A) Recording interest that has been earned but not received.

B) Recording revenue that has been earned but not yet collected in cash.

C) Recording supplies that have been purchased with cash but not yet used.

D) Recording salaries owed to employees at the end of the year that will be paid during the following year.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Melon Moving Company paid $55,000 to purchase a truck.The truck was expected to have a four-year useful life and a $5,000 salvage value.If Melon uses the straight-line method,the amount of book value shown on the Year 2 balance sheet is

A) $42,500

B) $30,000

C) $25,000

D) $12,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

Wichita, Inc. reported the following amounts on its financial statements prepared as of the end of the current accounting period:

![[The following information applies to the questions displayed below.] Wichita, Inc. reported the following amounts on its financial statements prepared as of the end of the current accounting period: -What is the company's return-on-assets ratio? A) 5% B) 10% C) 20% D) 50%](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f74_8e71_ace2_2719f619adf0_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg) -What is the company's return-on-assets ratio?

-What is the company's return-on-assets ratio?

A) 5%

B) 10%

C) 20%

D) 50%

F) A) and B)

Correct Answer

verified

B

Correct Answer

verified

True/False

Purchasing a truck for $50,000 cash with a four-year useful life and $6,000 salvage value is an example of a deferred expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a company purchases a depreciable asset,it must estimate the asset's useful life and salvage value.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Which of the following transactions would increase a company's return-on-assets ratio?

A) Received cash from customers for goods sold to them on account last month

B) Borrowed cash from a local bank

C) Incurred expenses on account

D) Paid cash to settle accounts payable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The financial statement ratio that may be of greatest interest to a company's stockholders is the amount of its return-on-assets ratio.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

A cost may be recorded as an expense or as an asset purchase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

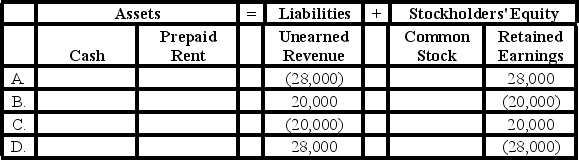

On June 1,Year 1,Jack Associates collected $48,000 cash for consulting services to be provided for one year beginning immediately.Based on this information,which of the following shows how the required adjustment on December 31,Year 1,would affect Jack's ledger accounts?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would cause net income on the accrual basis to be different from (either higher or lower than) "cash provided by operating activities" on the statement of cash flows?

A) Purchased land for cash

B) Purchased supplies for cash

C) Paid advertising expense

D) Paid dividends to stockholder

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

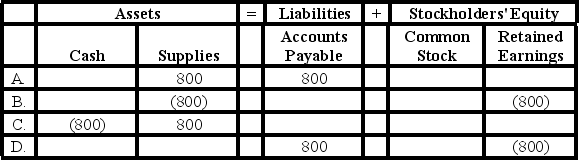

Hawk Company purchased $300 of supplies on account.Which of the following shows how this purchase will affect Hawk's ledger accounts?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Sometimes the recognition of revenue is accompanied by an increase in liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1 Marrow Moving Company paid $35,000 to purchase a truck.The truck was expected to have a four-year useful life and an $8,000 salvage value.If Marrow uses the straight-line method,the amount of accumulated depreciation shown on the Year 2 balance sheet is

A) $7,000

B) $13,500

C) $17,500

D) $35,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Martin Mowing Company paid $64,000 to purchase a truck.The truck was expected to have a six-year useful life and a $4,000 salvage value.If Margin uses the straight-line method,the amount of depreciation expense recognized on the Year 2 income statement is

A) $10,000

B) $20,000

C) $21,333

D) $30,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a claims exchange transaction?

A) Recognized revenue earned on a contract where the cash had been collected at an earlier date

B) Issued common stock

C) Provided services on account

D) Purchased land for cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the adjusting entry to recognize the portion of the unearned revenue that a company earned during the accounting period affect the elements of the financial statements?

A) An increase in assets and a decrease in liabilities.

B) An increase in liabilities and a decrease in equity.

C) A decrease in liabilities and an increase in equity.

D) A decrease in assets and a decrease in liabilities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in revenue may be accompanied by a decrease in a liability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1,Year 1,Gomez Company collected $9,000 in advance from a customer for services to be provided over a one-year period beginning on that date.How much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31,Year 1? How much would the company report as net cash flows from operating activities for Year 1?

A) $3,000; $3,000

B) $9,000; $9,000

C) $3,000; $9,000

D) $0; $9,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Betsy Company's December 31,Year 1,balance sheet showed $1,900 cash,$500 accounts payable,$400 common stock and $1,000 retained earnings.The company experienced the following events during Year 2. (1) On April 1,Year 2 the company paid $2,400 cash to rent office space for the coming year starting immediately (2) Earned $3,600 cash revenue (3) Paid a $200 cash dividend Based on this information,the company would report

A) a $1,200 net cash inflow from operating activities on the Year 2 statement of cash flows

B) a $2,600 balance in retained earnings on the Year 2 balance sheet

C) a $600 balance in a prepaid rent account on the Year 2 balance sheet

D) All of the answers are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On March 1,Year 1,Presco Enterprises paid $1,200 cash for an insurance policy that would provide protection for a one-year term.The company's fiscal closing date is December 31.Based on this information,the amount of insurance expense appearing on the Year 1 income statement would be

A) $200

B) $500

C) $1,000

D) $1,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 91

Related Exams