A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The U.S. tax burden is high compared to many European countries..

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pat calculates that for every extra dollar she earns, she owes the government 40 cents. Her total income now is $44,000, on which she pays taxes of $11,000. Determine her average tax rate and her marginal tax rate.

A) Her average tax rate is 40 percent and her marginal tax rate is 25 percent.

B) Her average tax rate is 40 percent and her marginal tax rate is 40 percent.

C) Her average tax rate is 25 percent and her marginal tax rate is 25 percent.

D) Her average tax rate is 25 percent and her marginal tax rate is 40 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-2 Suppose that Bob places a value of $10 on a movie ticket and that Lisa places a value of $7 on a movie ticket. In addition, suppose the price of a movie ticket is $5. -Refer to Scenario 12-2. What is total consumer surplus for Bob and Lisa?

A) $0

B) $2

C) $5

D) $7

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 12-1 Ken places a $20 value on a cigar, and Mark places a $17 value on it. The equilibrium price for this brand of cigar is $15. -Refer to Scenario 12-1. Suppose the government levies a tax of $3 on each cigar, and the equilibrium price of a cigar increases to $18. Because total consumer surplus has

A) fallen by more than the tax revenue, the tax has a deadweight loss

B) fallen by less than the tax revenue, the tax has no dead weight loss.

C) fallen by exactly the amount of the tax revenue, the tax has no deadweight loss.

D) increased by less than the tax revenue, the tax has a deadweight loss.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

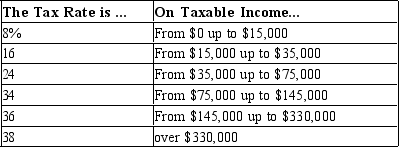

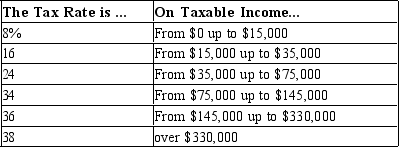

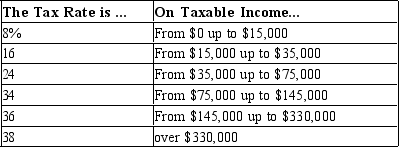

Table 12-11  -Refer to Table 12-11. If Bud has taxable income of $78,000, his tax liability is

-Refer to Table 12-11. If Bud has taxable income of $78,000, his tax liability is

A) $7,800.

B) $9,900.

C) $10,200.

D) $15,020.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the United States, the marginal tax rate on individual federal income tax

A) decreases as income increases.

B) increases as income increases.

C) is constant at all income levels.

D) applies only to payroll taxes.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are trying to design a tax system that will simultaneously achieve both of the following goals: 1) two people with the same total income would pay taxes of the same amount, and 2) a high-income person would pay a higher fraction of income in taxes than a low-income person. Which of the following tax systems could achieve both goals?

A) a lump-sum tax

B) a regressive tax

C) a progressive tax

D) a proportional tax

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The resources that a taxpayer devotes to complying with the tax laws are a type of

A) consumption tax.

B) value-added tax.

C) deadweight loss.

D) producer surplus.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Tax evasion is legal, but tax avoidance is illegal.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of a more efficient tax system?

A) The system minimizes deadweight loss.

B) The system raises the same amount of revenue at a lower cost.

C) The system minimizes administrative burdens.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sue earns income of $80,000 per year. Her average tax rate is 30 percent. Sue paid 20 percent in taxes on the first $30,000 she earned. What was the marginal tax rate on the rest of her income?

A) 20 percent

B) 24 percent

C) 30 percent

D) 36 percent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-11  -Refer to Table 12-11. If Bud has taxable income of $78,000, his marginal tax rate is

-Refer to Table 12-11. If Bud has taxable income of $78,000, his marginal tax rate is

A) 19.3%.

B) 24.0%.

C) 26.8%.

D) 34.0%.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A lump-sum tax would take different amounts from the poor and the rich.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Darby values a certain smart phone at $400. Jake values the same smart phone at $300. The pre-tax price of this smart phone is $250. The government imposes a tax of $75 on each smart phone, and the price rises to $325. The deadweight loss from the tax is

A) $50.

B) $0.

C) $100.

D) $150.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1950 there were approximately 7 working age people for every elderly person; however, in 2050 there will be

A) only 2.5 working people for every elderly person.

B) only 5 working age people for every elderly person.

C) 10 working age people for every elderly person.

D) 14 working age people for every elderly person.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

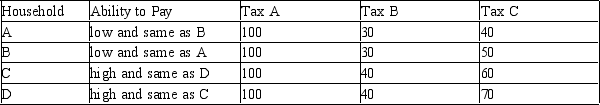

Table 12-13

The table below provides information on the 4 households that make up a small economy and how much they would pay in taxes under 3 types of taxes.  -Refer to Table 12-13. In this economy Tax A exhibits

-Refer to Table 12-13. In this economy Tax A exhibits

A) horizontal and vertical equity.

B) horizontal equity but not vertical equity.

C) vertical equity but not horizontal equity.

D) neither horizontal nor vertical equity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal equity refers to a tax system in which individuals with higher incomes pay more in taxes than individuals with lower incomes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-11  -Refer to Table 12-11. If Al has taxable income of $165,000, his average tax rate is

-Refer to Table 12-11. If Al has taxable income of $165,000, his average tax rate is

A) 26.6%.

B) 26.9%.

C) 27.3%.

D) 28.5%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If all taxpayers pay the same percentage of income in taxes, the tax system is proportional.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 521 - 540 of 549

Related Exams