A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The geometric average rate of return is based on

A) the market's volatility.

B) the concept of expected return.

C) the standard deviation of returns.

D) the CAPM.

E) the principle of compounding.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Studies of style analysis have found that ________ of fund returns can be explained by asset allocation alone.

A) between 50% and 70%

B) less than 10%

C) between 40 and 50%

D) between 75% and 90%

E) over 90%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The dollar-weighted return on a portfolio is equivalent to

A) the time-weighted return.

B) the geometric average return.

C) the arithmetic average return.

D) the portfolio's internal rate of return.

E) None of the options are correct.

G) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

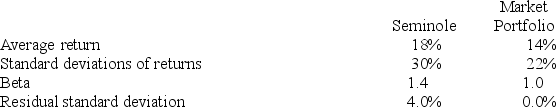

The following data are available relating to the performance of Seminole Fund and the market portfolio:

The risk-free return during the sample period was 6%.

Calculate the M2 measure for the Seminole Fund.

The risk-free return during the sample period was 6%.

Calculate the M2 measure for the Seminole Fund.

A) 4.0%

B) 20.0%

C) 2.86%

D) 0.8%

E) 40.0%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a particular investment earns an arithmetic return of 10% in year 1, 20% in year 2, and 30% in year 3. The geometric average return for the period will be

A) greater than the arithmetic average return.

B) equal to the arithmetic average return.

C) less than the arithmetic average return.

D) equal to the market return.

E) It cannot be determined from the information given.

G) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The Sharpe, Treynor, and Jensen portfolio performance measures are derived from the CAPM,

A) therefore, it does not matter which measure is used to evaluate a portfolio manager.

B) however, the Sharpe and Treynor measures use different risk measures. Therefore, the measures vary as to whether or not they are appropriate, depending on the investment scenario.

C) therefore, all measure the same attributes.

D) therefore, it does not matter which measure is used to evaluate a portfolio manager. However, the Sharpe and Treynor measures use different risk measures, so therefore, the measures vary as to whether or not they are appropriate, depending on the investment scenario.

E) None of the options are correct.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

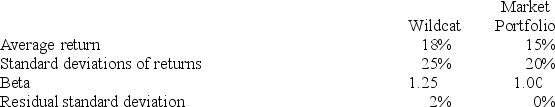

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

What is the information ratio measure of performance evaluation for Wildcat Fund?

The risk-free return during the sample period was 7%.

What is the information ratio measure of performance evaluation for Wildcat Fund?

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

E) 67.00%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Jensen portfolio evaluation measure

A) is a measure of return per unit of risk, as measured by standard deviation.

B) is an absolute measure of return over and above that predicted by the CAPM.

C) is a measure of return per unit of risk, as measured by beta.

D) is a measure of return per unit of risk, as measured by standard deviation, and is an absolute measure of return over and above that predicted by the CAPM.

E) is an absolute measure of return over and above that predicted by the CAPM, and is a measure of return per unit of risk, as measured by beta.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you own two stocks, A and B. In year 1, stock A earns a 2% return and stock B earns a 9% return. In year 2, stock A earns an 18% return and stock B earns an 11% return. ________ has the higher arithmetic average return.

A) Stock A

B) Stock B

C) The two stocks have the same arithmetic average return.

D) At least three periods are needed to calculate the arithmetic average return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

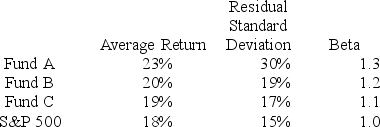

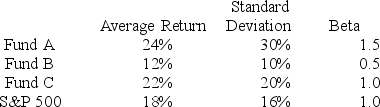

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 5%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The investment with the highest Sharpe measure is

The investment with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) the index.

E) Funds A and C (tied for highest) .

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

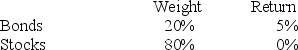

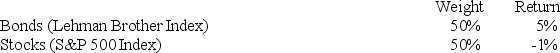

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.

The total excess return on the Razorback Fund's managed portfolio was

The total excess return on the Razorback Fund's managed portfolio was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.90%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you purchase 100 shares of GM stock at the beginning of year 1 and purchase another 100 shares at the end of year 1. You sell all 200 shares at the end of year 2. Assume that the price of GM stock is $50 at the beginning of year 1, $55 at the end of year 1, and $65 at the end of year 2. Assume no dividends were paid on GM stock. Your dollar-weighted return on the stock will be ________ your time-weighted return on the stock.

A) higher than

B) the same as

C) less than

D) exactly proportional to

E) More information is necessary to answer this question.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hedge funds I. are appropriate as a sole investment vehicle for an investor. II. should only be added to an already well-diversified portfolio. III. pose performance-evaluation issues due to nonlinear factor exposures. IV. have down-market betas that are typically larger than up-market betas. V. have symmetrical betas.

A) I only

B) II and V

C) I, III, and IV

D) II, III, and IV

E) I, III, and V

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return and the same standard deviation of returns, but portfolio A has a lower beta than portfolio B. According to the Treynor measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

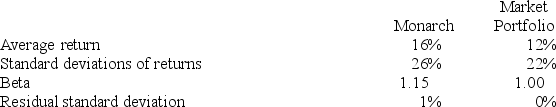

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

Calculate Treynor's measure of performance for Monarch Stock Fund.

The risk-free return during the sample period was 4%.

Calculate Treynor's measure of performance for Monarch Stock Fund.

A) 0.0143

B) 0.088

C) 0.44

D) 0.50

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

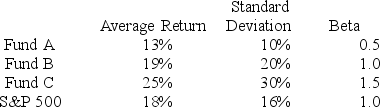

You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.

The fund with the highest Treynor measure is

The fund with the highest Treynor measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mutual funds show ________ evidence of serial correlation, and hedge funds show ________ evidence of serial correlation.

A) almost no; almost no

B) almost no; substantial

C) substantial; substantial

D) substantial; almost no

E) modest; modest

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

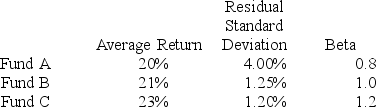

You want to evaluate three mutual funds using the information ratio measure for performance evaluation. The risk-free return during the sample period is 6%, and the average return on the market portfolio is 19%. The average returns, residual standard deviations, and betas for the three funds are given below.

The fund with the highest information ratio measure is

The fund with the highest information ratio measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

G) A) and D)

Correct Answer

verified

B

Correct Answer

verified

Showing 1 - 20 of 78

Related Exams