher inventory turnover than more upscale stores with higher merchandise prices.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A loss resulting from application of the lower-of-cost-or-market rule is included in cost of goods sold if the loss is material in amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At a time of declining prices,which inventory cost flow method will result in the highest ending inventory?

A) Weighted-average

B) FIFO

C) LIFO

D) Either weighted-average or FIFO

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 84

Related Exams