A) Debt securities

B) Equity securities

C) Investor

D) Investee

E) Cost method

F) Trading securities

G) Available-for-sale securities

H) Held-to-maturity securities

I) Equity method

J) Business combination

L) B) and G)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the definitions that follow with the appropriate investment term (a-j) . -When using this,dividends are treated as a reduction of the investment

A) Debt securities

B) Equity securities

C) Investor

D) Investee

E) Cost method

F) Trading securities

G) Available-for-sale securities

H) Held-to-maturity securities

I) Equity method

J) Business combination

L) C) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zach Company owns 45% of the voting stock of Tomas Corporation and uses the equity method in recording this investment.Tomas Corporation reported a $20,000 net loss.Zach Company's entry would include a

A) credit to cash for $9,000

B) debit to the investment account for $9,000

C) credit to the investment account for $9,000

D) credit to a loss account for $9,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Armando Company owns 17,000 of the 70,000 shares of common stock outstanding of Tito Company and exercises a significant influence over its operating and financial policies.The investment should be accounted for by the

A) equity method

B) market method

C) cost or market method

D) cost method

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Comprehensive income must be reported on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

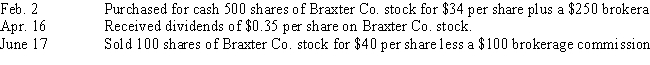

Journalize the entries to record the following selected equity investment transactions completed by Flurry Company during the current year.Flurry's purchase represents less than 20% of the total outstanding Braxter Co.stock.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Interest revenue on bonds is reported as

A) an addition to the investment in bonds account

B) part of comprehensive income but not as part of net income

C) part of other income

D) part of operating income

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost method of accounting for stock

A) recognizes dividends as income

B) is only appropriate as part of a consolidation

C) requires the investment to be increased by the reported net income of the investee

D) requires the investment to be decreased by the reported net income of the investee

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ruben Company purchased $100,000 of Evans Company bonds at 100.Ruben later sold the bonds at $104,500 plus $500 in accrued interest.The journal entry to record the sale of the bonds would be

A) debit Cash, $105,000; credit Investments-Evans Company Bonds, $104,500, and Interest Revenue, $500

B) debit Cash, $105,000; credit Investments-Evans Company Bonds, $100,000, and Gain on Sale of Investments, $5,000

C) debit Cash, $104,500, and Interest Receivable, $500; credit Investments-Evans Company Bonds, $100,000, Gain on Sale of Investments, $4,500, and Interest Revenue, $500

D) debit Cash, $105,000; credit Investments-Evans Company Bonds, $100,000, Gain on Sale of Investments, $4,500, and Interest Revenue, $500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor purchased 500 shares of common stock,$25 par,for $21,750.Subsequently,100 shares were sold for $49.50 per share.What is the amount of gain or loss on the sale?

A) $12,750 gain

B) $600 gain

C) $600 loss

D) $9,250 loss

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the definitions that follow with the appropriate investment term (a-j) . -The company investing in another company's stock

A) Debt securities

B) Equity securities

C) Investor

D) Investee

E) Cost method

F) Trading securities

G) Available-for-sale securities

H) Held-to-maturity securities

I) Equity method

J) Business combination

L) D) and F)

Correct Answer

verified

Correct Answer

verified

True/False

Investments in stocks that are expected to be held for the long term are listed in the Stockholders' equity section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Albright Company purchased as a long-term investment $500,000 of Benton Corporation 10-year,9% bonds.Present entries to record the following selected transactions:

Correct Answer

verified

Correct Answer

verified

True/False

Comprehensive income does not affect net income or retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered an "other comprehensive income" item?

A) net income

B) extraordinary loss related to flood

C) gain on disposal of discontinued operations

D) unrealized loss on available-for-sale securities

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Any gains or losses on the sale of bonds normally would be reported in the Other income (loss)section of the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changes in the value of available-for-sale securities are

A) reported as part of stockholders' equity

B) recognized on the income statement

C) not recognized

D) recognized on the income statement and as part of stockholders' equity

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Accounting for the sale of stock is the same for both the cost and the equity methods of accounting for investments.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Foreign currency translation adjustment is an example of an item that would be included in other comprehensive income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Butte Company's valuation allowance for trading investments account has a debit balance of $23,200.On December 31,the cost of the trading securities portfolio was $80,000.The fair value was $98,000.Which of the following would Butte report on the income statement for the current year?

A) an unrealized loss on trading investments, $5,200

B) an unrealized gain on trading investments, $5,200

C) an unrealized gain on trading investments, $18,000

D) an unrealized loss on trading investments, $18,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 169

Related Exams