A) in nearly efficient markets, it is extremely difficult for portfolio managers to outperform the market.

B) the measures usually result in negative performance results for the portfolio managers.

C) the high rates of return earned by the mutual funds have made the measures useless.

D) in nearly efficient markets, it is extremely difficult for portfolio managers to outperform the market, and the measures usually result in negative performance results for the portfolio managers.

E) None of the options are correct.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the risk-free return is 6%. The beta of a managed portfolio is 1.5, the alpha is 3%, and the average return is 18%. Based on Jensen's measure of portfolio performance, you would calculate the return on the market portfolio as

A) 12%.

B) 14%.

C) 15%.

D) 16%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

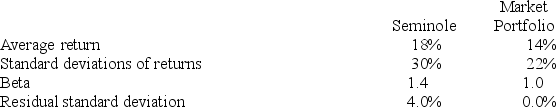

The following data are available relating to the performance of Seminole Fund and the market portfolio:

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

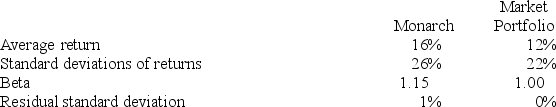

The following data are available relating to the performance of Monarch Stock Fund and the market portfolio:

The risk-free return during the sample period was 4%.

Calculate Jensen's measure of performance for Monarch Stock Fund.

The risk-free return during the sample period was 4%.

Calculate Jensen's measure of performance for Monarch Stock Fund.

A) 1.00%

B) 2.80%

C) 44.00%

D) 50.00%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

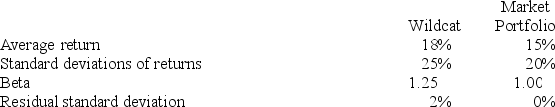

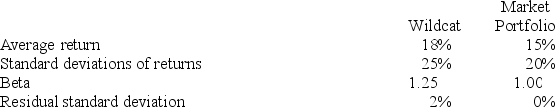

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

Calculate Sharpe's measure of performance for Wildcat Fund.

The risk-free return during the sample period was 7%.

Calculate Sharpe's measure of performance for Wildcat Fund.

A) 0.01

B) 0.08

C) 0.44

D) 0.50

E) 0.72

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

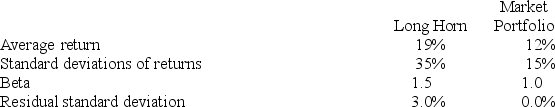

The following data are available relating to the performance of Long Horn Stock Fund and the market portfolio:

The risk-free return during the sample period was 6%.

What is the Sharpe measure of performance evaluation for Long Horn Stock Fund?

The risk-free return during the sample period was 6%.

What is the Sharpe measure of performance evaluation for Long Horn Stock Fund?

A) 0.0133

B) 0.04

C) 0.0867

D) 0.3143

E) 0.3714

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The comparison universe is not

A) a concept found only in astronomy.

B) the set of all mutual funds in the world.

C) the set of all mutual funds in the U.S.

D) a set of mutual funds with similar risk characteristics to your mutual fund.

E) a concept found only in astronomy, the set of all mutual funds in the world, or the set of all mutual funds in the U.S.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

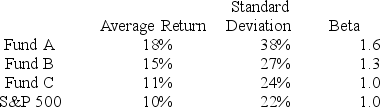

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 4%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data are available relating to the performance of Wildcat Fund and the market portfolio:

The risk-free return during the sample period was 7%.

Calculate Jensen's measure of performance for Wildcat Fund.

The risk-free return during the sample period was 7%.

Calculate Jensen's measure of performance for Wildcat Fund.

A) 1.00%

B) 8.80%

C) 44.00%

D) 50.00%

E) 55.00%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

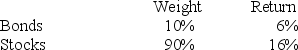

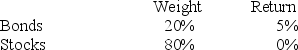

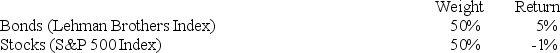

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:

The return on a bogey portfolio was 10%, calculated as follows:

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of selection within markets to total excess return was

The contribution of selection within markets to total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Value Line Index is an equally-weighted geometric average of the returns of about 1,700 firms. The value of an index based on the geometric average returns of three stocks where the returns on the three stocks during a given period were 32%, 5%, and -10%, respectively, is

A) 4.3%.

B) 7.6%.

C) 9.0%.

D) 13.4%.

E) 5.0%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ developed a popular method for risk-adjusted performance evaluation of mutual funds.

A) Eugene Fama

B) Michael Jensen

C) William Sharpe

D) Jack Treynor

E) Michael Jensen, William Sharpe, and Jack Treynor

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you purchase one share of the stock of Cereal Correlation Company at the beginning of year 1 for $50. At the end of year 1, you receive a $1 dividend and buy one more share for $72. At the end of year 2, you receive total dividends of $2 (i.e., $1 for each share) and sell the shares for $67.20 each. The time-weighted return on your investment is

A) 10.0%.

B) 8.7%.

C) 19.7%.

D) 17.6%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor has a portfolio that has constant proportions in T-bills and the market portfolio, the portfolio's characteristic line will plot as a line with ________. If the investor can time bull markets, the characteristic line will plot as a line with ________.

A) a positive slope; a negative slope

B) a negative slope; a positive slope

C) a constant slope; a negative slope

D) a negative slope; a constant slope

E) a constant slope; a positive slope

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The M2 measure was developed by

A) Merton and Miller.

B) Miller and Miller.

C) Modigliani and Miller.

D) Modigliani and Modigliani.

E) the M&M Mars Company.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

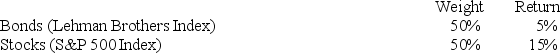

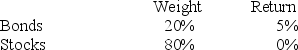

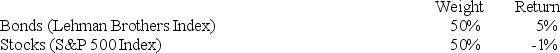

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of selection within markets to the Razorback Fund's total excess return was

The contribution of selection within markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.80%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return and the same standard deviation of returns, but portfolio A has a higher beta than portfolio B. According to the Sharpe measure, the performance of portfolio A

A) is better than the performance of portfolio B.

B) is the same as the performance of portfolio B.

C) is poorer than the performance of portfolio B.

D) cannot be measured as there are no data on the alpha of the portfolio.

E) None of the options are correct.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ measures the reward to volatility trade-off by dividing the average portfolio excess return by the standard deviation of returns.

A) Sharpe measure

B) Treynor measure

C) Jensen measure

D) information ratio

E) None of the options are correct.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

E) 1.80%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two portfolios have the same average return and the same standard deviation of returns, but Buckeye Fund has a higher beta than Husker Fund. According to the Sharpe measure, the performance of Buckeye Fund

A) is better than the performance of Husker Fund.

B) is the same as the performance of Husker Fund.

C) is poorer than the performance of Husker Fund.

D) cannot be measured as there are no data on the alpha of the portfolio.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 78

Related Exams