A) Incurred supplies expense

B) Purchased supplies on account

C) Used supplies

D) Purchased supplies with cash

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

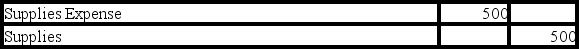

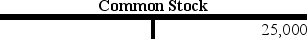

The Youngstown Company recorded the following adjustment in general journal format:

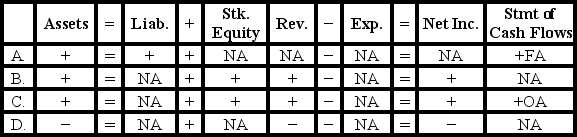

Which of the following choices accurately reflects how this event would affect the company's financial statements?

Which of the following choices accurately reflects how this event would affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

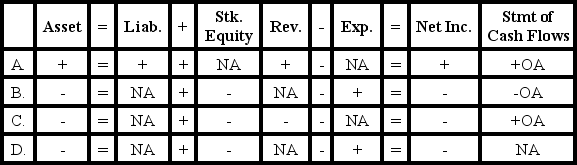

Multiple Choice

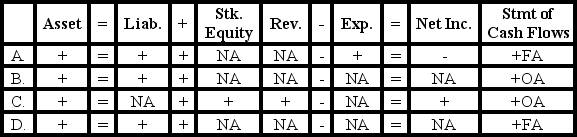

Callahan Corporation recorded an adjusting entry using T-accounts as follows:

Which of the following reflects how this adjustment affects the company's financial statements?

Which of the following reflects how this adjustment affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The three primary asset use transactions are incurring expenses,accruing liabilities,and paying dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following errors would cause the debit side of a trial balance to be larger than the credit side?

A) Revenue earned on account was recorded with a debit to Cash and a credit to Revenue.

B) Purchase of supplies on account was recorded with a credit to Supplies and a debit to Accounts Payable.

C) Land purchased with cash was recorded with a debit to the Land account and a credit to Accounts Payable.

D) None of these answer choices would cause the debit side of the trial balance to be larger than the credit side.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement year,Valley Packaging Company's adjusted trial balance showed a zero balance in retained earnings.Which of the following is the most likely explanation for this?

A) Valley reported zero net income in the current year.

B) Valley's trial balance will be out of balance until closing entries are recorded.

C) The current year was Valley's first year in business.

D) An error must have been made in preparing Valley's trial balance.

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

True/False

The balance in Retained Earnings is decreased by debiting the account.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

The left side of a T-account is the debit side.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

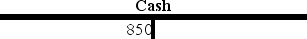

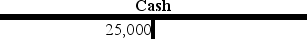

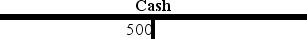

A transaction has been recorded in the T-accounts of Simpson Company as follows:

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?

A) The company borrowed $850.

B) The company loaned $850 to another company.

C) The company repaid a $850 debt.

D) Simpson acquired $850 cash from the issue of common stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions would increase a company's return-on-assets ratio?

A) Received cash from customers for goods sold to them on account last month.

B) Borrowed cash from a local bank.

C) Incurred expenses on account.

D) Paid cash to settle accounts payable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is decreased with a debit?

A) Accounts Receivable

B) Accounts Payable

C) Prepaid Rent

D) Rent Expense

F) A) and B)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Nelson Company began operations on December 1, Year 1. The following transactions and adjustments were recorded in December and posted to the company's ledger accounts: 1) Acquired $9,000 cash from the issue of common stock to its stockholders. 2) Provided services on account for $7,500. 3) Paid $4,500 cash for land. 4) Owed $3,000 of salaries expenses to employees for work done in December that will be paid during January. 5) Purchased $900 of supplies on account to be used in January. 6) Collected $3,900 from customers. What is the total of the debit account balances that will be reported on the company's adjusted trial balance at December 31,Year 1?

A) $12,000

B) $20,400

C) $6,900

D) $28,800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

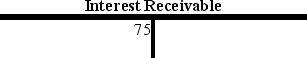

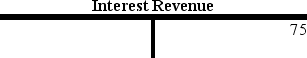

On August 1,Year 1,Bellisa Company issued a $10,000 6%,1-year note to Citizens Bank.Which of the following entries reflects the adjustment required as of December 31,Year 1?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Dividends account normally has a credit balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The employees of Able Company have worked the last two weeks of Year 1,but the employees' salaries have not been paid or recorded as of December 31,Year 1.The adjusting entry that Able should make to accrue these unpaid salaries on December 31,Year 1 is:

A) debit to Salaries Expense and credit to Cash.

B) debit to Salaries Expense and credit to Salaries Payable.

C) debit to Salaries Payable and credit to Salaries Expense.

D) no entry is required until the employee is paid next period.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

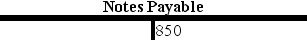

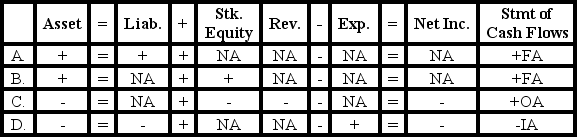

A transaction has been recorded in the general journal of Deluty Company as follows:

Which of the following describes the effect of this transaction on the company's financial statements?

Which of the following describes the effect of this transaction on the company's financial statements?

A) Increases Stockholders' Equity

B) Increases Liabilities

C) Decreases Assets

D) Increases Assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transaction has been recorded in the T-accounts of Horowitz Corporation as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following transaction has been recorded in the general journal entry:

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?

A) Provided services on account.

B) Paid cash to settle accounts payable.

C) Collected cash from customers.

D) Borrowed money to support operating activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A company's general ledger provides a chronological record of its business transactions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

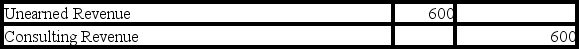

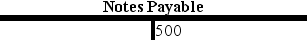

A transaction has been recorded in the T-accounts of Hough Company as follows:

Which of the following reflects how this event affects the company's financial statements?

Which of the following reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 106

Related Exams