Correct Answer

verified

Correct Answer

verified

Multiple Choice

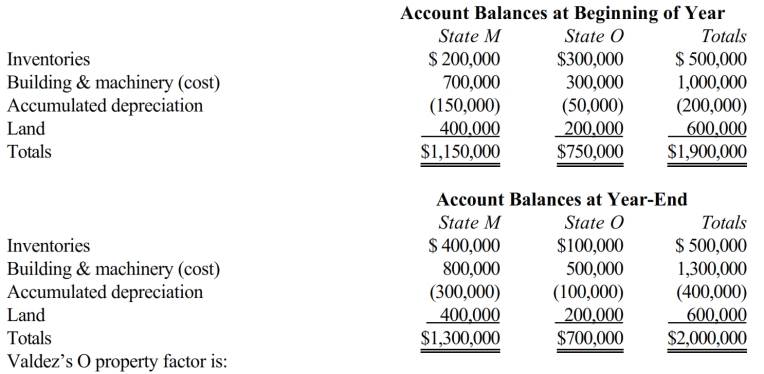

Valdez Corporation, a calendar-year taxpayer, owns property in States M and O. Both M and O require that the average value of assets be included in the property factor. M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.  Valdez's O property factor is:

Valdez's O property factor is:

A) 35.0%.

B) 37.2%.

C) 39.5%.

D) 53.8%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to a customer in B. General has not established nexus with B. State A does not apply a throwback rule. In which state(s) will the sale be included in the sales factor numerator?

A) In all of the states, according to the apportionment formulas of each, as the U.S. government is present in all states.

B) $100,000 in A.

C) $100,000 in B.

D) $0 in A and $0 in B.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A unitary business applies a combined apportionment formula, including data from operations of all of the affiliates.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses. a. Addition modification b. Subtraction modification c. No modification -Dividend income from P & G stock held.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A state sales tax usually falls upon:

A) Sales of groceries.

B) Sales of widgets made to out-of-state customers.

C) Sales of widgets made to an in-state ultimate consumer of the product or service.

D) Sales of real estate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected. a. Taxable b. Not taxable -Computing services purchased by a business.

Correct Answer

verified

Correct Answer

verified

Short Answer

A ________________ tax is designed to complement the local sales tax structure, to prevent the consumer from making no- or low-tax purchases in another state, outside the U.S., or online, and then bringing the asset into the state.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The model law relating to the assignment of income among the states for corporations is:

A) Public Law 86-272.

B) The Multistate Tax Treaty.

C) The Multistate Tax Commission (MTC) .

D) The Uniform Division of Income for Tax Purposes Act (UDITPA) .

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

In the apportionment formula, most states assign more than a one-third weight to ________________ the factor.

Correct Answer

verified

Correct Answer

verified

True/False

An LLC apportions and allocates its annual taxable income in the same manner used by any other business operating in the state.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A typical state taxable income addition modification is for the state's NOL allowed the taxpayer for the tax year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

General Corporation is taxable in a number of states. This year, General made a $100,000 sale from its A headquarters to the State B office of the FBI, the Federal Bureau of Investigation. In which state(s) will the sale be included in the sales factor numerator?

A) $0 in A and $0 in B.

B) $50,000 in A, with the balance exempted from other states' sales factors under the Colgate doctrine.

C) $100,000 in A.

D) $100,000 in B.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Roughly five percent of all taxes paid by businesses in the U.S. are to state, local, and municipal jurisdictions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A city might assess a recording tax when a business takes out a mortgage on its real estate.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The individual seller of shares of stock in Facebook is liable for sales tax on the transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses. a. Addition modification b. Subtraction modification c. No modification -Federal general business credit.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following terms with the appropriate description, in the state income tax formula. Apply the UDITPA rules in your responses. a. Addition modification b. Subtraction modification c. No modification -State-level NOL.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In conducting multistate tax planning, the taxpayer should:

A) Review tax opportunities in light of their effect on the overall business.

B) Exploit inconsistencies among the taxing statutes and formulas of the states.

C) Consider the tax effects of the plan after accounting for any new compliance and administrative costs that it generates.

D) All of the above are true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following items with the appropriate description, in determining whether sales/use tax typically must be collected. a. Taxable b. Not taxable -Groceries purchased by an individual and taken home for meal preparation there.

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 204

Related Exams