B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following transaction has been recorded in the general journal:

How will this transaction affect the company's financial statements after it is posted to the ledger accounts?

How will this transaction affect the company's financial statements after it is posted to the ledger accounts?

A) Decreases Total Liabilities

B) Increases Retained Earnings

C) Decreases Total Assets

D) Decreases Stockholders' Equity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

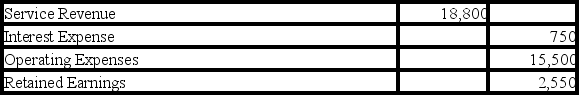

What effect will the following closing entry have on the retained earnings account?

A) Retained earnings will remain unchanged.

B) Retained earnings will decrease by $2,550.

C) Retained earnings will increase by $2,550.

D) Retained earnings will be transferred to the income statement.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Calculating the debt-to-assets ratio measures how efficiently a company is using its assets in the normal scope of business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

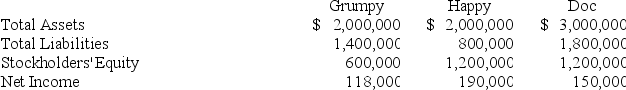

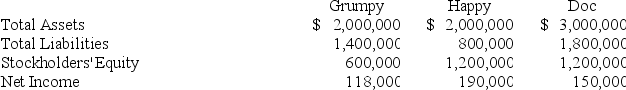

At the end of Year 1,the following information is available for Grumpy,Happy,and Doc Companies.

-Which company has the highest level of debt risk?

-Which company has the highest level of debt risk?

A) Grumpy

B) Happy

C) Doc

D) They all have equal debt risk

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

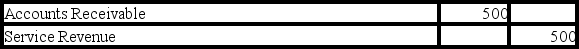

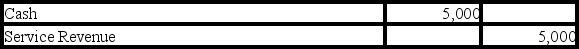

Explain how the following general journal entry affects the accounting equation.

A) Both assets and stockholders' equity increase.

B) Both liabilities and assets increase.

C) Assets increase and stockholders' equity decreases.

D) Liabilities increase and stockholders' equity decreases.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about debits is false?

A) Debits Increase Assets.

B) Debits Increase Expenses.

C) Debits Decrease Liabilities.

D) Debits Increase Liabilities.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

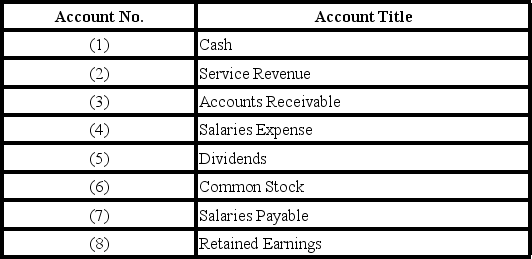

Multiple Choice

Bijan Corporation earned $4,000 of revenue that had been deferred.How would the related adjusting entry be recorded in the company's T-accounts?

A) ![]()

![]()

B) ![]()

![]()

C) ![]()

![]()

D) ![]()

![]()

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

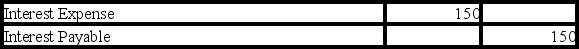

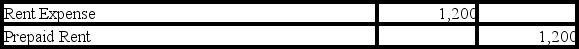

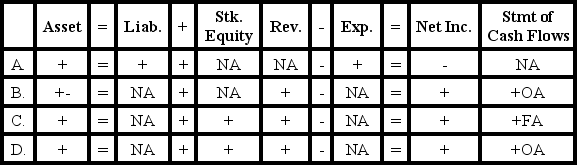

The Lazarus Company recorded the following adjustment in general journal format:

Which of the following choices accurately reflects how this event would affect the company's financial statements?

Which of the following choices accurately reflects how this event would affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of Year 1,the following information is available for Grumpy,Happy,and Doc Companies.

-Which company has the highest return-on-assets ratio?

-Which company has the highest return-on-assets ratio?

A) Grumpy.

B) Happy.

C) Doc.

D) They all have equal return-on-assets ratios.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement is true regarding the trial balance?

A) Incorrectly recording a cash sale as a sale on account would not cause the trial balance to be out of balance.

B) The income statement is prepared using the post-closing trial balance.

C) A balance of debits and credits ensures that all transactions have been recorded correctly.

D) Trial balances are only prepared at the end of an accounting period.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How would the trial balance column totals be affected if a $600 credit to Service Revenue was erroneously posted as a $600 debit to Salaries Expense?

A) The credit column of the trial balance would be $600 more than the debit column.

B) The debit column of the trial balance would be $1,200 more than the credit column.

C) The credit column of the trial balance would be $1,200 more than the debit column.

D) The debit column of the trial balance would be $600 more than the credit column.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A trial balance can be in balance,even if there are errors in the accounting system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the term used to describe the right side of a T-account?

A) Credit Side

B) Claims Side

C) Debit Side

D) Equity Side

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

At the end of its fiscal year,a company must adjust its accounting records for unrecorded accruals and deferrals before it can prepare financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

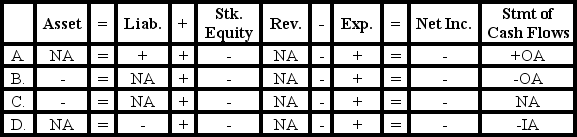

A transaction has been recorded in the general journal of Van Buren Company as follows:

Which of the following describes how this entry affects the company's financial statements when it is posted to the ledger accounts?

Which of the following describes how this entry affects the company's financial statements when it is posted to the ledger accounts?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

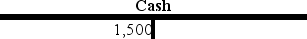

Multiple Choice

A transaction has been recorded in the T-accounts of Gibbs Company as follows:

Which of the following could be an explanation for this transaction?

Which of the following could be an explanation for this transaction?

A) Cash has been paid out to a company that will provide future services to Gibbs Company.

B) Gibbs has completed services for which they had earlier received cash in advance.

C) Gibbs has provided services to a customer on account.

D) Gibbs has received cash for service to be provided in the future.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A trial balance can only be prepared at the end of the fiscal year,as part of the adjusting and closing processes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $200 credit to Interest Payable was instead recorded in error as a $200 credit to Cash in an adjusting entry,which has been posted to the ledger accounts.Which of the following is the result of this error?

A) The trial balance is out of balance by $200.

B) Total assets are understated by $200.

C) Net income is overstated by $200.

D) Total liabilities are overstated by $200.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

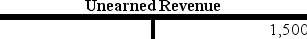

Multiple Choice

-Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that appear on that particular financial statement. )

-Which of the following is a true statement? (Note: A statement may be true even if it does not identify all accounts that appear on that particular financial statement. )

A) Account numbers 2,4,and 5 will appear on the income statement.

B) Account numbers 1,3,and 8 will appear on the balance sheet.

C) Account numbers 2,5,and 8 will appear on the statement of cash flows.

D) Account numbers 4,5,and 6 will appear on the statement of changes in stockholders' equity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 106

Related Exams