A) Increase total assets by $2,300

B) Increase total stockholders' equity by $3,600

C) Increase total assets by $1,300

D) Increase total assets by $3,600

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the net cash flow from operating activities as a result of the four transactions?

A) $5,100

B) $7,726

C) $6,550

D) $11,074

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

A company's chart of accounts includes, in part, the following account numbers and corresponding account titles:

![[The following information applies to the questions displayed below.] A company's chart of accounts includes, in part, the following account numbers and corresponding account titles: -Which accounts would affect gross margin? A) Account numbers 2 and 9 B) Account numbers 3 and 9 C) Account numbers 3, 4, 7, and 9 D) Account numbers 3, 7, 8, and 9](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f65_e936_ace2_1d414f84598a_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -Which accounts would affect gross margin?

-Which accounts would affect gross margin?

A) Account numbers 2 and 9

B) Account numbers 3 and 9

C) Account numbers 3, 4, 7, and 9

D) Account numbers 3, 7, 8, and 9

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Middleton Company uses the perpetual inventory system.The company purchased an item of inventory for $130 and sold the item to a customer for $200.How will the sale affect the company's Inventory account?

A) The Inventory account will decrease by $200.

B) The Inventory account will decrease by $130.

C) The Inventory account will decrease by $70.

D) The Inventory account will not change.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

JJ Co.purchased on account merchandise with a list price of $10,000.Payment terms were 1/15,n/45.If collection occurs before the discount expires,what is the effect of the sales discount on the balance sheet?

A) Decreases accounts receivable

B) Decreases inventory

C) Increases accounts payable

D) Increases cash

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The write-off to record the amount of inventory shrinkage affects both the balance sheet and the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes the purpose of a common size financial statement?

A) Compare the amount of common stock to other types of stock

B) Make comparisons between firms of different sizes

C) Make comparisons between different time periods

D) Make comparisons between firms of different sizes and between different time periods

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

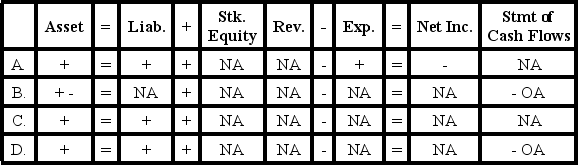

A company purchased inventory on account.If the perpetual inventory system is used,which of the following choices accurately reflects how the purchase affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Common size financial statements are prepared by converting dollar amounts to percentages.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following retailers would be expected to have the highest gross margin percentage?

A) Kmart

B) Neiman Marcus

C) Walmart

D) A supermarket chain such as Safeway

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Tin Company included the following: Based on the information provided,what was the company's cost of goods sold?

A) $200,000

B) $600,000

C) $700,000

D) $900,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is considered a product cost?

A) Utility expense for the current month

B) Salaries paid to the employees of a merchandiser

C) Transportation cost on goods received from suppliers

D) Transportation cost on goods shipped to customers

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For a company that uses the perpetual inventory system,a physical count of the inventory can reveal the amount of inventory shrinkage the company has experienced.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A perpetual inventory system updates the Merchandise Inventory account for all purchases of inventory,as well as returns of inventory to suppliers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about period costs is true?

A) Most period costs are expensed in the period the costs are incurred.

B) Period costs are expensed when the products associated with these costs are sold.

C) Period costs are usually recorded as assets.

D) Period costs do not adhere to the matching concept.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Merchandising businesses include retail companies and manufacturing companies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the periodic inventory system.Which of the following accounts would not be affected when recording purchases and related transactions?

A) Merchandise Inventory

B) Purchase Returns and Allowances

C) Purchase Discounts

D) Purchases

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Costs charged to the Merchandise Inventory account are product costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

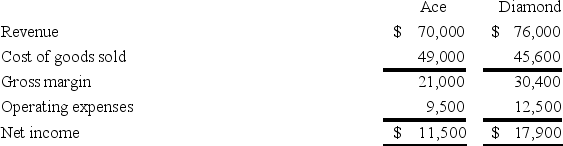

The following are the income statements for Ace and Diamond Companies.

What are the net income percentages for Ace and Diamond,respectively?

What are the net income percentages for Ace and Diamond,respectively?

A) 6.09% and 4.25%

B) 1.83% and 1.70%

C) 16.4% and 23.6%

D) 30% and 40%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Matching

Indicate whether each of the following statements is true or false.(Assume a periodic inventory system)

Correct Answer

Showing 41 - 60 of 106

Related Exams