B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tierney Enterprises is constructing its cash budget.Its budgeted monthly sales are $5, 000, and they are constant from month to month.40% of its customers pay in the first month and take the 2% discount, while the remaining 60% pay in the month following the sale and do not receive a discount.The firm has no bad debts.Purchases for next month's sales are constant at 50% of projected sales for the next month."Other payments, " which include wages, rent, and taxes, are 25% of sales for the current month.Construct a cash budget for a typical month and calculate the average net cash flow during the month.

A) $1, 092

B) $1, 150

C) $1, 210

D) $1, 271

E) $1, 334

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality receipts are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm sells on terms of 2/10 net 30 days, and its DSO is 28 days, then the fact that the 28-day DSO is less than the 30-day credit period tells us that the credit department is functioning efficiently and there are no past-due accounts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The facts (1)that no explicit interest is paid on accruals and (2)that the firm can control the level of these accounts at will makes them an attractive source of funding to meet working capital needs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Because money has time value, a cash sale is always more profitable than a credit sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

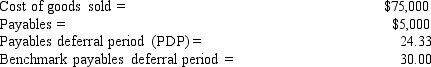

Data on Mertz Co.for the most recent year are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks.The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average.If this were done, by how much would payables increase? Use a 365-day year.

A) $764

B) $849

C) $943

D) $1, 048

E) $1, 164

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm that follows an aggressive current asset financing approach uses primarily short-term credit and thus is more exposed to an unexpected increase in interest rates than is a firm that uses long-term capital and thus follows a conservative financing policy.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accruals are "free" capital in the sense that no explicit interest must normally be paid on accrued liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Accruals are "free" in the sense that no explicit interest is paid on these funds.

B) A conservative approach to working capital management will result in most, if not all, permanent current operating assets being financed with long-term capital.

C) The risk to a firm that borrows with short-term credit is usually greater than if it borrowed using long-term debt.This added risk stems from the greater variability of interest costs on short-term debt and possible difficulties with rolling over short-term debt.

D) Bank loans generally carry a higher interest rate than commercial paper.

E) Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The maturity matching, or "self-liquidating, " approach to financing involves obtaining the funds for permanent current assets with a combination of long-term capital and short-term capital that varies depending on the level of interest rates.When short-term rates are relatively high, short-term assets will be financed with long-term debt to reduce costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's suppliers stop offering discounts, then its use of trade credit is more likely to increase than to decrease, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered to be an aggressive current operating asset financing strategy because of the inherent risks of using short-term financing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Long-term loan agreements always contain provisions, or covenants, that constrain the firm's future actions.Short-term credit agreements are just as restrictive in order to protect the interest of the lender.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a firm that sells on terms of net 30 changes its policy to 2/10 net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase.

B) If a firm sells on terms of 2/10 net 30, and its DSO is 30 days, then the firm probably has some past-due accounts.

C) If a firm sells on terms of net 60, and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July.

D) If a firm changed the credit terms offered to its customers from 2/10 net 30 to 2/10 net 60, then its sales should increase, and this should lead to an increase in sales per day, and that should lead to a decrease in the DSO.

E) Other things held constant, the higher a firm's days sales outstanding (DSO) , the better its credit department.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT commonly regarded as being a credit policy variable?

A) Collection policy.

B) Credit standards.

C) Cash discounts.

D) Payments deferral period.

E) Credit period.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net operating working capital is defined as operating current assets minus operating current liabilities..

B) False

Correct Answer

verified

Correct Answer

verified

True/False

For a firm that makes heavy use of net float, being able to forecast collections and disbursement check clearings is essential.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 138 of 138

Related Exams