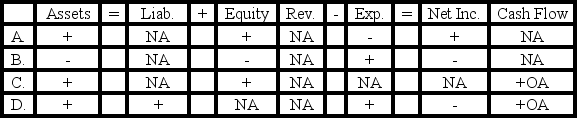

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following businesses is most likely to use a specific identification cost flow method?

A) Car dealership

B) Grocery store

C) Hardware store

D) Roofing company

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is inventory turnover calculated?

A) Cost of goods sold divided by inventory

B) Sales divided by inventory

C) Beginning inventory divided by the ending inventory

D) Inventory divided by cost of goods sold

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If prices are rising,which inventory cost flow method will produce the lowest amount of cost of goods sold?

A) LIFO

B) FIFO

C) Weighted average

D) LIFO,FIFO,and the weighted-average inventory cost flow methods will all produce equal amounts of cost of goods sold.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Landis Company is preparing its financial statements.Gross margin is normally 40% of sales.Information taken from the company's records revealed sales of $25,000;beginning inventory of $2,500 and purchases of $17,500.What is the estimated amount of ending inventory at the end of the period?

A) $15,000

B) $5,000

C) $8,000

D) $10,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does an error that results in an overstatement of ending inventory affect the elements of the company's financial statements in the current year?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blake Company purchased two identical inventory items.The item purchased first cost $16.00,and the item purchased second cost $18.00.Blake sold one of the items for $24.00.Which of the following statements is true?

A) Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method.

B) Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C) The dollar amount assigned to ending inventory will be the same no matter which inventory cost flow method is used.

D) Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why are the inventory and cost of goods sold accounts attractive targets for managerial fraud?

A) There are few if any procedures that can check for fraud in these accounts.

B) There are no adequate methods of record keeping for inventory.

C) These accounts are more significant than most other accounts.

D) Cost of goods sold and Inventory accounts are not attractive targets of fraud.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

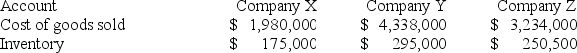

-What is the average number of days to sell inventory for Company Y?

-What is the average number of days to sell inventory for Company Y?

A) 15.3

B) 24.8

C) 23.9

D) 25.6

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

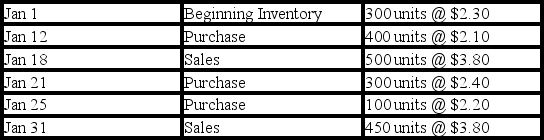

Chase Co.uses the perpetual inventory method.The inventory records for Chase reflected the following information:

-Assuming Chase uses a FIFO cost flow method,what is the ending inventory on January 31?

-Assuming Chase uses a FIFO cost flow method,what is the ending inventory on January 31?

A) $345

B) $340

C) $330

D) $1,020

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

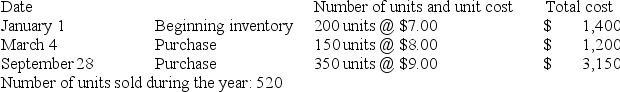

Singleton Company's perpetual inventory records included the following information:

-If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.

-If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the Year 2 accounting period,DeYoung Company determined that the market value of its inventory was $79,800.The historical cost of this inventory was $81,400.DeFazio uses the perpetual inventory method.Assuming the amount is material,how will the entry necessary to reduce the inventory to the lower of cost or market affect the elements of the company's financial statements?

A) Decrease total assets and gross margin

B) Decrease total assets and net income

C) Increase total assets and net income

D) Decrease total assets,gross margin,and net income

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hoover Company purchased two identical inventory items.The item purchased first cost $33.00.The item purchased second cost $35.00.Then Hoover sold one of the inventory items for $62.00.Based on this information,which of the following statements is true?

A) The ending inventory is $35.00 if Hoover uses the LIFO cost flow method.

B) The gross margin is $28.00 if Hoover uses the weighted-average cost flow method.

C) The cost of goods sold is $35.00 if Hoover uses the FIFO cost flow method.

D) The cost of goods sold is $33.00 if Hoover uses the LIFO cost flow method.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the LIFO cost flow method,it is not required by generally accepted accounting principles to apply the lower-of-cost-or-market rule.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The lower-of-cost-or-market rule can be applied to which of the following?

A) Major classes or categories of inventory

B) The entire stock of inventory in the aggregate

C) Each individual inventory item

D) All of these answer choices are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company applies the lower-of-cost-or-market rule to the entire stock of inventory in the aggregate,its write-down of inventory is likely to be greater than if it applies the rule to individual items of inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

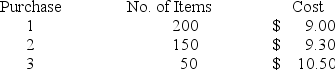

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each.During the period,the company purchased inventory items as follows:

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's ending inventory under LIFO?

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's ending inventory under LIFO?

A) $2,730

B) $2,460

C) $2,220

D) $1,950

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In most businesses,the physical flow of goods occurs on a FIFO basis,but a different cost flow method is allowed under generally accepted accounting principles.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stubbs Company uses the perpetual inventory method and the weighted-average cost flow method.On January 1,Year 2,Stubbs purchased 400 units of inventory that cost $8.00 each.On January 10,Year 2,the company purchased an additional 600 units of inventory that cost $9.00 each.If the company sells 700 units of inventory for $16.00 each,what is the amount of gross margin reported on the income statement?

A) $5,180

B) $5,250

C) $5,000

D) $6,020

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A loss resulting from application of the lower-of-cost-or-market rule is included in cost of goods sold if the loss is material in amount.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 86

Related Exams