B) False

Correct Answer

verified

Correct Answer

verified

True/False

The lower the firm's tax rate, the lower will be its after-tax cost of debt and also its WACC, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Westbrook's Painting Co.plans to issue a $1, 000 par value, 20-year noncallable bond with a 7.00% annual coupon, paid semiannually.The company's marginal tax rate is 40.00%, but Congress is considering a change in the corporate tax rate to 30.00%.By how much would the component cost of debt used to calculate the WACC change if the new tax rate was adopted?

A) 0.57%

B) 0.63%

C) 0.70%

D) 0.77%

E) 0.85%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Firms raise capital at the total corporate level by retaining earnings and by obtaining funds in the capital markets.They then provide funds to their different divisions for investment in capital projects.The divisions may vary in risk, and the projects within the divisions may also vary in risk.Therefore, it is conceptually correct to use different risk-adjusted costs of capital for different capital budgeting projects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Acme Industries correctly estimates its WACC at a given point in time and then uses that same cost of capital to evaluate all projects for the next 10 years, then the firm will most likely

A) become less risky over time, and this will maximize its intrinsic value.

B) accept too many low-risk projects and too few high-risk projects.

C) become more risky and also have an increasing WACC.Its intrinsic value will not be maximized.

D) continue as before, because there is no reason to expect its risk position or value to change over time as a result of its use of a single cost of capital.

E) become riskier over time, but its intrinsic value will be maximized.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Anderson Company has equal amounts of low-risk, average-risk, and high-risk projects.The firm's overall WACC is 12%.The CFO believes that this is the correct WACC for the company's average-risk projects, but that a lower rate should be used for lower-risk projects and a higher rate for higher-risk projects.The CEO disagrees, on the grounds that even though projects have different risks, the WACC used to evaluate each project should be the same because the company obtains capital for all projects from the same sources.If the CEO's position is accepted, what is likely to happen over time?

A) The company will take on too many low-risk projects and reject too many high-risk projects.

B) Things will generally even out over time, and, therefore, the firm's risk should remain constant over time.

C) The company's overall WACC should decrease over time because its stock price should be increasing.

D) The CEO's recommendation would maximize the firm's intrinsic value.

E) The company will take on too many high-risk projects and reject too many low-risk projects.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have been hired as a consultant by Feludi Inc.'s CFO, who wants you to help her estimate the cost of capital.You have been provided with the following data: rRF = 4.10%; RPM = 5.25%; and b = 1.30.Based on the CAPM approach, what is the cost of common from reinvested earnings?

A) 9.67%

B) 9.97%

C) 10.28%

D) 10.60%

E) 10.93%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When working with the CAPM, which of the following factors can be determined with the most precision?

A) The beta coefficient, bi, of a relatively safe stock.

B) The most appropriate risk-free rate, rRF.

C) The expected rate of return on the market, rM.

D) The beta coefficient of "the market, " which is the same as the beta of an average stock.

E) The market risk premium (RPM) .

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) A cost should be assigned to reinvested earnings due to the opportunity cost principle, which refers to the fact that the firm's stockholders would themselves expect to earn a return on earnings that were distributed rather than retained and reinvested.

B) No cost should be assigned to reinvested earnings because the firm does not have to pay anything to raise them.They are generated as cash flows by operating assets that were raised in the past; hence, they are "free."

C) Suppose a firm has been losing money and thus is not paying taxes, and this situation is expected to persist into the foreseeable future.In this case, the firm's before-tax and after-tax costs of debt for purposes of calculating the WACC will both be equal to the interest rate on the firm's currently outstanding debt, provided that debt was issued during the past 5 years.

D) If a firm has enough reinvested earnings to fund its capital budget for the coming year, then there is no need to estimate either a cost of equity or a WACC.

E) The component cost of preferred stock is expressed as rp(1 - T) .This follows because preferred stock dividends are treated as fixed charges, and as such they can be deducted by the issuer for tax purposes.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your consultant firm has been hired by Eco Brothers Inc.to help them estimate the cost of common equity.The yield on the firm's bonds is 8.75%, and your firm's economists believe that the cost of common can be estimated using a risk premium of 3.85% over a firm's own cost of debt.What is an estimate of the firm's cost of common from reinvested earnings?

A) 12.60%

B) 13.10%

C) 13.63%

D) 14.17%

E) 14.74%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quinlan Enterprises stock trades for $52.50 per share.It is expected to pay a $2.50 dividend at year end (D? = $2.50) , and the dividend is expected to grow at a constant rate of 5.50% a year.The before-tax cost of debt is 7.50%, and the tax rate is 40%.The target capital structure consists of 45% debt and 55% common equity.What is the company's WACC if all the equity used is from reinvested earnings?

A) 7.07%

B) 7.36%

C) 7.67%

D) 7.98%

E) 8.29%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When estimating the cost of equity by use of the DCF method, the single biggest potential problem is to determine the growth rate that investors use when they estimate a stock's expected future rate of return.This problem leaves us unsure of the true value of rs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Since 70% of the preferred dividends received by a corporation are excluded from taxable income, the component cost of equity for a company that pays half of its earnings out as common dividends and half as preferred dividends should, theoretically, be Cost of equity = rs(0.30)(0.50)+ rps(1 - T)(0.70)(0.50).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's marginal tax rate is increased, this would, other things held constant, lower the cost of debt used to calculate its WACC.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In general, firms should use their weighted average cost of capital (WACC)to evaluate capital budgeting projects because most projects are funded with general corporate funds, which come from a variety of sources.However, if the firm plans to use only debt or only equity to fund a particular project, it should use the after-tax cost of that specific type of capital to evaluate that project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

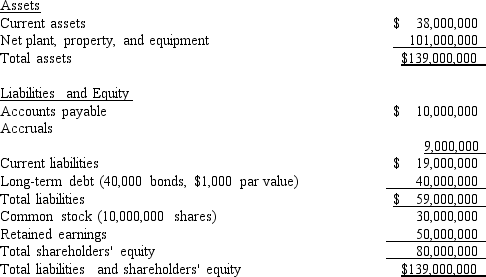

Exhibit 9.1

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.Which of the following is the best estimate for the weight of debt for use in calculating the firm's WACC?

The stock is currently selling for $15.25 per share, and its noncallable $1, 000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00.The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 40%.

-Refer to Exhibit 9.1.Which of the following is the best estimate for the weight of debt for use in calculating the firm's WACC?

A) 18.67%

B) 19.60%

C) 20.58%

D) 21.61%

E) 22.69%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If investors' aversion to risk rose, causing the slope of the SML to increase, this would have a greater impact on the required rate of return on equity, rs, than on the interest rate on long-term debt, rd, for most firms.Other things held constant, this would lead to an increase in the use of debt and a decrease in the use of equity.However, other things would not stay constant if firms used a lot more debt, as that would increase the riskiness of both debt and equity and thus limit the shift toward debt.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When estimating the cost of equity by use of the CAPM, three potential problems are (1)whether to use long-term or short-term rates for rRF, (2)whether or not the historical beta is the beta that investors use when evaluating the stock, and (3)how to measure the market risk premium, RPM.These problems leave us unsure of the true value of rs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a typical firm, which of the following sequences is CORRECT? All rates are after taxes, and assume that the firm operates at its target capital structure.

A) re > rs > WACC > rd.

B) WACC > re > rs > rd.

C) rd > re > rs > WACC.

D) WACC > rd > rs > re.

E) rs > re > rd > WACC.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

"Capital" is sometimes defined as funds supplied to a firm by investors.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 92

Related Exams