A) Paid a cash dividend.

B) Earned cash revenue.

C) Borrowed money from a bank.

D) The information provided does not represent a completed event.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

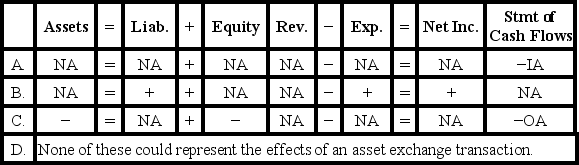

Which of the following could represent the effects of an asset exchange transaction on a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Liabilities are reported on which of the following financial statement(s) ?

A) Income statement

B) Balance sheet

C) Statement of cash flows

D) Statement of changes in stockholders' equity

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The Financial Accounting Standards Board is a privately funded organization with authority for establishing accounting standards for businesses in the US.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glavine Company repaid a bank loan with cash.How should the cash flow from this event be shown on the horizontal statements model?

A) An operating activity that decreases cash,decreases equity,and decreases net income

B) A financing activity that decreases cash and decreases liabilities

C) A financing activity that decreases cash,decreases equity,and decreases net income

D) An investing activity that decreases cash and decreases liabilities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All of a business's temporary accounts appear on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of accounting information is intended to satisfy the needs of external users of accounting information?

A) Cost accounting

B) Managerial accounting

C) Tax accounting

D) Financial accounting

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $950 cash from the issue of common stock. 2) Borrowed $420 from a bank. 3) Earned $650 of revenues. 4) Paid expenses of $250. 5) Paid a $50 dividend. During Year 2, Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $325 of common stock. 2) Repaid $220 of its debt to the bank. 3) Earned revenues of $750. 4) Incurred expenses of $360. 5) Paid dividends of $100. -What is Packard Company's net cash flow from financing activities for Year 2?

A) $220 outflow

B) $320 outflow

C) $5 inflow

D) $225 inflow

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which section of a statement of cash flows would the payment of cash dividends be reported?

A) Investing activities.

B) Operating activities.

C) Financing activities.

D) Dividends are not reported on the statement of cash flows.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happened as a result of this transaction?

A) The balance in the Cash account on Northern's books decreased,while the balance in the Cash account on South Company's books increased.

B) South Company has a cash inflow from investing activities.

C) Northern Corporation has a cash outflow from financing activities.

D) All of these statements are true.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yi Company provided services to a customer for $5,500 cash.Based on this information alone,which of the following statements is true?

A) Total assets increased and total equity decreased.

B) Total assets were unchanged.

C) Liabilities decreased and net income increased.

D) Total assets increased and net income increased.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

Northern Corporation invested $800 cash in South Company stock.

-Which of the following describes the effects of this transaction on the elements of Northern Corporation's books?

![[The following information applies to the questions displayed below.] Northern Corporation invested $800 cash in South Company stock. -Which of the following describes the effects of this transaction on the elements of Northern Corporation's books? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8dc6_cc3d_a2a1_3f66c67a16a7_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Financial accounting information is usually less detailed than managerial accounting information.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 2,Chavez Company had beginning balances as follows: total assets of $12,500,total liabilities of $4,500,and common stock of $3,000.During Year 2,Chavez paid dividends to its stockholders of $2,000.Given that retained earnings amounted to $6,000 at the end of Year 2,what was Chavez's net income for Year 2?

A) $3,000

B) $5,000

C) $7,000

D) $2,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] Lexington Company engaged in the following transactions during Year 1, its first year in operation: (Assume all transactions are cash transactions) Acquired $6,000 cash from issuing common stock. Borrowed $4,400 from a bank. Earned $6,200 of revenues. Incurred $4,800 in expenses. Paid dividends of $800. Lexington Company engaged in the following transactions during Year 2: (Assume all transactions are cash transactions) Acquired an additional $1,000 cash from the issue of common stock. Repaid $2,600 of its debt to the bank. Earned revenues, $9,000. Incurred expenses of $5,500. Paid dividends of $1,280. -What was the amount of retained earnings that will be reported on Lexington's balance sheet at the end of Year 1?

A) $6,200

B) $5,400

C) $1,400

D) $600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following appears in the investing activities section of the statement of cash flows?

A) Cash inflow from interest revenue

B) Cash inflow from the issuance of common stock

C) Cash outflow for the payment of dividends

D) Cash outflow for the purchase of land

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Liabilities are not a source of assets for a business.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During Year 2,Chico Company earned $1,950 of cash revenue,paid $1,600 of cash expenses,and paid a $150 cash dividend to its owners.Based on this information alone,which of the following statements is not true?

A) Net income amounted to $350.

B) Total assets increased by $200.

C) Cash inflow from operating activities was $350.

D) Cash inflow from operating activities was $200.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Borrowing cash from the bank is an example of which type of transaction?

A) Asset source

B) Claims exchange

C) Asset use

D) Asset exchange

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The information reported in financial statements is organized into ten categories known as accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 94

Related Exams