A) −26.6 days

B) −29.5 days

C) −32.8 days

D) −36.4 days

E) −40.5 days

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Not taking cash discounts is costly, and as a result, firms that do not take them are usually those that are performing poorly and have inadequate cash balances.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Long-term loan agreements always contain provisions, or covenants, that constrain the firm's future actions. Short-term credit agreements are just as restrictive in order to protect the interest of the lender.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant, if a firm "stretches" (i.e., delays paying) its accounts payable, this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit can be reduced by paying late.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Firms hold cash balances in order to complete transactions (both routine and precautionary) that are necessary in business operations and as compensation to banks for providing loans and services.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cash conversion cycle (CCC) combines three factors: The inventory conversion period, the average collection period, and the payables deferral period, and its purpose is to show how long a firm must finance its working capital. Other things held constant, the shorter the CCC, the more effective the firm's working capital management.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The concept of permanent current operating assets reflects the fact that some components of current assets do not shrink to zero even when a business is at its seasonal or cyclical low. Thus, permanent current operating assets represent a minimum level of current assets that must be financed.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Suppose the suppliers of your firm offered you credit terms of 2/10 net 30 days. Your firm is not taking discounts, but is paying after 25 days instead of waiting until Day 30. You point out that the nominal cost of not taking the discount and paying on Day 30 is approximately 37%. But since your firm is neither taking discounts nor paying on the due date, what is the effective annual percentage cost (not the nominal cost) of its costly trade credit, using a 365-day year?

A) 60.3%

B) 63.5%

C) 66.7%

D) 70.0%

E) 73.5%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Famous Farm's payables deferral period (PDP) is 50 days (on a 365-day basis) , accounts payable are $100 million, and its balance sheet shows inventory of $125 million. What is the inventory turnover ratio?

A) 4.73

B) 5.26

C) 5.84

D) 6.42

E) 7.07

G) C) and D)

Correct Answer

verified

C

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality receipts are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Trade credit can be separated into two components: free trade credit, which is credit received after the discount period ends, and costly trade credit, which is the cost of discounts not taken.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following statement completions is CORRECT? If the yield curve is upward sloping, then the marketable securities held in a firm's portfolio, assumed to be held for emergencies, should

A) consist mainly of short-term securities because they pay higher rates.

B) consist mainly of U.S. Treasury securities to minimize interest rate risk.

C) consist mainly of short-term securities to minimize interest rate risk.

D) be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates.

E) consist mainly of long-term securities because they pay higher rates.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Accruals are "free" in the sense that no explicit interest is paid on these funds.

B) A conservative approach to working capital management will result in most, if not all, permanent current operating assets being financed with long-term capital.

C) The risk to a firm that borrows with short-term credit is usually greater than if it borrowed using long-term debt. This added risk stems from the greater variability of interest costs on short-term debt and possible difficulties with rolling over short-term debt.

D) Bank loans generally carry a higher interest rate than commercial paper.

E) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tierney Enterprises is constructing its cash budget. Its budgeted monthly sales are $5,000, and they are constant from month to month. 40% of its customers pay in the first month and take the 2% discount, while the remaining 60% pay in the month following the sale and do not receive a discount. The firm has no bad debts. Purchases for next month's sales are constant at 50% of projected sales for the next month. "Other payments," which include wages, rent, and taxes, are 25% of sales for the current month. Construct a cash budget for a typical month and calculate the average net cash flow during the month.

A) $1,092

B) $1,150

C) $1,210

D) $1,271

E) $1,334

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

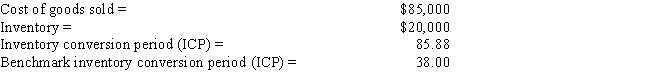

Data on Liu Inc. for the most recent year are shown below, along with the inventory conversion period (ICP) of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its inventory enough to reduce its ICP to the benchmarks' average. If this were done, by how much would inventories decline? Use a 365-day year.

A) $7,316

B) $8,129

C) $9,032

D) $10,036

E) $11,151

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Cash is often referred to as a "non-earning" asset. Thus, one goal of cash management is to minimize the amount of cash necessary for conducting a firm's normal business activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

One of the effects of ceasing to take trade credit discounts is that the firm's accounts payable will rise, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm that follows an aggressive current asset financing approach uses primarily short-term credit and thus is more exposed to an unexpected increase in interest rates than is a firm that uses long-term capital and thus follows a conservative financing policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions should Reece Windows take if it wants to reduce its cash conversion cycle?

A) Take steps to reduce the DSO.

B) Start paying its bills sooner, which would reduce the average accounts payable but not affect sales.

C) Sell common stock to retire long-term bonds.

D) Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock.

E) Increase average inventory without increasing sales.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 138

Related Exams